ERA needs at least $1bn in additional cash to fund even near-term Ranger rehabilitation costs

ERA needs to find at least $1.2bn to fund the Ranger uranium mine’s rehabilitation until 2027. Will ERA’s minority shareholders keep backing a company that cannot offer any return?

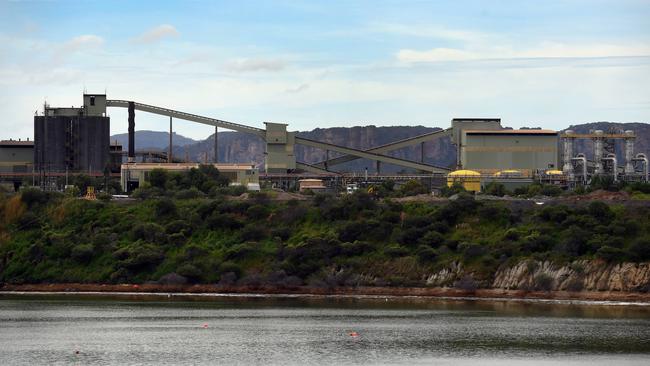

ERA will need to raise more than $1bn to fund even the short – term costs of cleaning up the Ranger uranium mine, the company has revealed in the latest blowout on rehabilitation efforts within the Kakadu National Park in the Northern Territory.

Energy Resources of Australia said on Tuesday it expected to have to spend at least $2.3bn cleaning up after uranium mining in the World Heritage-listed national park, up from previous estimates of $1.6bn to $2.2bn.

But the company, 86.3 per cent owned by Rio Tinto, also said it would need to find at least $1.2bn to cover its rehabilitation program until the end of 2027, suggesting ERA would need to conduct a monster capital raising – for which shareholders would see little hope of a return – by the end of 2024.

ERA had $273.6m in cash at the end of September, but is spending about $55m a quarter on rehabilitation work and corporate costs.

At that rate, the former uranium miner would be running short of cash within a year and has previously flagged a return to the capital markets before July 2024.

Although ERA has not yet outlined its strategy for future capital raisings, it will need to tuck away a substantial capital raising to cover its $1.2bn in proposed spending over the next three years.

Spending beyond that is still subject to ongoing feasibility studies, but ERA said on Tuesday its $2.3bn total rehabilitation liability figure – which will be included in the company’s annual financial results in February – is still subject to ongoing costing and remains “highly uncertain”.

“Of the increase in the provision, approximately 85 per cent is attributable to rehabilitation activities post 2027. These activities remain subject to a number of studies and are also potentially sensitive to external events such as rainfall,” ERA said.

ERA raised $363.6m at 2c a share in May – discounting the company’s shares by more than 90 per cent to get the raising away.

The last uranium oxide was processed at Ranger in January 2021 and ERA no longer generates revenue from the operation which ran for 40 years and was, for much of that time, arguably the most controversial mining operation in Australia.

Rio Tinto’s consistent position is that it will not allow ERA to push for an extension of mining at Ranger without the permission of the Mirarr traditional owners – who are vehemently opposed to any continuation of either deposits below the Ranger mine, or at the rich Jabiluka deposit within the project envelope.

But despite this, minority shareholders, including Perth fund manager Willy Packer and Richard Magides’ Zentree investments, still bought in to the ERA raising to maintain their minority position in the company.

Both have expressed a willingness to maintain their stake in ERA for the long term in the hope the remaining deposits at the Ranger mine will eventually be exploited.

As ERA’s dominant shareholder, Rio has promised it will back the full rehabilitation of Ranger, and has been firm on its commitment to honour a pledge made in 2005 to respect the wishes of the region’s traditional owners. That position has also been backed by the Albanese federal Labor government.

ERA has also said it will respect the wishes of the Mirarr people. But the company’s mining leases over Jabiluka expire in August 2024, and the company has also consistently said it planned to seek an extension to its control of a “a large, high-quality uranium ore body of global significance”.

ERA’s minority shareholders may also be taking some heart from the aggressive campaign being run by federal Opposition Leader Peter Dutton in favour of both the potential use of nuclear power in Australia’s energy mix, and the need to support nuclear energy outside of Australia by ending national restrictions on uranium mining.

ERA shares closed up 0.2c to 4.2c on Tuesday.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout