Galilee Basin coal boom looms after Adani start

Nation is on the brink of opening up a massive, untapped coal region after Adani committed to begin its mine project.

Australia is on the brink of opening up a massive, untapped coal province after Adani committed to begin construction of its controversial Carmichael mine project in central Queensland before Christmas.

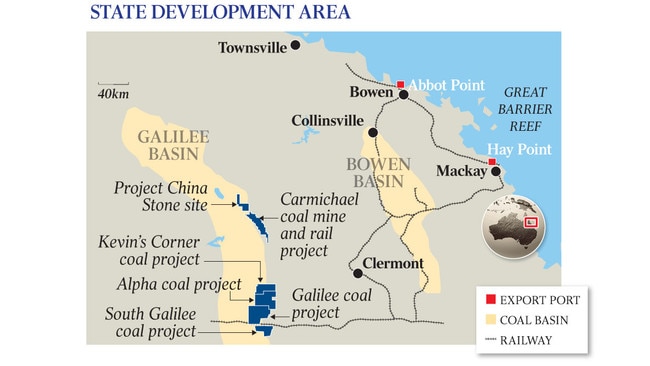

After almost a decade of delays, legal challenges and protests, the Indian conglomerate is planning to begin exporting high-quality thermal coal from the Galilee Basin, west of Mackay, by the end of 2020.

Adani’s decision to self-fund a scaled-down version of its original mine-rail proposal — involving what would have been Australia’s biggest-ever coalmine — could pave the way for five other proposed mines in the basin. Its planned rail link to the Abbot Point port will be opened for use to Adani’s rivals, with an initial coal-hauling capacity of 40 million tonnes a year that could be doubled within a few years.

Last week, Queensland’s Co-ordinator-General approved the proposed $6.7 billion Chinese-backed MacMines coalmine in the Galilee Basin.

The Gina Rinehart-backed $6bn Kevin’s Corner and Alpha projects in the Galilee, both run by India’s GVK, have also received environmental approvals, and the cash-flush Clive Palmer recommitted last month to the Alpha North mine in the basin.

Queensland Resources Council boss Ian Macfarlane said the go-ahead for Adani’s project could be the springboard for up to five other coalmines and possibly help mooted gas exploration in the region.

Mr Macfarlane said access to Adani’s 200km rail line, which will connect to central Queensland’s existing Aurizon freight network, would help secure financing for neighbouring mines.

“It means that this basin will finally be developed,” he said. “This is not just about Adani but also the other proposed mines in the basin. If they have got access to the rail link, then they can export their coal without needing to build the infrastructure.

“It is a continuation of the good news story around coal in Queensland and the billions of dollars it earns for the state in royalty taxes.’’

Despite the expected boost to state royalties and new jobs in Queensland’s regional areas, where unemployment is high, Premier Annastacia Palaszczuk elected not to comment on the announcement.

Instead, a spokesman for the Labor government said Adani still needed to clear additional hurdles, relating to the proposed rail corridor and water use. “This appears to be a very different proposal to previous announcements that have been made in relation to this project,” he said.

“In addition to the change in scope, this announcement involves a rail corridor that will require, among other things, agreements with existing users and the operator.”

Adani’s Australian chief executive, Lucas Dow, who addressed a meeting in Mackay yesterday of community leaders, mining industry leaders and suppliers, told The Australian that the remaining agreements and approvals would be secured within weeks.

“We have all of the environmental licences and key conditions in place already,’’ Mr Dow said. “There are a couple of management plans that are currently with the state and federal government, and they are essentially routine.’’

Adani had struggled to secure finance for the rail link after Ms Palaszczuk withdrew required support for a $1bn federal loan during last year’s state election campaign after Labor was dogged by protests against the mine, particularly in inner-city seats.

Conservationists have repeatedly delayed the project through court challenges, and later lobbying of international banks. Several major banks refused to finance the project.

Once touted as able to produce 60 million tonnes a year, the mine project has been scaled back to an initial output of 10 million tonnes a year before ramping up to an annual 27.5 million tonnes within a decade. The project, initially costed at $16.5bn, is now expected to cost less than $2bn and be in full production in two years.

An estimated 1500 jobs will be created in the construction and “ramp-up’’ stage of the mine and rail project, and several hundred people will be employed on a permanent basis.

Mr Dow said 10 million tonnes of coal a year would fuel the electrification of India. “We look forward to people getting in behind us and starting to help us deliver these jobs to north and central Queensland,” he said. “They have some of the highest unemployment levels in the state.”

Federal Resources Minister Matt Canavan congratulated the company’s commitment despite having faced “longstanding, ill-informed protest” and state government indecision. “Adani’s ability to re-scope and finance its Carmichael mine and rail project proves it is a viable, job-creating concern which stands on its own two feet financially and environmentally,” Senator Canavan said.

Nationals deputy leader Bridget McKenzie said the government’s loan offer to Adani was not a mistake and made when the project was double the size of the one going forward.

She expected 100 ongoing jobs after the construction phase.

“The proposal’s changed significantly. Adani has made their own decision after a decade of trying to get this up that they will fund it themselves, I think it’s fantastic news, I’m looking forward to it starting and the jobs rolling out right across Queensland,” Senator McKenzie told Sky News.

But Deputy Labor leader Tanya Plibersek said she remained “very sceptical” about the Adani mine and questioned if the Morrison government would loan $1 billion to the project.

“That’s a very important question for Scott Morrison. In the past the Liberal government has said they want to contribute $1bn to this project, $1bn of taxpayers’ money and we would absolutely oppose that,” Ms Plibersek told ABC radio.

“It’s obvious that no business, no bank wants to invest in it. Adani has made announcement after announcement in the past, they’ve been on the verge of going ahead many times so you’ll forgive me for being sceptical now as well. Certainly one of the things to notice is that all along we’ve said the jobs claims that were being made at this mine have been overblown, it seems that that certainly is the case.”

Ms Plibersek said her party would not rely on “this overseas company to fix all of the demand for jobs in central and north Queensland”, listing a number of alternative projects Labor would help fund.

“I understand people in Central and north Queensland need work, absolutely they do, but this project has had many false states and all along bank after bank reject the option to invest and business after business reject the option to invest in this because most people understand we’ve gone past the peak demand for coal,” she said.

The Sydney Labor MP warned it was not easy to “tear up signed agreements” if Labor won office at next year’s election, after environmental groups urged the opposition to scrap any environment approvals for the mine.

An executive from Ms Rinehart’s company said Adani’s move to secure financing and target first production could boost the prospects of other mines in the basin, including GVK Hancock projects. Hancock Prospecting executive director Tad Watroba told The Australian: “Of course it’s welcome and well-timed. There is an urgent need for more coal supply in the market and that includes the Galilee.”

Mr Watroba said coal-fired power stations were still the cheapest form of energy “by a mile” and would need supplies from basins including the Galilee for years to come.

Opposition resources spokesman Jason Clare said Adani’s “vastly smaller” proposal showed Labor was right to criticise the initial project. “We said the project as first proposed would not stack up, and it didn’t,” a spokeswoman for Mr Clare said.

CFMEU Queensland district president Steve Smyth accused green activists of using the Adani campaign as a “stalking horse” against the coal industry. He urged Adani to use as many local permanent employees as possible, rather than relying on labour hire or fly-in, fly-out workers.

Adani’s investment promises to support thousands of jobs beyond the mine. They include SEW Eurodrive’s service centre at Mackay, 800km north of Brisbane, where 11 staff supply and maintain industrial gears.

Managing director Rob Merola said the workshop was approaching full capacity and hoped to invest and employ more workers as the Galilee opened. “We consciously made the decision to invest in Mackay to be near to the mining and sugar industries, knowing in the background there was the sleeping giant, Adani, that could get off the ground and we’d be well-positioned to add to their business,” he said.

The Australian Conservation Foundation ramped up pressure on politicians to stop the mine, claiming that emissions from the coal would intensify storms and bushfires.

Additional reporting: Rosie Lewis, Perry Williams