Glencore to cap its coal production as pressure rises

Coal giant Glencore will abandon the pursuit of large coal deals and freeze production to help address climate change concerns.

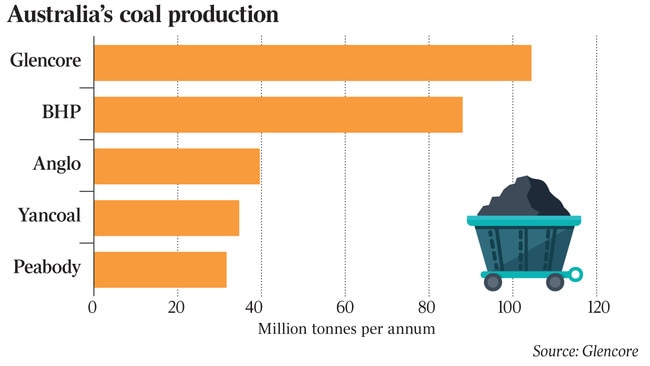

Australia’s largest coal producer, Glencore, will abandon the pursuit of large coal acquisitions and freeze production at current levels to help address climate change concerns, following pressure from institutional investors including major Australian superannuation funds for the fossil fuel to be phased out.

The Swiss-based resources giant, headed by billionaire Ivan Glasenberg, says it will cap its global thermal and coking coal production at the current level of about 145 million tonnes after holding talks with the Climate Action 100+ initiative, which controls $US32 trillion ($45 trillion) in global investment.

Climate Action 100+ members in Australia include AustralianSuper, AMP Capital, Cbus, IFM Investors, QSuper and BT Financial Group.

“To deliver a strong investment case to our shareholders, we must invest in assets that will be resilient to regulatory, physical and operational risks related to climate change,” Glencore said in a statement yesterday.

“To meet the growing needs of a lower-carbon economy, Glencore aims to prioritise its capital investment to grow production of commodities essential to the energy and mobility transition and to limit its coal production capacity broadly to current levels.”

The plan to effectively end the pursuit of new coal mines by one of the world’s top producers signals a broader rethink among miners over their future exposure to the highly polluting fossil fuel.

While Glencore said it would retain the right to buy minority stakes in its existing operations, the move is likely to ensure projects such as its giant Wandoan thermal coal project in Queensland are put permanently on ice. Glencore’s Australian mines account for almost 100 million tonnes of its global volumes, underlining the impact it may have on major new mines being delivered in Queensland and NSW.

Glencore said it would “rebalance its portfolio” towards commodities that support the transition to a low-carbon economy in a move it expected would lower so-called Scope 3 emissions, which covers customers’ end use of the commodities produced by the company.

The Church of England — a member of Climate Action 100+ — said Glencore’s decision to align its business and investments with the goals of the Paris climate agreement was a first for the mining industry.

“Delivering on the goals of the Paris Agreement requires unprecedented collaboration and today’s announcement is a positive step forward for Glencore, its investors and the fight against climate change,” Church Commissioners for England’s head of responsible investment Edward Mason said.

The miner’s new stance on coal and its impact on global emissions marks a dramatic shift less than a year after it paid Rio Tinto $US1.7 billion for the Hail Creek coking coal mine in Queensland.

It also paid $US1.26bn for a 49 per cent share of Rio’s Coal & Allied thermal coal operations in NSW’s Hunter Valley the previous year.

Rio chairman Simon Thompson subsequently linked the company’s exit from NSW thermal coal mines to climate change concerns, saying the decision was influenced by the implications of climate change on coal supply and demand.

Coal prices have performed strongly since Glencore bought the mines at prices generally seen at the time as fully valued.

However, investors are increasingly banding together to question the longevity of thermal coal in particular, as cleaner renewable energy sources provide alternative power supply options.

Glencore noted it would review its membership of relevant trade associations and consider whether they aligned with its stated positions on climate change and the Paris accord.

BHP last year axed its membership of the World Coal Association, citing the lobby group’s stance on energy and climate change. In Australia, coal recently pipped iron ore as the nation’s largest export earner. Australia exported $66.bn worth of thermal and coking coal last year, the highest amount ever recorded, due in large part to soaring coal prices.

However, new mines face a much tougher test to receive regulatory approvals due to community and investor concern over environmental impacts and the threat of new coal facilities becoming stranded assets in the face of cheaper clean alternatives.

The NSW Land and Environment Court this month upheld a decision by the NSW government to block the development of Gloucester Coal’s proposed Rocky Hill coking coal mine, with judge Brian Preston citing the mine’s potential contribution to climate change as a reason for the decision.

Meanwhile, Adani has hit a last-minute hurdle in its attempt to start work at its Carmichael coal mine in Queensland’s Galilee Basin, due to environmental concerns over the project’s impact on the endangered black-throated finch.