Gold shines amid a year of megadeals and batterings

A grim year for battery metals miners has finally ended, but the tale in 2019 for Aussie miners rests in the soaring gold price.

A grim year for battery metals miners has finally drawn to a close, but the tale of the tape in 2019 for Australian miners rests in the soaring gold price, which sparked megadeals, resurgent shares prices for some and a market battering for miners that disappointed.

The year was one of the biggest for corporate activity in the Australian gold space in years, kicked off by the Barrick-Randgold and Newmont-Goldcorp megamergers at the beginning of the year.

Australia’s contribution was headlined by the return of Kalgoorlie’s Super Pit mine to Australian hands in a $2.3bn two-tranche sale by Barrick to Saracen Mineral Holdings and Newmont to Northern Star Resources.

Northern Star also picked up Echo Resources for $193m, and long-term rival Evolution Mining could not stay out of the action, dropping $553m on Newmont’s Red Lake operations.

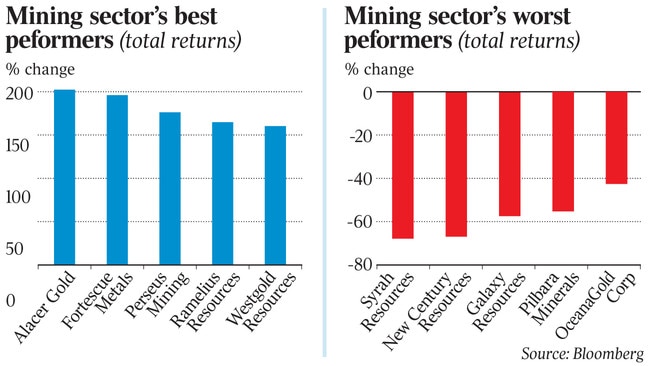

The big movers were far from the best performers on the market, though, with small producers and turnaround stories dominating the list of best stocks on the ASX 300 Metals and Mining Index.

Dual Canadian and Australian-listed gold producer Alacer led that list in 2019, with the expansion of its Turkish gold mines helping the company narrowly pip the massive dividends and stellar performance of Fortescue Metals as the top performer on a total return basis.

Alacer’s Australian-listed stock began the year at $2.60 and closed at $7.65, having hit highs of $8.44 in early December, for a total annual return of 202.4 per cent.

Fortescue’s cash machine rode the back of the 2019 iron ore price surge to pay out $3.1bn in dividends last year, with chairman Andrew Forrest talking home cheques worth $1.24bn during the year. Including dividends, Fortescue delivered a total annual return of 196 per cent to shareholders, the company stock having surfed the iron price from $3.80 to a Tuesday close of $10.69.

Fellow iron ore major Rio Tinto delivered a total return of 40.1 per cent in 2019, while rival BHP came in with 24.9 per cent. Mount Gibson Iron returned 89.1 per cent.

But gold producers that got their act together in time took advantage of stellar gold prices, while those that did not helped tell the twin tails of the mining index.

Alacer led the charge, but West African producer Perseus Mining and WA’s Ramelius Resources and Westgold were not far behind, delivering total returns of 176.2 per cent, 164.7 per cent and 160.2 per cent respectively.

The gold price averaged $2006 an ounce for the year in Australian dollar terms, and $2160 in the second half of the year — and those that failed to deliver promised ounces were punished.

Ongoing problems with mining authorities in The Philippines over its Didipio gold mine undermined Oceanagold, which led the gold laggards with a 42.6 per cent price fall for the year.

Serial disappointments from St Barbara’s Gwalia operations and the poorly received takeover of Atlantic Gold resulted in its shares tumbling more than 40 per cent for the year.

The failure of Dacian Gold to get the ramp-up of its Mount Morgans operations in order received a similar response. Dacian’s shares are only now approaching levels seen before June’s disastrous cut to production guidance, which resulted in its shares diving 67.5 per cent on the day, to 51.5c. The stock has since recovered and closed the year at $1.59, still 36.4 per cent below its 2018 close.

As a comparison, the ASX All Ordinaries gold index closed up 27.4 per cent for the year, on a total return basis.

And then there was lithium.

Oversupply and slower-than-expected growth in demand battered lithium producers, with Alita Resources collapsing and the share price of former high-flyers such as Pilbara Minerals and Galaxy Resources collapsing 55.2 per cent and 57.4 per cent respectively.

The only real highlight was Mineral Resources’ exquisitely timed $1.2bn deal to sell a majority stake in its Wodgina mine — mothballed only a week after the deal closed — to Albemarle for cash and a 40 per cent stake in under-construction downstream processing facilities. MinRes posted a 10 per cent gain in 2019, on a total return basis.

But the biggest losers were another pair of former market darlings, graphite producer Syrah Resources and zinc miner New Century Resources.

Neither lived up to their pre-production hype and both were severely punished, with New Century down 66.9 per cent for the year at 27.5c and Syrah off 67.8 per cent at 47c, for a market capitalisation of $194m — a long way from its $1.7bn peak in mid-2016.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout