Government must lift tax transparency to stem mining, oil and gas avoidance

Government needs to guard against tax avoidance in mining and energy as revenue is squeezed by COVID-19, a new analysis says.

Australia urgently needs to boost transparency requirements for mining and energy companies to ward against tax avoidance, offshore secrecy and businesses seeking unfair tax breaks, as government coffers are hit by COVID-19, new analysis has found.

Ethical Partners Funds Management in partnership with Publish What You Pay Australia — a coalition of 30 anti-corruption, human rights, environmental, union and faith-based organisations — will release the new report on Monday. The research, undertaken in the three months to June 23, benchmarked the top 20 ASX-listed companies across the mining and energy sectors. It found just five — BHP, Fortescue, Rio Tinto, Iluka and Woodside Petroleum — had renounced the use of “artificial arrangements” for tax optimisation.

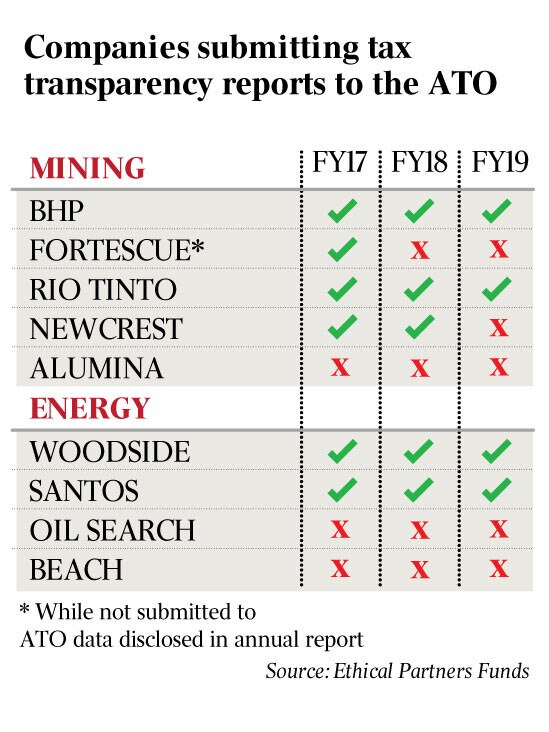

The research also showed just 47 per cent of companies reported to the Australian Taxation Office under the Voluntary Tax Transparency Code in the 2019 financial year, compared to 67 per cent in financial 2017.

Alumina, Saracen Minerals, Oil Search and Beach Energy had not submitted any reports to the ATO under the code since financial 2017.

The report found just 11 of the 20 companies assessed had publicly committed to pay tax on profits where value is created and economic activity takes place. The outliers were Fortescue, Alumina, Saracen, Carnarvon, Cooper Energy, Galilee Energy, Karoon, Senex and Strike Energy.

Ethical Partners’ sustainability and advocacy manager Robyn Parkin said the issue of tax and disclosure for mining and energy companies was top of mind, given the COVID-19 economic turmoil and debate about social licences.

“As we’ve all seen with the budget blowout, taxation is going to be an even more important issue going forward,” she added.

“It’s more about finding the (company) leaders, and those leaders in transparency will actually give us peace of mind that there is good governance all around

“... We prefer not to get to the point of AGMs (annual general meetings) and voting — we’d prefer companies to try and be leaders in this space rather than being adversarial.”

Last week’s federal budget update forecast a 4 per cent drop in company tax take this financial year due to a slowing economy.

Ethical Partners manages about $2bn, and is part of a growing contingent of investment firms focused on environmental, social and governance screens as well as financial metrics for choosing portfolio companies.

Its research comes as several companies in the mining and energy sectors have been in the headlines for the wrong reasons over the past two months.

Alcoa of Australia was last month hit with a $921m ATO bill over alleged transfer pricing relating to a bribery and corruption scandal to win business in the Middle East.

The federal government has taken measures to bolster tax transparency and ensure companies pay their fair share. They include moving to limit transfer pricing by multinationals under an OECD action plan, and introducing the voluntary tax code and the Corporate Tax Transparency Report.

Publish What You Pay Australia’s national director Clancy Moore said despite some bright spots Australia was still “falling behind” comparable economies and resource-rich countries on tax transparency.

“Australia has made some really positive steps and we do see some of the companies such as BHP and Rio Tinto really leading the way, which is great, partly because of their size but partly because they are dual-listed,” he added, noting they were bound by British requirements.

“Australia has committed to implementing the Extractive Industries Transparency Initiative (EITI), they just haven’t fulfilled that promise as of yet.”

The EITI is a global voluntary initiative that requires payment-to-government information.

The report also noted that Australia lacked a mandatory disclosure law for all payments made to governments on a country-by-country and project-by-project basis, which exist in Britain, the EU, Canada, Norway, Switzerland and the US.

The research recommends the government implement the EITI and introduces legislation mandating project-by-project level tax reporting for companies operating in or from Australia.

The recommendations for companies included publicly renouncing the use of tax havens and submitting annual reports under the voluntary tax code.

The report was shared with the benchmarked companies ahead of being made public.

Rio Tinto got some praise in the research for being the only company to publicly disclose any contributions or donations to political parties, industry associations and lobbyists.

Ethical Partners investment director Nathan Parkin observed that if companies had a low tax base, often it was not sustainable.

“Of the companies there that don’t report (under the voluntary tax code) we exclude four of them from our investable universe based on this, but also where they operate,” he said.

“Australian companies generally haven’t fared well where those arrangements have been in place because they come to an end, or there is a deal broken, or some other arrangement in an offshore country can result in writedowns of projects.”

In Australia, the mining and energy sectors account for 8.2 per cent of economic output.

Clarification

Beach Energy clarified after publication that it had submitted its fiscal 2019 report to the ATO in the last week of June, 2020.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout