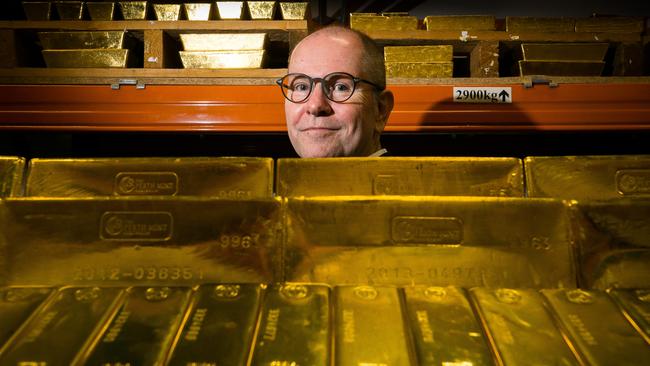

Golden moment for Perth Mint

The Perth Mint is set to expand its business selling gold to China following a deal with the Shanghai Gold Exchange (SGE).

The Perth Mint is set to expand its $US10-billion-a-year business selling gold to China, following a deal to become an international member of the Shanghai Gold Exchange (SGE), to be announced today.

“The deal will give us access to a far greater spread of the market in China,” Perth Mint chief executive Richard Hayes told The Australian yesterday.

“Joining the exchange means we can take gold into China and sell it to a much wider range of buyers and consumers. It will give us direct access to the market in China we haven’t had previously.”

The mint has been selling gold to China for the past eight years. The business has increased from about 30 tonnes a year since 2014 — when it became the first foreign refinery to be accredited by the exchange as a “good delivery” refinery — to export more than 800 tonnes of gold to China, valued at a total of $US33bn.

It shipped 200 tonnes of gold worth $US10bn to China last year, making it the largest source of imported gold into the Chinese market for the past two years.

At the moment the mint is only allowed to ship gold to Chinese banks that have their own import licences, or through its dealings with international bullion banks that sell into China.

Mr Hayes said the mint would continue to deal with its Chinese banking customers but would be looking for a wider spread of potential customers.

“We are hoping that by becoming an international member of the exchange it will increase the volume of gold we are supplying to China,” he said, but added that he did not want to predict how fast the business would grow.

Mr Hayes said Chinese banks had increased their holdings of gold since the global financial crisis after they saw the value of their US dollar holdings fall.

“What happened after the financial crisis, as the US dollar started to depreciate against other currencies, the Chinese government decided that a play on gold was a good way of diversifying out of US dollars and reducing its reliance on US dollars as a reserve currency,” he said.

China produces some 400 tonnes of gold a year that it retains for its own use, and imports another 300 to 400 tonnes a year.

The Perth Mint supplies between 50 per cent and 60 per cent of all gold imports into China. “China is a very large consumer of gold, partly because gold is a great strategic asset to have in an uncertain world, but Chinese people also have a strong cultural affinity for gold, which they have had for centuries,” Mr Hayes said.

The Perth Mint refines about 93 per cent of all the gold mined in Australia as well as gold mined in other neighbouring countries.

Mr Hayes said the mint has refined about 12 per cent of all gold produced globally each year.

“The gold is of high quality and ethically sourced, making the Australian commodity particularly appealing to Chinese investors. Our membership with the SGE will further raise awareness of the Perth Mint brand and strengthen our position as the largest supplier of gold to this premier market,” Mr Hayes said.