Forrest-backed gas terminal offers $10 gas deal

The AIE consortium planning to build a gas import facility at Port Kembla is pitching a fixed price of $10/GJ to industry.

The Andrew-Forrest backed consortium planning to build an import facility bringing cheap international gas onshore at Port Kembla is pitching a fixed price of $10 per gigajoule to business groups in a bid to secure contracts with customers in gas-starved NSW.

Confirming that it received priority development status from the NSW government yesterday, the Australian Industrial Energy consortium also rejected claims that it would be the most expensive development of three proposed gas import terminals in southeast Australia.

AIE chief executive James Baulderstone said the consortium was negotiating memorandums of understanding with 15 large industrial users to contract for gas supplies as part of plans to rapidly develop the project.

The consortium is understood to have pitched prices between $8 and $12, with the midpoint below the $11-$12 price for gas sourced and piped from fields in Victoria and Queensland.

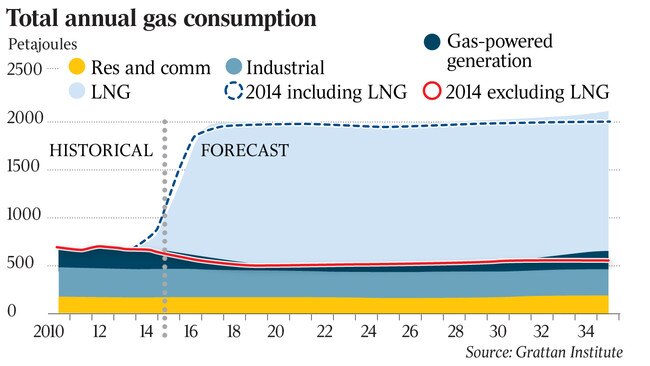

AIE wants to secure fixed price contracts at a time when gas prices in Australia are high and volatile following expected declines in Bass Strait production that has been the mainstay of the east coast market and amid heavy demand for exports of coal-seam gas out of Queensland.

Mr Baulderstone said the pitch to businesses in the vicinity of the port — which include the BlueScope steel plants, plastics cement and chemical industries — was to provide certainty of price, delivery date and reliability in “the state that needs it most”.

Ai Group chief executive Innes Willox said the manufacturing industry peak body had been supportive of the project because it would add supply and security to the market. But Mr Willox said the fixed price remained a concern as it was still two or three times the price large contracted users were paying for gas five years ago.

“It is a high price, but if that is the best that can be done, so be it,” he said.

Mr Baulderstone, a former executive with gas producer and exporter Santos, is leading a consortium backed by Fortescue Metals Group founder Andrew Forrest’s Squadron Energy and Japan’s JERA and Marubeni, which already operates gas terminals in other countries.

The slated 2020 date for delivering gas would also make the Port Kembla operation the first of the three planned gas import terminals launched to take advantage of rising gas prices and tight supply conditions.

AGL Energy has committed $100 million so far to the development of the Crib Point gas terminal while it awaits approvals. ExxonMobil is considering its own plant to meet the supply shortfall from expected production declines in the Bass Strait fields it operates alongside BHP.

Mr Baulderstone said AIE would have the first mover advantage, and disputed claims by analysts that the $200m to $300m development cost would make it the most expensive of the three proposed terminals.

Comparisons with the other projects had overlooked the expense of pipelines that they would need to be built from the terminals to distribution hubs, including a 15km link from onshore to the Longford facility in Victoria.

AIE will need to build a 6km spur to the Eastern Gas Pipeline operated by Jemena.

“I am very confident that we will be the cheapest,” Mr Baulderstone said.

Over the weekend the NSW government assigned Critical State Significant Infrastructure status on the project, in a move that could lop six months from the standard 18-month approvals process.

Mr Forrest said that since 2000 only 20 projects had received the designation, making it a powerful demonstration of the need to solve the state’s gas security challenges.

AIE is also forging ahead with engineering design, negotiations over the floating terminal and discussions with potential suppliers.

Mr Baulderstone said a huge gas surplus in the US meant gas could be sourced there at prices around $3GJ, liquefied and shipped to Australia and still be competitive with local production.

But he said the company hoped to have diverse supply and was in discussions with Australian and Asian producers as well.

A string of gas import terminals that were conceived for the US before the fracking boom have since been converted into export terminals capable of shipping out the surplus supplies.

At least one of the terminals is owned by IFM Investors, the same Australian funds management business that bought the Port Kembla and Port Botany from the NSW government.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout