Cooper boss warns Canberra not to meddle in gas pricing

Cooper Energy’s boss warns the discovery of new gas fields could be put at risk by interference in pricing to support manufacturers.

Cooper Energy boss David Maxwell has warned the federal government not to meddle in gas pricing to support manufacturers as his company prepares to deliver new east coast supplies into long-term contracts, saying discovery of new fields could be put at risk by interference in the market.

Speaking after Cooper and pipeline player APA Group told the market they finally had issues at their troubled Orbost processing plant in Victoria under control, and announcing that gas was set to flow from the facility under long-term contracts from January 1, the managing director said the troubles the companies had faced commissioning the facility should serve as a warning that governments should not interfere in the market to try to set gas prices.

The Orbost plant was designed to service Cooper’s Sole gas project, and output from a $250m upgrade to the plant conducted by APA was originally due to enter the market in mid-2019.

But ongoing problems with the plant forced multiple temporary closures and Cooper said on Wednesday it was finally in a position to begin supplying long-term contracts from January 1, after the plant was able to maintain stable output of 22.5 terajoules a day since December 9.

Mr Maxwell said the start of the commercial contracts was a great relief to the company, which had been waiting on a fix at Orbost for the cashflow from its contracts to accelerate exploration at its other Victorian prospects.

“We’ll reinvest the cashflow together with debt facilities in further gas supplies for southeast Australia, in the offshore Otway and offshore Gippsland,” he said.

The entry of Sole gas to the east coast market will alleviate a drop-off in supply from the ageing Bass Strait fields owned by BHP and Exxon, but the Australian Energy Market Operator has warned that further gas discoveries are needed in southeast Australia to avoid a big shortfall in supply in coming years.

Amid ongoing debate around how the federal governments should act in the gas market to try to secure lower prices for major manufacturers, Mr Maxwell said the fact that Cooper was making good on long-term contracts from Sole showed the big gas users were still able to win supply at prices they were comfortable with.

“We have to allow commercial forces to negotiate the price. Without that, my view is that supply will be impaired because there will be additional uncertainty. These are projects with some risk

— this project is 18 months late, that’s a risk we’ve had to wear,” he told The Australian.

“If you have additional risks, like uncertainty on price where the government can come in and change the price, it starts to get difficult,” Mr Maxwell added.

A draft heads of agreement on gas supply sent to Queensland’s three LNG producers early this month included reference to a pricing mechanism, following sustained pressure from Australia’s big manufacturers for cuts to their gas costs, sparking concerns from gas suppliers that they would pay a price for federal government support for the manufacturing industry.

Cooper has been selling gas from Sole into the Australian spot market since April, but the company said on Wednesday the start of its long-term contract arrangements would lead to a significant lift in revenue.

Cooper’s contracts with major buyers such as Visy, AGL and Alinta date back to the inception of the Orbost refurbishment in 2017, but Mr Maxwell said the price they contained remained competitive with current terms won in more recent deals signed by others.

He said the commercial launch of Orbost and Sole, the first new gas field developed offshore in southeast Australia in a decade, would add more competitive tension into the market, although it would not add significantly to total supply available due to the rapid decline of ageing Bass Strait fields owned by BHP and Exxon.

In its 2020 statement of market opportunities, the Australian Energy Market Operator noted the start of Sole, and the Esso-BHP West Barracouta project, would not be “sufficient to slow the decline in production, but further anticipated projects in the Otway, Gippsland and Cooper Eromanga basins are expected to be on track to start production over the coming years”.

“To maintain levels of production beyond 2024, gas from more uncertain field developments will need to progress,” AEMO said.

“The utilities and the industrials, the large gas buyers, are still able to negotiate contracts, notwithstanding what some people say. People are still negotiating contracts, which says the market is working,” Mr Maxwell said.

“I think at the moment, some of the noise coming from the buyers is what they need is internationally competitive prices — the price required to support gas developments in eastern Australia has increased. So the days of gas prices where they were 10 years ago have gone, because it’s just not economic.”

But while Cooper and APA are celebrating the start of commercial contracts from Orbost, the gas producer said uncertainty remained around the long-term performance of the plant, noting APA had still not got to the bottom of the problems that had plagued the plant.

“The performance of the Orbost Gas Processing Plant (OGPP) has been impaired by foaming in the sulphur recovery unit’s absorbers requiring regular maintenance,” the company said.

“Analysis and review are being undertaken to determine the root cause of the foaming.”

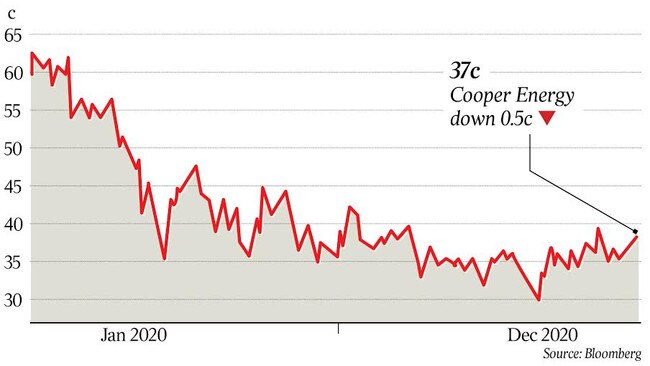

Cooper Energy shares closed down 0.6c at 37c on Wednesday, while APA fell 29c to $9.84.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout