FIRB approves DUET takeover by Cheung Kong Infrastructure

Hong Kong’s CKI has won a tick for its $7.4bn deal to buy Australian energy networks operator DUET.

Hong Kong conglomerate Cheung Kong Infrastructure has cleared the Foreign Investment Review Board process for its $7.4 billion purchase of energy networks operator DUET Group.

The FIRB approval came ahead of a vote by shareholders of the target company today to approve the deal.

DUET (DUE) told the ASX this morning that it had been notified by CKI that the federal Treasurer had no objection to the deal proceeding.

DUET shares popped 10 per cent higher after trading at a discount to the $3.03 bid price amid concerns the Treasurer could block the deal.

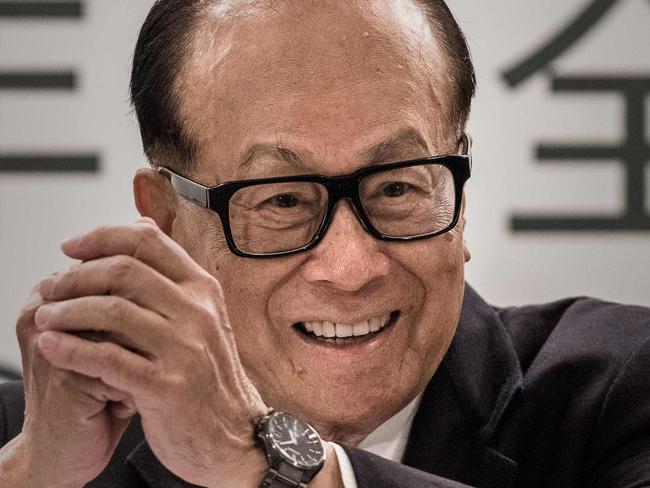

CKI, controlled by Hong Kong billionaire Li Ka-Shing, and Chinese Government-controlled network operator State Grid were blocked from buying Ausgrid last year for unspecified national security reasons, clearing the way for AustralianSuper and IFM Investors to buy the network from the NSW government.

Peter Jennings, from the Australian Strategic Policy Institute, last month raised concerns that the DUET deal raised national security concerns because of the company’s ownership of the Dampier to Bunbury Pipeline that links Western Australia’s massive gas reserves to Perth and the iron ore rich Pilbara, as well as electricity distribution networks in Victoria.

The offer price was a premium of up to 30 per cent above DUET’s trading price and nearly 19 per cent above the midpoint of the $2.32 to $2.77 valuation range assessed by expert KPMG.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout