Gas pressure rises as exports soar

Queensland’s three big gas export plants are shipping at their strongest rates in seven months as global LNG prices rise.

Queensland’s three big gas export plants are shipping at their strongest rates in seven months as global LNG prices rise to four-year highs and southern winter demand pushed Sydney and Melbourne gas prices to records last month.

The spike may inform talks gas producers and LNG exporters will hold with federal Resources Minister Matt Canavan this week, with two meetings convened to discuss the extension of a deal to offer uncontracted gas to domestic markets before export markets.

Labor leader Bill Shorten has also raised the risk of renewed scrutiny of the nation’s squeezed east coast gas markets during the next federal election after pledging to introduce a new price trigger to potentially curb exports of the fuel.

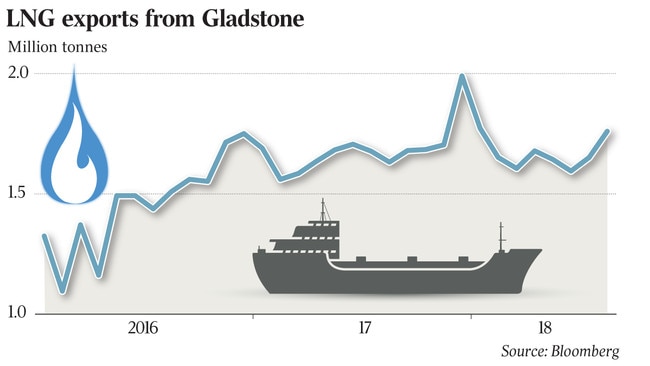

The latest Gladstone Port data shows the $70 billion of LNG projects built to export gas through six big Curtis Island freezers boosted August exports by 6 per cent to a seven-month high of 1.76 million tonnes, representing an annual rate of 20.7 million tonnes a year.

The rate was up 7 per cent on July and the third-highest on record, but shy of the December 2017 record of 1.99 million tonnes.

While exports are up, it appears the three big Queensland exporters are sticking to last year’s deal with the federal government to prioritise domestic over export markets for non-contracted volumes.

This is illustrated by winter domestic spot prices being similar to last year despite a near doubling of LNG prices.

LNG spot prices this week hit a four-year high of $US11.33 per million British thermal units, or $16.75 per gigajoule, as China continues to buy all available LNG as part of its cleaner-air policies.

The rising LNG spot price combined with increased volumes from Queensland and off Western Australia to push the nation’s July LNG export value to a monthly record $3.72bn, according to Australian Bureau of Statistics data released last week.

Australian domestic gas contract prices are being signed at between $8 to $11 a gigajoule, according to the latest ACCC report on pricing. This is roughly triple historical prices but lower than the average $12 to $15 level being offered at the start of last year before the federal government probed the market.

Spot domestic gas prices in Sydney and Melbourne were at August records, averaging $9.26 and $9.04 per gigajoule, respectively, as cold weather drove demand and Bass Strait produced less gas than last year, The Australian’s analysis of the latest Australian Energy Market Operator data shows.

But prices for southern domestic users remain below the equivalent price exporters could get selling the gas to international spot buyers (the netback price) after recent LNG price rises. The 2018 winter average price in Melbourne of $9.27 was flat from the previous year, while in Sydney it was down 27c at $9.49.

The biggest LNG producer of three plants at Gladstone is the Australia Pacific LNG plant, run by Origin Energy and ConocoPhillips.

“The market is working to make sure domestic customers have the gas they need,” an Origin spokeswoman said.

“Prices remain below export parity despite strong demand through a cold winter and higher gas use for power generation due to coal plant outages.”

Under a non-binding agreement signed between the three exporters — APLNG, Shell and Santos — and the federal government in September last year, the LNG companies pledged to make sure there was enough gas going to domestic markets to avoid export restrictions.

EnergyQuest managing director Graeme Bethune said the increased August volumes out of Gladstone were due to a single extra cargo compared to July, when 25 LNG tankers left the harbour. AEMO data showed gas was still flowing strongly from Queensland to southern markets, he said.

Santos chief Kevin Gallagher last week warned of rising sovereign risk in Australia that would prevent investment in new supplies critical for keeping down domestic prices. “If the threat of government intervening and tearing up export contracts is out there — which hasn’t happened to date — it will discourage long-term investments,” Mr Gallagher said on the sidelines of the conference.

KPMG’s head of Australian oil and gas, Jonathan Peacock, said Labor’s east coast gas policy of linking a set price to the export restrictions risked stifling supply if it set too low a price.

“One of the companies I spoke to said ‘we’ll just leave the gas in the ground because we won’t get a return if the price is going to sit at that level’,” Mr Peacock said.

“If you are going to try to get investment in Australia, I would argue that you want to be really clear to the producers, to industry and to others about the mechanism you are going to put in.”

Mr Peacock said AEMO’s recent forecast that there would not be a gas shortage out to 2030, on the back of reduced gas-fired power demand and producer pledges to convert resources to reserves, was a “credible scenario”. “But there are a number of other credible scenarios as well,” he said.