Energy titans brace for profit shock

The centrepiece of the government’s scheme to force down power prices is biting.

Australian energy retailers and the investors behind them are bracing for a hit to profits from next month after EnergyAustralia’s value was written down by $1.3 billion to cover the expected impact of new government schemes to lower default market prices.

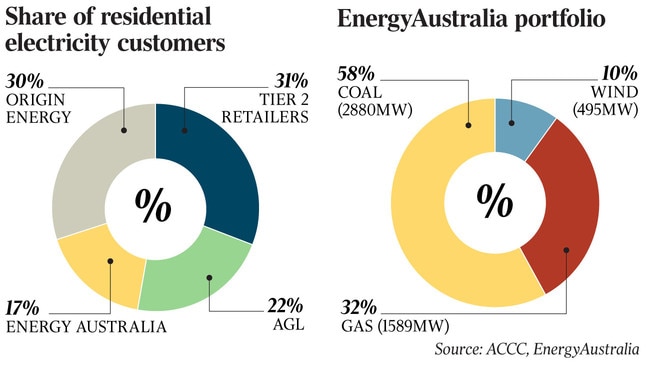

Fellow “big three” generators and retailers AGL and Origin Energy are also expected to book lower profits as a result of the federal and Victorian government schemes that from July 1 introduce default prices for customers who have not attempted to switch to more competitive offers.

The default offers are the centrepiece of a federal government scheme to force prices down but have sparked criticism that they represent creeping re-regulation of the industry and could lead to a less competitive market.

Frontier Economics founder Danny Price said the schemes would “wipe out” second-tier electricity retailers who thrived on cherrypicking customers from the big three and did not have their own generation assets.

“It is just like re-regulation — it is the complete reversal of the objectives of those reforms years ago to take regulation out of the market and make it more vibrant and competitive,” Mr Price told The Weekend Australian.

The move could also chill investment from the private sector, with companies concerned they may not be able to recover their costs in a more regulated market, Mr Price said.

EnergyAustralia’s owner, the Hong Kong-listed CLP Group, said it expected a goodwill impairment of between $HK6 billion ($1.1bn) and $HK7bn ($1.3bn) in the first half of 2019, which would push it to a loss for the six-month period.

The EnergyAustralia writedown equates to a potential 46 per cent cut to the Australian goodwill on CLP’s books — covering the acquisition of TXU in 2005 and the deal to buy EnergyAustralia in 2011 — based on the previous value of $HK15.07bn recorded by the Asian company at the end of 2018.

Earnings for EnergyAustralia’s retail unit will also drop as much as $HK300 million ($55m) in the second half of 2019 due to the impact of Canberra’s “safety net” tariffs and cheaper power plans for customers who have been on market offers.

“These changes mandate lower regulated ‘safety net’ retail tariffs for the markets in which the EnergyAustralia retail business operates,” CLP said. “This reduction will likely sustain into the future, but may vary as market participants and customers adjust to these new market conditions.”

Energy Minister Angus Taylor criticised the big three retailers in February for declaring bumper profits while consumers were struggling with high electricity bills.

Yesterday he defended the move, saying the government would “continue to ask energy companies to start putting their customers first”.

Mr Taylor said Australia would continue to see record levels of new generation investment and there had been a “strong response” to the underwriting generation investments program, with a shortlist of 12 projects and combined generation capacity of more than 4000MW, backed by the government.

The schemes run counter to other pressures in the market, with a flood of new renewable projects undermining the viability of coal-fired generation and uncertainty in coal supplies, and high-priced domestic gas driving up electricity prices.

Analysts said there may be some “downside risk” to earnings estimates for EnergyAustralia’s rivals. Morgan Stanley analyst Rob Koh estimated that Origin Energy faced a $100m hit this year from the default plans.

AGL Energy has already brought forward some of the risk with discounts for customers who pay their bill early, but Mr Koh said there was still some “downside risk” for AGL’s earnings.

However, the two companies are not expected to face writedowns of the scale of EnergyAustralia’s because their businesses were not created the same way.

CLP bought two electricity retailing businesses from the NSW government and it was the goodwill that it wrote down.

EnergyAustralia was also being hit by tough conditions in the Australian market, with a coal supply problem at its Mount Piper power station in NSW and ongoing maintenance issues at its Yallourn coal plant in Victoria contributing to lower electricity production, CLP said.

Prices for forward energy contracts also increased in the first half, resulting in losses on electricity derivative contracts.

EnergyAustralia is weighing up long-term investments in Australia this year, including turbine upgrades at its Mount Piper power station and a new gas-fired plant in the state along with pumped-hydro projects in South Australia and Queensland.

But the investment decisions have been clouded by uncertainty about policy and the timeline for some coal plant closures. The federal government has previously pressured AGL to keep its Liddell coal-fired plant in the Hunter Valley open beyond its scheduled 2022 closing date.