Goldminers rise as bullion breaks record, eyes $US2000 an ounce

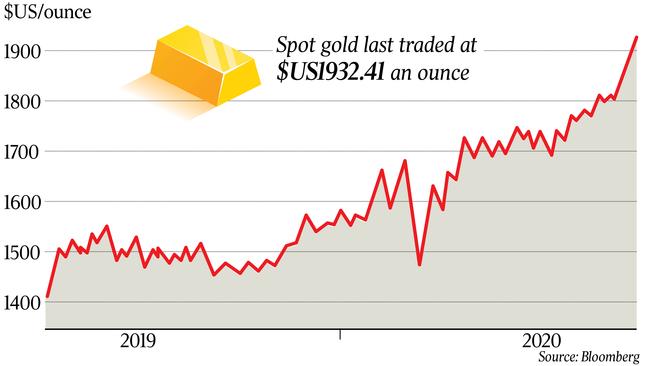

The price of gold broke through longstanding record highs on Monday as the US dollar weakened.

The price of gold broke through longstanding record highs on Monday as the US dollar weakened, boosting Australian gold stocks amid speculation the price of the precious metal soon could hit $US2000 an ounce.

Amid rising tensions between China and US and uncertainty around the progress of the fight against COVID-19, gold breezed through highs set in 2011 to an intraday peak of $US1944.71 an ounce — more than $US20 above its previous peak — before softening towards the end of the day. Citi and Goldman Sachs analysts have suggested bullion could cross the $US2000 an ounce mark within the next year but gold futures traded on COMEX hit $US1966 on Monday, suggesting the price is on track to test that mark sooner.

The strength of the Australian dollar against the greenback means gold did not top record highs of $2711 an ounce set in April, climbing to a peak of $2700.91 in intraday trading on Monday.

But the momentum was enough to put fresh legs beneath local gold stocks.

The S&P All Ordinaries Gold index also lifted to record highs on Monday, adding 4.4 per cent during the course of the day to close above 9500 for the first time as a raft of ASX-listed goldminers hit record highs, including Saracen Mineral Holdings, Westgold Resources and Silver Lake Resources.

Shares in dual-listed AngloGold Ashanti fared the best, albeit on thin volumes, jumping 82c or 8.9 per cent, to close at $9.99, with Australia’s biggest goldminer, Newcrest Mining, lifting 4.9 per cent to close the day up $1.71 to $36.31,

Northern Star Resources and Saracen — half-owners of Australia’s best-known goldmine, the Kalgoorlie Super Pit — both posted solid gains, with Saracen up 32c, or 5.2 per cent, to close at a record $6.48. Saracen touched $6.605 during intraday trading, and Northern Star closed up 64c to $16.14.

The index is now up almost 40 per cent since the beginning of the year as cash comes pouring into the coffers of Australian goldminers and even projects considered marginal a year ago look like money spinners.

Gold’s rise is partly fuelled by the massive wave of stimulus measures unleashed by global governments in response to the pandemic’s impact on local economies, and record low interest rates in place across most major developed economies — sparking fears from some economists of rampant inflation resulting from money printing or, alternatively, fears from other schools of economics that Japanese-style deflation could result from the fact central banks have little room to move to stimulate economies.

In a review of bullion’s outlook published on July 14 the World Gold Council pointed to research suggesting that gold could be an effective hedge against either possibility.

World Gold Council data suggests that investors have responded at record rates, with gold-backed exchange traded funds seeing seven successive months of investment inflows, with another 104 tonnes of gold added to total fund holdings last month and 734 tonnes in the first half of the year — well above record annual inflows of 646 tonnes in 2009, and taking told gold held in ETFs to 3621 tonnes.

Gold was trading at about $US1933 an ounce late Monday evening and $2713 an ounce in Aussie dollar terms.

Demand for precious metals also has helped silver more than double in value from its March lows, with the commodity up 4 per cent on Monday to $US24.10 an ounce.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout