From big oil to a potash pivot: BHP’s evolution

How long does it take to build a new pillar at the world’s biggest resources company? About four chief executives and 15 years, on current form.

How long does it take to build a new pillar at the world’s biggest resources company? About four chief executives and 15 years, on current form.

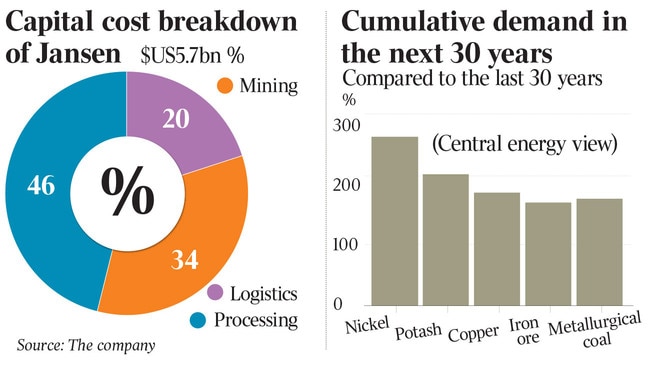

BHP’s announcement on Tuesday it had finally sanctioned the $US5.7bn ($8bn) Jansen potash mine in Canada came more than 15 years since it first acquired the assets. And 10 years and 364 days after Marius Kloppers launched the mining giant’s ill-fated attempt to find a shortcut into potash through the $US39bn takeover of PotashCorp.

This week the Jansen announcement was almost an afterthought amid the news BHP wants to sell its petroleum division to Woodside through a $40bn scrip-based asset merger, and plans to finally collapse the dual-listed company structure that remains its last legacy of the $US28bn merger with Billiton in 2001.

Taken together, the three announcements represent a seismic shift in BHP’s future shape – a pivot from Houston to Toronto as the driver of its North American ambitions, and a permanent shift away from fossil fuels to Mike Henry’s preferred “future facing commodities” – copper, nickel and now potash.

It removes one of BHP’s “four pillars” of production, oil and gas, and replaces it with another, potash. Jansen, as BHP has made a point of noting this week, is rated as a 100 year asset, even in its first stage. It is arguably, like the iron ore riches in the Pilbara, a tier 1 asset.

But it has been a long and winding road for both legs of the asset transformation.

While BHP ultimately decided not to proceed with a demerger of its petroleum arm this time round, in favour of the sale of its assets to Woodside, it‘s an issue that has vexed the mining giant for more than four decades.

BHP first considered a spin-off of its oil and gas arm in the mid 1980s and a demerger was twice proposed in the following decade to BHP to focus on its core mining business.

But a deal was never done.

BHP’s petroleum division is ultimately the result of its gamble to invest in gas exploration in the 1960s.

Jansen is a product of the “acorn program” launched by BHP under the leadership of former chief executive Chip Goodyear, which seeded a swath of joint ventures with juniors across the world – from diamonds, gold and copper in Africa, to base metals in Tasmania and South Australia. And potash in Canada.

BHP entered potash through a joint venture with Anglo Potash in 2006, farming into the project that became Jansen, before taking out its partner in a $US282m deal in 2008.

Mr Goodyear left BHP in 2007, and his successor had far grander ideas about how to grow the business without waiting for acorns to sprout. It was a strategy immediately obvious, given Mr Kloppers first major move on taking control of BHP was to launch its blockbuster $160bn bid to merge with Rio Tinto.

In 2008 BHP’s annual report said Jansen was at the pre-feasibility stage, but Mr Kloppers had bigger plans for BHP’s entry into potash.

Two years later, on August 18, BHP launched a $US39b bid for Canada’s PotashCorp.

Like the bold bid to merge with Rio Tinto it was a costly failure. PotashCorp’s full-throated battle to hold BHP at bay was referred to as the 100-days war, as it furiously lobbied local and national politicians in Canada, and global regulators, to kill the deal and remain independent from BHP.

In the end, the BHP bid was scuttled by the Canadian government, which rejected the deal as delivering no “net benefit” to Canada. Ultimately, PotashCorp shareholders didn’t get a say in the matter.

Like the Rio bid, BHP’s failure to capture PotashCorp set the scene for Mr Kloppers successful – and ultimately far more expensive – bids to enter the US onshore gas market, which also helped reshape BHP’s petroleum portfolio.

Mr Kloppers’ takeover frenzy eventually brought his leadership unstuck, but BHP kept spending on Jansen’s development under the new leadership of Andrew Mackenzie – despite the fact that Mr Mackenzie was noticeably cool on its prospects even early on in his term.

By 2012 BHP had already sunk more than $US1.2bn into Jansen, and in late 2013 it elected to spend another $US2.6bn on building deep shafts to access the deposit – a project led, curiously enough, out of BHP’s Houston offices because Jansen had been attached to its petroleum division.

By 2019, shortly before he made way for Mr Henry as the BHP boss, Mr Mackenzie was admitting the company had overinvested in Jansen, suggesting it may mothball the shafts and project despite their massive cost.

The departure of Mr Mackenzie – a former BP executive and now the chairman of Shell – means petroleum is on the outer and “future facing” commodities are all the rage under Mr Henry.

BHP took a $US1.3bn pre-tax impairment on Jansen this week, but Minerals America boss Rag Udd said that, with an internal rate of return of about 14 per cent, the project is still competitive.

“We‘ve been very open over the last couple of years that we’re not thrilled with where we are. At the same time, we actually have to make investments based off the next dollar moving forward, particularly when you’re dealing with counter cyclical investments,” he said.

When complete in 2027, Jansen will produce about 4.35 million tonnes of fertiliser a year, and BHP is betting that global population growth and the need to preserve remaining wilderness areas means that existing farmlands need to be more productive to feed the world.

The BHP board has finally sanctioned Jansen, according to Mr Henry, because potash gives BHP “increased leverage to key global mega-trends, including rising population, changing diets, decarbonisation and improving environmental stewardship”.

As for BHP’s exit from petroleum?

Woodside‘s newly appointed boss Meg O’Neill told The Weekend Australian the asset merger was a “once in a lifetime” deal.

“Everybody‘s been elated. I mean this is the sort of deal that happens very infrequently in a company’s life,” she said.

“It gives us the financial capability to fund our investments, it gives us confidence in our pathway to a final investment decision on Scarborough and Pluto Train 2. And there‘s a real buzz about the opportunity to participate in parts of the world like the Gulf of Mexico that we’ve not historically had a significant presence in. So yeah, everybody’s thrilled.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout