Fortescue Metals still in race for Simandou deposit

Fortescue Metals Group has confirmed it is still in the running to pick up a slice of the ‘Pilbara of Africa’.

Fortescue Metals Group has confirmed it is still in the running to pick up a slice of the “Pilbara of Africa”, with the Andrew Forrest-led company believed to be one of only two left vying for the right to develop blocks 1 and 2 of Guinea’s massive Simandou iron ore deposit.

Fortescue chief executive Elizabeth Gaines confirmed Fortescue is a bidder for the slice of the project handed back to the Guinean government by billionaire Beny Steinmetz's BSG Resources in February after the settlement of a protracted legal dispute.

The blocks were put to tender in June. Fortescue and Guinea’s biggest bauxite producer SMB-Winning — a consortium of French logistics giant UMS, Chinese aluminium producer Shandong Weiqiao, Singapore's Winning Shipping and the Yantai port group — are believed to be the only groups left bidding.

Brazil’s Vale, which is still suing Mr Steinmetz and BSG Resources after an earlier attempt to get hold of the two blocks ended in disaster, is said to have paid the $US300,000 ($444,500) to enter the data room but did not progress an offer.

Fortescue has previously fended off reports linking it to a pitch for a piece of Simandou, sparked by a July visit by chairman Andrew Forrest to Liberia, in which the Australian mining magnate reportedly signed a memorandum of understanding, along with Emirati Sheikh Ahmed Dalmook Juma Al Maktoum, over potential infrastructure.

But Ms Gaines confirmed Fortescue’s interest on Monday.

“Consistent with our active business development program, Fortescue is interested in global opportunities in iron ore and other commodities which align with our strategy and expertise,” she said. “Details of Fortescue’s bid are confidential and there is no guarantee that any bid submitted will be successful.”

It is understood Fortescue has also hired a number of new staff with direct experience of working on Guinean and Liberian projects since submitting its first expression of interest in early August, as it prepares for a possible entry into the region.

According to a Reuters report the Guinean government is due to pick a winner in the contest within the next month, with Fortescue’s fate likely to rest on its willingness to play ball with the Guinean government’s insistence any developer build a 650km railway and take product out through a new Guinean port rather than ship it through a much closer option in Liberia.

Once wholly owned by Rio Tinto, Simandou is tipped as the world’s biggest undeveloped iron ore project, holding more than 2 billion tonnes of some of the highest-grade iron ore available, with average grades of about 65 per cent iron.

But the project has long been mired in claims of corruption and bogged down by the insistence of the Guinean government on the capital-intensive local railway and port option, tipped to put the price tag of the project beyond the $US20bn mark.

Rio was stripped of half of the project in 2008, with blocks 1 and 2 handed to BSG — which then sold 51 per cent of the stake to Vale in 2010. That relationship ended in acrimony, and ongoing litigation, when BSG was accused of having corruptly acquired the concession by the new government of President Alpha Conde, which withdrew the mining rights in 2014 — allegations that were withdrawn as part of the settlement with BSG in February.

Rio’s 2011 re-acquisition of half of Simandou also cost it dearly, when the company admitted in 2016 it had paid French banker Francois Polge de Combret, an adviser to President Conde, $US10.5m to use his influence to help win back its rights, sparking ongoing foreign corruption investigations into the mining giant in the US and Britain.

Mr Forrest has previously been fiercely critical of Rio’s talk of developing Simandou, penning a newspaper column in 2015 as iron ore prices fell in the face of a flood of new supply from global miners, accusing Rio and BHP of trying to flood the market and put competitors out of business.

“Rio Tinto has a huge project they call the Pilbara of Africa they are trying to develop,” he said.

“The problem is, it’s not in Australia and won’t help any Australian. Is that why they are in a scramble for increased market share?”

The post-boom iron ore price crash cooled interest in Simandou and other Guinean deposits which, despite their high grade, did not stack up against the mooted $US20bn price tag required to build a mine, 650km railway and new port.

But this year’s resurgent iron ore price has rekindled interest in iron ore in the West African nation, with BHP successfully selling its Nimba iron ore deposit to a private company of Canadian mining billionaire Robert Friedland, and former Xstrata boss Mick Davis picking up the right to develop the nearby Zogota deposit, previously owned by BSG.

Rio and its partner in the other half of Simandou, China’s Chinalco, are also reportedly working on ways to revive their portion of the massive project.

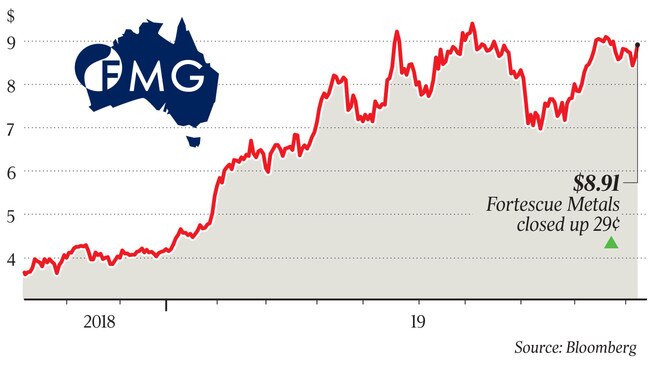

Fortescue shares closed up 29c to $8.91 on Monday, with Rio down 5c to $87.60.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout