Evolution Mining founder Jake Klein says Newmont assets could be growth target after Newcrest merger

Evolution Mining will be in the hunt for any assets shed by Newmont after the global giant closes its blockbuster merger with Newcrest.

Evolution Mining will be in the hunt for any assets shed by Newmont after the global giant closes its blockbuster merger with Newcrest Mining, according to Evolution founder Jake Klein.

Mr Klein confirmed at Evolution’s annual investor day on Monday the company would be a contender for assets shed by any of the world’s gold majors, even as the Australian miner laid out its plans to build output from its existing mines.

“The best opportunities do come for us from the majors and obviously (there’s) a lot of activity in the market at the moment,” he said. “Newmont has made it clear that they are looking to dispose of some of their non-core assets if they proceed with the new post merger. So that is obviously a place that we would be looking in the future – recognising that it will take them probably until 2024 to make any decisions.”

Newcrest’s ageing Telfer mine in WA is widely expected to be one of the assets shed by Newmont if it closes a deal to buy the Australian gold major, with existing smaller Newmont operations in Canada such as Musselwhite and Porcupine also falling outside of the company’s definition of “tier one” gold assets.

Evolution acquired its cornerstone Cowal gold mine in NSW as Barrick exited Australia in 2015, and bought its first interest in the Ernest Henry gold and copper mine in Queensland as Glencore looked to pay down debt in 2016, before closing a deal to buy the mine outright in 2022.

Mr Klein noted that Cowal had only five years’ life remaining when Evolution acquired the mine, and the company had since pushed its production out for another 10 years through an underground expansion.

The company also announced the results of a pre-feasibility study on Ernest Henry that would push its life out to 2040.

Evolution Mining also said on Monday it has pulled the trigger on a $250m expansion of the mill at its Kalgoorlie gold operations, in a sign concerns about the cost of building new projects in Western Australia has started to ease.

The company shelved the mill expansion a year ago as the impact of the state’s skills shortage pushed up project costs across the industry, with the company saying at the time conditions had reached an “unsustainable level”.

But Evolution said at its annual investor day it would now push ahead of the plant to double the capacity of the mill at its Mungari operations, just outside Kalgoorlie, to 4.2 million tonnes a year.

Evolution said it had also restructured its borrowings to push out the repayment schedule as it looks to invest in its operating mines.

The company replaced an existing $590m term loan facility with a four-year $300m loan, plus a $US200m ($300m) debt placement – with $U100m due in 2033 and the balance in 2035, and carrying a 7.26 per cent and 7.44 per cent coupon rate respectively.

Evolution said it had not increased the size of its borrowings, just pushed out the repayment schedule of its debts to free up cash to allow it to pay dividends while still investing in its operating mines, with the rejig freeing up $445m in cash over the next three years that would otherwise have gone towards term loan repayments.

The Newcrest board’s recommendation of the Newmont takeover is subject to no superior offer emerging for the company, with Newmont agreeing to pay a $US375m break fee if it pulls out of the deal, and Newcrest liable for a $US174m payment if it exits the arrangement.

Newcrest expects to offer shareholders a vote on the deal in September or October, with the deal likely to close in 2023.

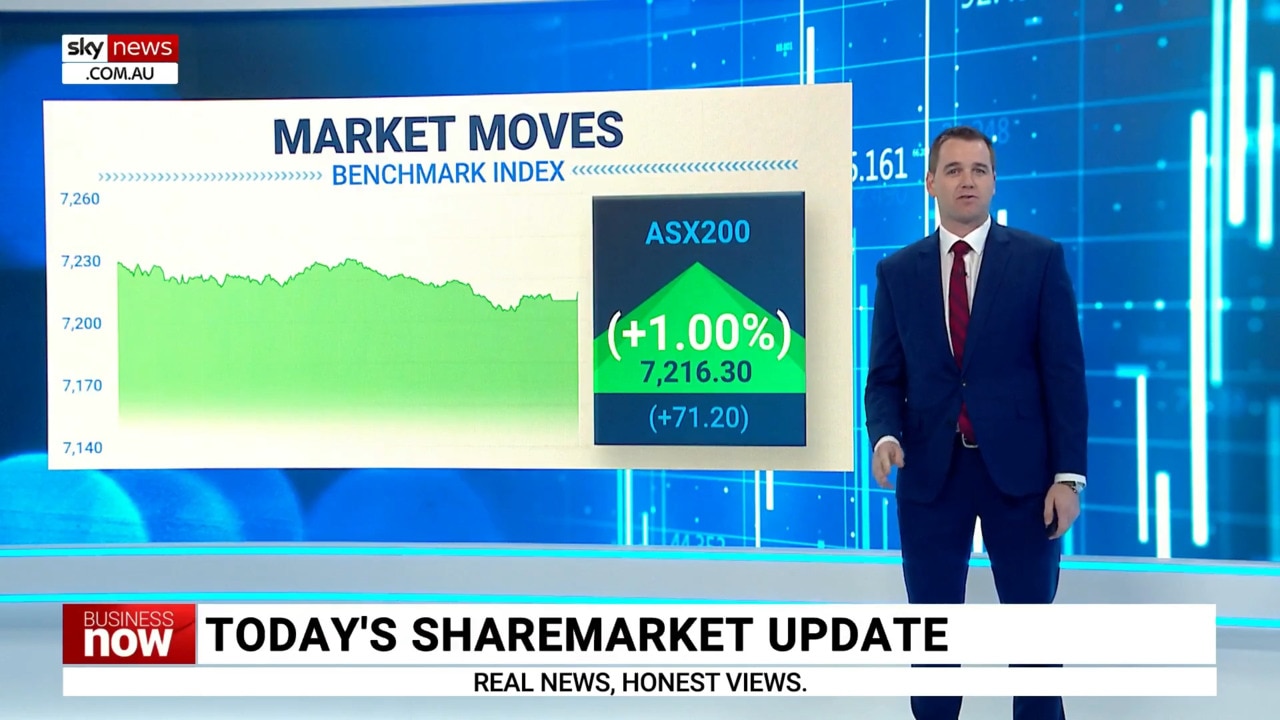

Evolution shares closed up 11.5c to $3.645 on Monday.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout