Gina Rinehart and Chris Ellison have spent big on lithium – the iron ore market is a clue why

Gina Rinehart and Chris Ellison’s lithium buying spree has puzzled market observers. Nick Evans looks at the motivations behind the cash splash.

The billionaire bidding war for West Australian lithium projects is shaping as a generational play in the hope of replicating the state’s dominant position in the iron ore industry, amid growing competition for control of critical and battery minerals.

Gina Rinehart’s Hancock Prospecting and Chris Ellison’s Mineral Resources have pursued an increasingly aggressive buy-up of stakes in WA’s junior explorers, in part aimed at fending off attempts by global lithium majors SQM and Albemarle to grow their own footprint in the state.

Hancock spent big to acquire a 20 per cent interest in Liontown Resources, spoiling Albemarle’s $6.6bn takeover play for the company. Last week it ran a similar intervention in SQM’s bid for emerging lithium play Azure Minerals, buying an 18.9 per cent stake.

MinRes has since been buying shares, taking a position estimated to be worth at least 4 per cent of Azure’s register.

Combined, the pair are likely to be able to vote down SQM’s friendly offer for the company, and are in a position to contest any subsequent on-market takeover made by the South American chemicals giant.

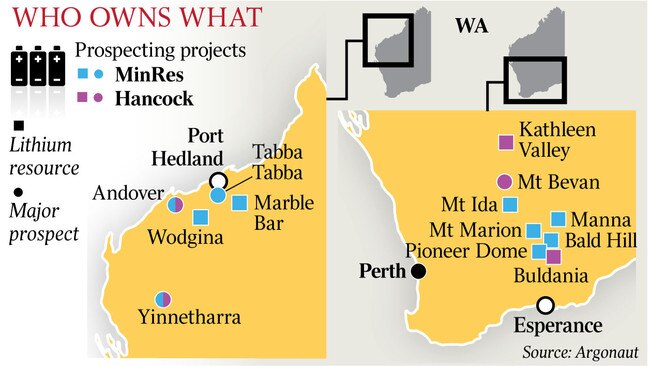

Of the state’s top 15 lithium deposits, according to WA broking and advisory firm Argonaut, MinRes now has an interest in nine.

Hancock has an interest in five, some in common with MinRes.

Of those top deposits, the pair only lack any interest in the giant Greenbushes mine (owned by China’s Tainqi, WA’s IGO and Albemarle), Pilbara Minerals’ Pilgangoora operations, and the Mt Holland joint venture between Wesfarmers and SQM.

The recent bidding war has seen both companies pay a premium for exploration and development stocks at a time of crumbling lithium prices and sagging demand.

As a result Hancock and MinRes now own stakes in most of WA’s most advanced juniors.

MinRes holds shares in Global Lithium, Delta Lithium, Bill Beament’s Develop (which is acquiring Essential Metals), Wildcat Resources, and Azure Minerals.

Hancock owns a major stake in Liontown Resources and Azure, is also a shareholder in Delta, and has a lithium deal with Hawthorn Resources and Legacy Iron at Mt Bevan in the state’s Mid West.

Both companies have separate short and medium-term interests. But a broader play is also clearly under way – if not in concert, at least in parallel.

Hancock’s primary driver is diversification beyond the company’s Roy Hill iron ore mine, which shipped its first tonnes to customers in late 2015, and had a 17-year mine life when financed.

While Hancock has a vast suite of other interests across the globe, it has no immediate successors for Roy Hill.

Exploration programs in Australia and South America are still at a relatively early stage, and Hancock’s foray into Canadian metallurgical coal is stuck in a regulatory quagmire.

Lithium, along with WA gas, now appears to be a key plank in that diversification.

For MinRes, the play is a familiar one. Despite its direct mining interests, the company remains at its core a mining services provider. MinRes strategy is to build a strong presence around its own assets – Wodgina in the Pilbara and Mt Marion near Kalgoorlie – and become a dominant player in the business of mining, transporting and processing lithium deposits around those core assets.

In mid-2000, Rio Tinto paid $3.5bn to acquire fellow Pilbara iron ore miner North Limited. The takeover turned Rio into the world’s second-biggest iron ore miner, delivered a host of valuable assets – and helped shape the industry over the next decade as China rose to economic and geopolitical prominence.

Rio’s bid for North was opposed by the WA government, which wanted to keep three players active in the Pilbara to ensure new iron ore deposits could be opened up more easily. It was also opposed by the Japanese steel industry, then the world’s largest, because it would give Rio and BHP more influence over steel pricing.

Rio argued the takeover would allow more efficient development of Pilbara iron ore deposits – to develop the best deposits first, and match the mines to the market.

The takeover also left Pilbara export infrastructure in the hands of only two companies, allowing BHP and Rio to lock up Pilbara iron ore developments until Andrew Forrest’s Fortescue Metals Group fought off frenzied opposition to build its own port and rail operations.

Until the commodity took off last decade, lithium supply was also dominated by a cosy oligopoly – largely controlled by SQM and Albemarle. WA’s Greenbushes mine was the only hard rock operation of any note, supplying about 40 per cent of world demand. When demand boomed, the existing majors weren’t able to respond in time and new players, including MinRes and WA’s Pilbara Minerals, forced their way into the market.

Now, as then, China is the dominant buyer of raw commodities. Despite all the political talk about alternatives to China’s downstream processing dominance from the US and its allies, no serious challenge is likely to emerge in the near future.

Australia will never build downstream lithium processing plants, chemical precursor or battery making plants on the kind of scale needed to compete with China.

If Australia is to be a major supplier to Asian lithium markets, the moves by Hancock and MinRes make sense.

It remains to be seen whether full takeovers eventuate – but between them MinRes and Hancock are in a position to influence the development of almost every major undeveloped lithium deposit in WA.

That’s not a bad position to be in – the only question is whether the two can turn it into the market position enjoyed by the state’s iron ore majors.