Fortescue Metals Group ups iron ore shipping forecast, draws down debt

Fortescue is making hay as the iron ore price shines, upgrading shipping guidance for the financial year as the cash rolls in.

Fortescue is making hay as the iron ore price shines, upgrading shipping guidance for the financial year as the cash rolls in.

But despite strong shipments and high iron ore prices, Fortescue joined the legion of Australian corporate majors in bolstering its cash position in the face of the coronavirus crisis, drawing down a $US1bn debt facility in April to “enhance the strong liquidity position” of the company.

Fortescue chief executive Elizabeth Gaines said the decision to draw down the facility was a prudent one to ensure it maintained its own liquidity in the face of an uncertain period as the coronavirus crisis took hold globally, not a sign the company was concerned about the outlook for its own products.

A strong quarter put Fortescue in the best financial position since it began building its iron ore projects more than a decade ago, and the company finished the period in a net-cash position for the first time since construction began.

The company finished March with $US4.2bn in cash, up from $US3.3bn at the end of December, and in a net cash position of $US100m — up from net debt of $US2.9bn at the end of December. That will have now changed after the payment of $US1.6bn in dividends on April 6, and the drawdown of another $US1bn in debt.

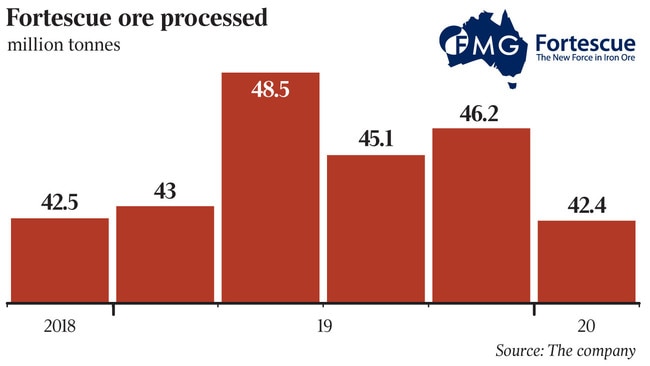

Fortescue shipped 42.3mt in the March quarter, up 10 per cent from the same period last year when all of the Pilbara majors were hit hard by Cyclone Veronica.

The iron ore major said it was on track to improve its performance over the rest of the year, saying it now expects financial year shipments to total 175 to 177 million tonnes, up from earlier guidance of 170 to 175mt.

While cash poured in to the company’s coffers amid the strong price and shipping performance, cash production costs rose in the period, though, from $US12.54/t to $US13.27/t.

Chief executive Elizabeth Gaines said Fortescue saw ongoing strong demand from its Chinese customers, as its economy recovered from the coronavirus crisis.

“We saw a strong start to the calendar year with Chinese crude steel production up 1.2 per cent to 234.5mt. Earlier in the year the indications were the industry would grow between 2 per cent and 4 per cent, and those expectations might moderate but it still underpins a very healthy environment for iron ore demand,” she said.

“We’re seeing market conditions remain very robust, we’re going into that pretty intensive northern hemisphere summer period where construction activity is very strong.

“There’s nothing we’re seeing at the moment that would indicate there’s going to be a softening in production or demand for iron ore, but we can’t be complacent.”

Ms Gaines conceded Fortescue’s Korean and Japanese customers — a minority of its business — were under pressure with the closure of steel mills and downstream manufacturing industries in both countries, but said Fortescue had not seen any shipment delays or cancellations.

“We’re not a major supplier to those markets, but we have longstanding relationships with key customers and we’re working with them. But they’re honouring our long-term contracts with them,” she said.

Fortescue shares closed up 22c, or 1.9 per cent, to $11.96 on Thursday.