Glencore Mt Isa plant the latest east coast facility facing closure

Glencore is weighing up the future of its Mount Isa copper smelter and Townsville refinery as energy prices undermine their viability.

Mining giant Glencore is weighing up the future of its Mount Isa copper smelter and Townsville refinery as energy prices undermine their viability and Australia’s manufacturing base faces a wave of closure decisions over electricity and gas prices.

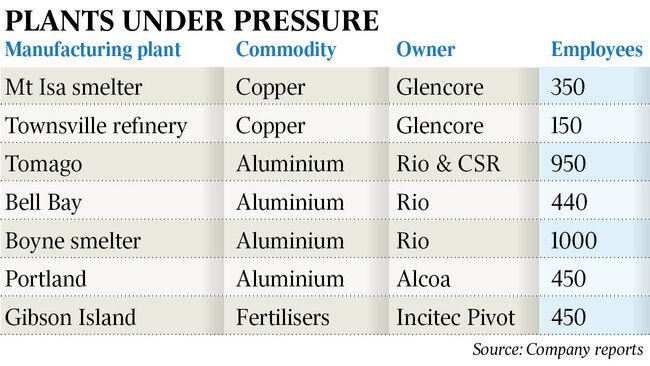

Seven major industrial facilities along the east coast are now threatened with closure as federal and state governments meet at national cabinet on Friday amid increasing pressure to support manufacturing jobs during Australia’s first recession in almost three decades.

In addition to Glencore’s looming decision on its copper smelting and refining plants, Rio Tinto is weighing the future of its aluminium smelting operations in Australia, Victoria’s Portland aluminium smelter faces closure without a new and cheaper power deal and Incitec Pivot is again seeking a long-term gas supply deal that would keep its Gibson Island fertiliser plant viable.

Collectively the facilities employ almost 4000 workers and their operations support thousands more indirect jobs. All are facing critical tipping points over their future within the next year, and all of them could be closed by 2022 if a solution to long-running concerns about high gas and energy prices is not found, their owners say.

Glencore’s decision on the fate of its Mount Isa smelter and Townsville refinery will be delivered ahead of Treasurer Josh Frydenberg’s October 6 budget, which is expected to include a range of measures to support gas production and target power and gas costs.

One option believed to be under consideration by Mr Frydenberg for the October budget is a “book build” from gas and power users for future gas needs, with the government believed to be considering offering to underwrite additional gas production from existing facilities to incentivise delivery of up to 100 petajoules a year of extra supply into the domestic market.

Under the concept the government would underwrite the production by up to $1.50 a gigajoule, to a total cost of $350m to $750m over the forward estimates.

Energy Minister Angus Taylor said this week that analysis of national energy market data showed wholesale electricity costs had fallen by around 46 per cent over the last year, and that price reductions had begun to flow to customers.

“We are going to keep the pressure on the energy companies to make sure they keep coming down,” he said.

Wholesale spot gas prices on Australia’s east coast have also rapidly fallen this year, but buyers wanting to lock in gas on a contractual basis say they are still being offered prices in a much higher $8-$10 a gigajoule range.

Wholesale spot electricity prices have also fallen to five-year lows but many manufacturers are still locked into deals struck at higher levels in the past few years.

Glencore blames “high fixed costs”, including power prices, for the uncertainty surrounding the future of its smelter and refinery.

Glencore needs to rebrick the Mount Isa smelter at a cost of about $40m. While the outlay is relatively small given Glencore’s size, the company said this week the decision to do so is not assured.

A Glencore spokesman said the company was in the final stages of reviewing the business case for the Mount Isa copper smelter and Townsville refinery.

“These assets are facing significant international competition and high fixed costs in Australia which negatively impacts their ongoing commercial viability,” he said.

“We have been transparent about the challenges and discussions are ongoing with both the Queensland and federal governments.”

Any decision to close the smelter could have significant knock-on effects for the Mount Isa mining district. In addition to processing concentrate from Glencore’s own mines, the smelter also takes concentrate from other producers in the region, who would need to negotiate new offtake agreements and transport arrangements if the smelter were to shut after 2022.

Its exit could also put pressure on Incitec Pivot’s Phosphate Hill fertiliser plant, which relies partially on the sulphuric acid produced as a by-product from the Glencore smelter.

Other manufacturers will also make decisions on the future of their facilities over the next year.

The subsidised power deal supplying Alcoa’s Portland aluminium smelter in Victoria expires in the middle of 2021, and the company has said it needs a far cheaper power offer to extend the plant’s life.

And while Rio Tinto has not put a deadline on a decision over its smelters, chief executive Jean Sebastien Jacques told the Australian in July they remained “on thin ice” and he wanted to make a decision on their fate sooner rather than later.

“We are working as quickly as we can, as hard as we can, but at some point in time we will have to take stock of where we are,” he said.

A decision is also approaching for Incitec Pivot over its Gibson Island fertiliser plant, where a gas contract expires in 2022.

The company has already taken a replacement contract out to the market, but Incitec boss Jeanne Johns said last month it had received only a tepid response from gas suppliers, with only a few bids for parts of the 10-year supply deal having been submitted, and at rates “substantially” above international gas prices.

Manufacturing Australia, which counts Tomago and Incitec Pivot as members, said the industry had helped keep Australia running through the pandemic but faced a difficult outlook amid high costs and inefficient energy markets.

“The biggest impediment to new manufacturing in those sectors is stubbornly high energy costs and dysfunctional markets. We’ve had the ACCC report highlighting the significant shortcomings in the domestic gas market and we’re not going to fix gas if we don’t implement those recommendations and tackle issues around industry structure,” Manufacturing Australia chief executive Ben Eade said.

“What we need to look at is how we get Australia back on the map for greenfields manufacturing investment.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout