FAR rues bad timing as funding deal falls over

Banks walked away from FAR Limited’s debt deal in late March as oil crashed below $US20 a barrel.

Woodside Petroleum’s partner in a delayed $US4.2bn ($6.3bn) Senegal oil venture has described the oil crash as “mind numbing” and defended the collapse of a critical debt financing deal, saying it was desperately unlucky after energy prices plunged.

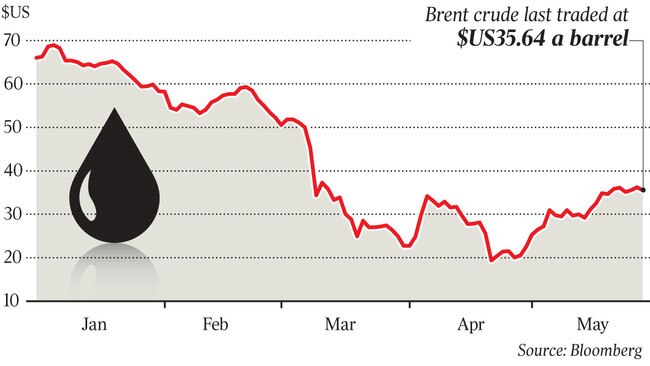

The Melbourne-based FAR Limited saw banks walk away from a finalised debt deal in late March as oil crashed below $US20 a barrel with the producer failing to conclude a $US300m reserve-based lending facility to fund its share of the giant Senegal project.

The massive ructions in the oil market including a 70 per cent fall in prices sparked by a record drop in demand caused by COVID-19 had hammered the entire industry, FAR said.

Global “demand has dropped 30 per cent which is just mind-numbing”, FAR chairman Nicholas Limb told the company’s annual general meeting on Wednesday. “Just to remind you that in the GFC global demand dropped by 1 per cent.

“Typically we look for a supply-demand balance to control pricing and the difference of 1 per cent either side of that balance is either a boom or bust in price usually. And we had a 30 per cent fall, so it was pretty difficult.”

The fall in oil prices came at a particularly sensitive time for FAR as it looked to conclude talks with Macquarie, Glencore and BNP Paribas for $US100m each to help fund its $US500m share of the Senegal project along with a separate $US150m junior debt facility. Mr Limb said the timing of COVID-19 and the oil collapse hit the financing discussions.

“The senior facility was done, completed and was only subject to what was a fairly normal syndication process and the mezzanine we were just dotting the i’s and crossing the t’s when COVID broke loose. So we were definitely unlucky with our timing,” Mr Limb said. Still, the banks may have pulled their commitments in any case.

“Even if it was signed, done and delivered they would have found a way out in this environment anyhow. It’s no different to if you agree to buy a house, you get your loan set up and then the house burns down. You’re pretty sure the banks aren't going to make it easy for you to draw that money.”

Shareholders also expressed their concern over a “going concern” statement in FAR’s annual report which laid out a range of scenarios should it fail to win a funding deal.

FAR’s chairman revealed the board was forced to hastily rework its annual report in reaction to the oil market and could not buy any more time from the Australian Securities and Investments Commission.

“We were finished and about to publish when all hell broke loose because of COVID and the oil price collapse,” Mr Limb said.

“We were waiting for the audit report to be signed off and of course the world became incredibly uncertain, banks were going wobbly and no one knew what was happening.

“ASIC would not give relief to companies like us who were about to publish but gave it to people who were publishing in six months. It was a pretty odd decision, so we were forced to publish at very short notice with the world going pear-shaped around us. Given the litigious world we operate in, the directors and auditors really had no option but to look closely at worst case scenarios.”

Debt talks with its lenders had not been killed, according to FAR chief executive Cath Norman, but it was “pens down” for the time being while alternatives were assessed. FAR has opened a data room to consider selling some or all of its 15 per cent stake in the offshore Sangomar development which aims to become the first oil project in the West African country, delivering 100,000 barrels a day of oil from early 2023.

A number of potential buyers had entered the process but many had “come in cold” and needed time to understand a complex set of data underpinning the project, Ms Norman said.

Woodside owns a 35 per cent stake in the Sangomar venture alongside Cairn Energy with 40 per cent, Far with 15 per cent and Petrosen the 10 per cent balance.

FAR said 11 staff had left the company as a result of cost cutting. Its shares dropped 12.5 per cent to 1.4c.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout