Hedges clip gold miners’ loot

Australian gold miners could miss out on up to $2bn in additional cash if the gold price remains near record levels.

Australian gold miners could miss out on up to $2bn in additional cash if the gold price remains near record levels over the next few years, as a legacy of underwater hedges locked in as the gold price started to surge in 2019.

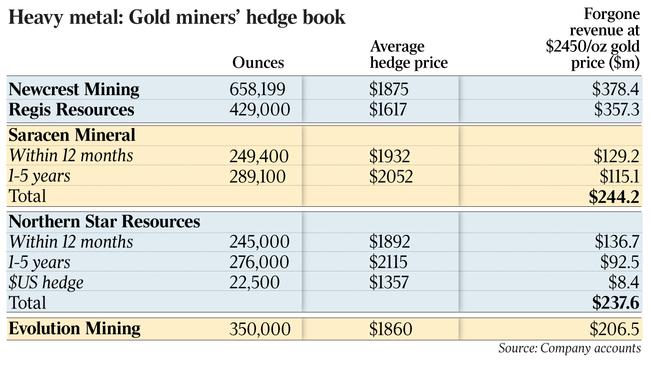

Analysis by The Australian of the latest round of financial reports shows that the nation’s top gold mining companies have locked in forward sales of more than 3 million ounces of gold at prices well below current levels.

At a gold price of $2450, the hedge position of the nation’s top 20 gold miners is more than $2.2bn out of the money, the analysis shows.

And while many companies have locked in prices at above $1800 an ounce, and some better than $2000 an ounce — a gold price unheard of until the middle of 2019 — the Aussie dollar and the US dollar gold price are still heading in opposite directions.

The value of the precious metal touched highs of more than $2510 an ounce in late February as the coronavirus scare sent panic through global markets, putting the spotlight firmly on forward gold sale prices that would have been seen as a coup a year ago, but are now more than $400 an ounce out of the money.

But while the headline numbers are large, hedging expert Sean Russo from risk advisory firm Noah's Rule says the hedge position of the Australian sector remains small by historic standards.

“I’ve seen a few brokers carrying on about how value has been left behind, but until a few months ago the all-time record high for Aussie dollar gold was $1900, so this is fairly rarefied atmosphere that we’re in,” he said.

“At the end of the last quarter, a lot of companies would have had hedging better than $1900 an ounce. And the books are not that large in size any more — so you’ll see some companies that will have about a third of their production for each of the next three years.”

Newcrest Mining has the biggest single losing position at the current spot price, with more than $378m in out-of-the-money hedges after locking in sales of more than 658,000oz over the next three years from its struggling Telfer mine at an average price of $1875 an ounce.

The decision to hedge Telfer production was originally made in 2016 to underpin the mine’s finances as Newcrest embarked on a big capital spending program. But ironically the miner’s last financial report said delivering into hedged positions in the first half of the financial year stripped $33m from potential Telfer revenue, tipping it into an $22m loss for the half.

But while the numbers are large, with expected group production of about 2.5 million ounces a year, Newcrest has hedged only a small fraction of its annual output.

Regis Resources is in a far trickier position. Although it has more flexibility than most in terms of when it delivers gold into its hedge position, it has 429,000 ounces hedged at an average $1617 an ounce — a position that is $347.7m under the odds at current prices.

It is delivering 10,000 ounces a quarter into that position, the company says, picking the lowest priced sales first to clear the 187,000oz sold at prices below $1500 an ounce. It says the delivery into out-of-the-money hedges at that rate will only cost it only a 4 per cent drop in average realised price compared to spot gold.

But its hedging position was serious enough for UBS analyst Glynn Lawcock to warn clients ahead of its February financial statements that the position could eventually affect its dividend payments. “This ineffective hedge position and the capex spend coming at McPhillamys may make the board more conservative in their dividend decision,” he said.

While Northern Star Resources and Saracen Mineral positions are large in absolute terms, both have just committed more than $1.2bn to the acquisition of the Kalgoorlie Super Pit, and sold forward larger positions to give themselves certainty over cashflow from their new asset.

Northern Star, with underwater hedges worth about $235.6m at current prices, says it has only about 16 per cent of its production pre-sold for the next three years. Saracen has a larger portion hedged, but still only about a third of annual output over the next three years.

Analysis by brokerage JPMorgan this week noted that while all Australian gold miner’s hedge books were under water, it had little impact on their valuation of the company.

JPMorgan analysts said they had reduced their net present valuation of Northern Star by 0.5 per cent on its hedge position, Newcrest by 0.9 per cent, Evolution by 2 per cent and Saracen by the same.

Regis took the biggest hit, with JPMorgan shaving 6 per cent from the company’s net present value over its hedge book.

Hedging has only returned to fashion among Australians over the last five years after a slew of disasters in the late 1990s and early 2000s, including the near-collapse of Ashanti Goldfields and Cambior Mining over hedge book margin calls, and the failure of Sons of Gwalia when it could not deliver gold output into forward sales.

Newcrest was one of a swath of Australian gold miners that swore off hedging permanently a decade ago, after it was forced into a $2bn capital raising in 2007 in order to close out losing positions on more than 4 million ounces worth of forward sales, but changed its position in 2016 as the gold price soared to $1670 an ounce.

But Mr Russo said most producers now used hedging to manage risk. “Our clients tend to be in a position where they don’t know where the price is going, but they have large capital commitments.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout