Fortescue Metals Group half year profit pumped up by record iron ore shipments

Surging iron ore prices have delivered an $828m payday for Fortescue Metals Group chairman Andrew Forrest.

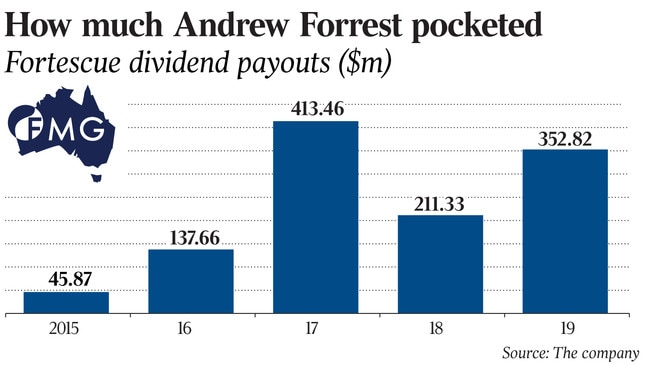

Another bumper dividend from Fortescue Metals Group will push its payouts to founder and chairman Andrew Forrest to more than $2bn since the beginning of 2019, as iron ore prices and strong export volumes propelled Fortescue to a $US2.5bn ($3.7bn) half-year profit.

Fortescue will pay a 76c a share interim dividend on the back of its half-year profit, handing Mr Forrest and his Minderoo Group another $828m cheque – on top of the $1.24bn it paid out to the mining magnate in 2019.

And the result, which left Fortescue sitting with $US3.3bn in cash at the end of December, puts the company in an ever-stronger position as it looks to up spending on growth projects in iron ore over the next two years and considers diversifying beyond its core commodity, according to chief executive Elizabeth Gaines.

Fortescue’s Pilbara mines shipped 88.6 million tonnes of iron ore in the first half of the financial year, generating revenue of $US6.5bn as prices stayed high and supply constraints elsewhere in the market – a legacy of Vale’s January 2019 Brazilian tailings dam disaster and a poor year from Rio Tinto – meant Fortescue got more for its product than in previous years.

Fortescue’s realised price for the half year was 73 per cent above the same period in 2018, as the company lifted shipments of higher-grade ore and discounts for its traditional products narrowed against benchmark prices.

It generated underlying earnings before interest, tax, depreciation and amortisation of $US4.2bn and a nearly three-fold lift in net profit for the half-year, to $US2.5bn.

Fortescue will spend another $US1.2bn on its two new Pilbara iron ore mines – a traditional dig and ship operation at Eliwana and a processing-heavy magnetite mine at Iron Bridge – through the remainder of this financial year, and another $US1.7bn the following financial year.

It will also spend $US450m on new power infrastructure connecting its Pilbara mines.

But its stellar 2019 performance still leaves Fortescue with plenty of firepower to grow, according to Ms Gaines, either in its ever-expanding global exploration program, or through early-stage efforts to commercialise hydrogen production in the Pilbara, in a collaboration with the CSIRO.

And although Ms Gaines says merger and acquisition activity for later stage projects or producing mines is not a major priority for Fortescue, she admits it’s a possibility if the right opportunity comes along.

Fortescue’s confidence in its once-strained balance sheet was enough to take an unsuccessful tilt at the giant Simandou iron ore project in Guinea, and the iron ore major has also reportedly run its eyes over the Bouganville copper mine in Papua New Guinea.

It is also said to be in the data room of ASX-listed Metals X, running the numbers on the company’s Nifty copper mine in the Pilbara.

“Never say never. We look at a range of opportunities. It would have to be absolutely compelling, and it would have to present significant value for our shareholders,” Ms Gaines said.

“Our focus at the moment is on early stage exploration, but that doesn’t mean we aren’t assessing a range of opportunities. If you look at our recent announcements we’ve picked up quite lot of tenure in South Australia, near Olympic Dam, and a lot of that’s through farm-ins with juniors – that in its own right represents transactions our team are actively working on.”

Fortescue shares gained 8c to $11.14 on Wednesday.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout