Gas developers unmoved, wait for full code of conduct text

While outwardly tensions between the government and the gas sector have cooled, industry sources said they would not yet make any decisions about resuming work on stalled projects.

Gas developers will not make a decision on whether to proceed with shelved projects until after they have seen the full text of the mandatory code of conduct unveiled by the federal Labor government, prolonging a stalemate that has loomed over Australia’s future gas supply.

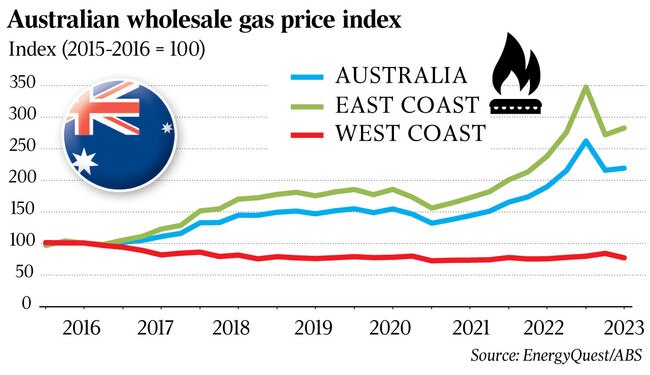

Labor on Wednesday unveiled its much anticipated code governing Australia’s gas industry, the centrepiece of which includes a cap on uncontracted gas at $12 a gigajoule.

Developers responded to the proposal of the code in 2022 by shelving plans for new projects, insisting the plans failed to recognise the swathes of capital that they put at risk to underpin exploration and development, exacerbating concerns about a forecast east coast shortfall in the coming years.

Immediate concerns about supplies were tempered when the government said the gas industry had committed to an additional 260 petajoules to 2027 – reducing the risk of a crisis after official warnings the east coast faces gas shortages every winter until 2026.

The gas commitment came after the government in April had offered several concessions, hinting hostility between the two sides had relented.

While outwardly tensions between the government and the gas industry have cooled, industry sources said they would not make any decisions about resuming work on stalled projects until after the full text of the code of conduct was released amid an ongoing feeling of suspicion.

“We have to see the full document. Until then, we can’t be sure there aren’t any issues that we aren’t aware of,” said one industry source, who declined to be named as negotiations with the government are confidential.

The gas industry were loud vocal critics of the government intervention, which they said was done without market consultation.

Labor was unapologetic, insisting it was forced to act amid a cost of living crisis and concerns about the future viability of Australia’s manufacturing industry – the dominant user of gas.

Notable projects to watch include Senex Energy’s $1bn Atlas project in Queensland and Cooper Energy’s planned expansion of its Otway gas project off Victoria.

A Senex spokesman said there was no change to the status of Atlas for now.

“We eagerly await the release of the final text of the Code in the coming weeks and we hope it establishes workable rules that will bring on much needed new gas supply to the market,” the spokesman said.

Senex Energy, and its owners South Korea’s Posco and Gina Rinehart’s Hancock Prospecting, have been loud opponents of the government intervention.

Critics have said Australia is risking its reputation as a stable and trusted LNG exporter, but Labor insists Australia must prioritise affordable gas to its domestic market first.

These future gas projects will be critical to preventing a long-term structural gas shortfall.

The Labor government has pledged its commitment to the gas as a transitional fuel, but recent legislative changes have squeezed the industry.

In March, Labor secured Greens support for the centrepiece of its carbon emission reduction plan, but only after including a stipulation that new gas projects developed to supply existing LNG plants be net zero carbon from the outset.

That will be particularly onerous on several proposed gas projects, which are also grappling with increased demands to consult with local landowners after an unexpected court ruling last year which overturned a previous environmental approval.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout