Gold merger: Northern Star to buy De Grey in $5bn deal

Northern Star says labour and other costs are on the way down as it prepares to build Australia’s next big gold mine, after striking a $5bn deal to buy De Grey Mining and its Hemi project in WA.

Northern Star says labour and other costs are on the way down as it prepares to build Australia’s next big gold mine after striking a $5bn deal to acquire De Grey Mining and its Hemi project in WA.

The all-scrip transaction is the biggest deal in the sector this year and represents one of the highest prices ever paid for an undeveloped gold project. The deal comes with prices for the precious metal soaring to more than $4000 an ounce and with question marks over ageing mines in the Northern Star portfolio.

In targeting De Grey and the Hemi deposit discovered in 2020, Northern Star has abandoned the strategy of breathing new life into old mines that took it from a penny dreadful to the biggest gold miner on the ASX.

The deal will need the support of 75 per cent of De Grey shareholders, leaving Gold Road Resources – which owns 17 per cent of the stock – as a potential king maker if a rival suitor emerges.

A Gold Road spokesman said the company was reviewing its options.

The Northern Star share price fell 7.6 per cent to $16.17 while De Grey stock soared 27 per cent to $1.93 in trading on Monday.

Northern Star boss Stuart Tonkin said he was unfazed about buying Hemi without final federal and state environmental approvals in place, despite the recent controversy over an 11th-hour call by Environment Minister Tanya Plibersek that scuttled plans for the McPhillamys gold mine in NSW.

Mr Tonkin said Northern Star would move quickly to build the mine as soon as the approvals were locked in and noted easing cost pressures in WA on the back of the collapse of the nickel industry, a string of mine closures in lithium and belt-tightening in iron ore.

“We certainly are seeing stability and downward pressure on costs, particularly in service providers and labour in the Goldfields,” he said. “And it gives us greater confidence in forecasts going into a (mine) build.”

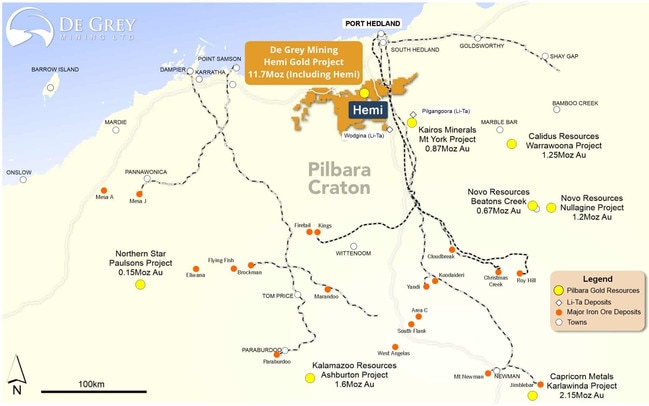

De Grey is due to have talks with officials from the Federal Department of Climate Change, Energy, the Environment and Water this week, as it seeks a green tick for the Hemi project, which sits about 80km from Port Hedland in WA’s resources-rich Pilbara region.

Federal authorities have requested more information on environmental issues with a decision expected in the March quarter. The time frame for a decision from WA’s environmental watchdog is unclear.

Hemi is one of the largest undeveloped gold projects in a leading mining jurisdiction and is forecast to produce 530,000 ounces of gold a year over its first 10 years, with potential to hit 700,000 ounces annually a year by tapping into satellite deposits and through underground mining.

Citi analysts said the deal was a departure from Northern Star’s typical “old asset turnaround” playbook that has included a $16bn merger with Saracen Minerals in 2020 that consolidated ownership of the fabled Superpit mine on the outskirts of Kalgoorlie.

“Northern Star clearly sees upside given the premium and required $1.3bn-plus project capex which we expect Northern Star could comfortably fund,” Citi said in a note to clients.

“De Grey will help to address a key pushback on the stock at a price — that Northern Star’s assets are all ageing, becoming more capital-intensive and facing declining grades.”

Under a scheme of arrangement unveiled on Monday, De Grey shareholders will receive 0.119 new Northern Star shares for each De Grey share, and end up with about 19.9 per cent of the expanded Northern Star.

The offer represented an implied price of $2.08 per De Grey share, representing It a 37.1 per cent premium on last Friday’s closing share price of $1.52.

Drummond Knight Asset Management, which owns both stocks, described it as a great deal and raised the prospect of rival suitor emerging.

“There were questions about whether De Grey management could execute but the market is more comfortable with Northern Star’s ability to execute,” Drummond Knight investment manager Kenneth Wan said. “It’s the last Tier 1 asset in Australia for sale.”

The deal comes as Northern Star pushes ahead with a $1.5bn project to more-than-double milling capacity at the Superpit, which together with the linked Mt Charlotte underground mine, has produced more than 65 million ounces of gold over its lifetime.

Mr Tonkin said Hemi was a “near shovel-ready mine” with agreements with traditional owners and other approvals in place.

De Grey ended the September quarter with more than $820m in cash and was close to locking in $1bn-plus finance package to build Hemi, including a $150m loan from the taxpayer-funded Northern Australia Infrastructure Facility.

Mr Tonkin said a cashed-up Northern Star could comfortably fund the mine, pursue its existing growth projects and continue to pay dividends.

The De Grey acquisition is set to propel Northern Star back into the ranks of the world’s top five gold producers and also marks a return to the Pilbara for the company that started out operating the Paulsens mine in the region in 2010.

Northern Star said it was on track to be producing 2 million ounces a year by 2025-26 from its Kalgoorlie and Yandal operations in WA, and Pogo mine in Alaska.

The addition of Hemi is expected to lift production to about 2.5 million ounces a year by 2028-29.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout