Energy Security Board chair Kerry Schott warns against state energy intervention

Draft energy plans flag payments for big industrial users and other consumers prepared to turn off equipment at times of peak demand.

Energy Security Board chair Kerry Schott has warned state and federal governments they risk future investment in the National Energy Market if they push ahead with patchwork reforms to their own energy systems without factoring in the needs of the broader grid.

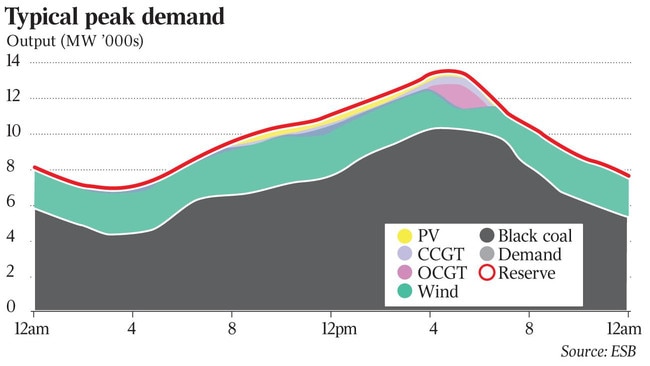

The Energy Security Board will issue its latest update on new post-2025 market rules on Tuesday, flagging payments for major industrial users and other consumers prepared to turn off equipment at times of peak demand and the establishment of an “operating reserve market” within the NEM to ensure generators that bid into the market can deliver on promises as energy usage soars in summer.

Its draft plans indicate it will push ahead with plans to develop a “locational marginal pricing” scheme for the energy market, a regional scheme where large-scale electricity suppliers would pocket higher returns if they build in more cost-effective locations and solar and wind developers would pay part of the transmission costs.

The ESB will publish a raft of documents outlining its approach to the design of the energy market on Tuesday, with an options paper setting out proposals due by March, and final recommendations to go to federal and state energy ministers by the middle of 2021.

Included in the releases on Tuesday are consultation papers for the Australian Energy Market Commission, for the development of rules for the demand-response mechanism and the development of an operating reserves scheme, and an ESB consultation paper covering the development of renewable energy zones.

The ESB has also ditched a program to develop formal plans to manage the exit of ageing coal-fired power stations from the market, electing to roll planning for the retirement of thermal power stations into other work streams addressing the adequacy of resource planning for the NEM.

Dr Schott acknowledged many of the proposed new design elements of the future NEM had been controversial. Renewable energy developers say location-based pricing will increase power costs and put investment at risk, and an operating reserve system has been previously as a means of keeping fossil fuel facilities in the market for longer.

But writing in The Australian on Tuesday, Dr Schott said the time for discussion about the shape of the market was over, and that the ESB and other regulators, as well as state and federal governments, needed to deal with the reality that the transformation of the NEM into one driven by renewables was no longer an “if or when proposition”.

“It is here and now,” she writes.

Dr Schott said the pace of change in the Australian energy sector was “massive”, and the critical issue now was to ensure the design of the market after 2025 would allow it to cope with the influx of renewable energy, particularly from consumer-driven uptake of solar rooftop arrays, which are putting increasing pressure on distribution networks.

“We’re dealing with the pace of change as it is happening. Co-ordination is the key from here,” she said.

But after years of chaotic policy arguments about the role of renewables in the system, with governments seeking to shape energy networks around reliability concerns and carbon emission reduction efforts, the ESB warned that go-it-alone policies aimed at rewarding particular types of energy generation could lead to a “an increasingly fragmented market with (potentially inconsistent) jurisdictional investment schemes”.

In November the NSW government published its Energy Infrastructure Roadmap, which included plans to underwrite investment in renewable and storage generation to help smooth the state’s transition away from a coal-fired grid over time.

The Victorian government has also broken away from a more national approach after changing the state’s electricity act, adding more transmission and storage generation, including a giant battery, to ensure it doesn’t get caught short when coal plants close.

The federal government’s plan for the under-construction Snowy Hydro 2.0 scheme under Prime Minister Malcolm Turnbull, and more recent plans to add gas-peaking facilities to Snowy, also represent breaks with market-driven energy developments, and the Queensland government has also targeted support for 1000 megawatts of new renewable generation by 2025, and committed $500m into a renewable energy fund that would allow government-owned corporations to buy into new renewable plants.

The ESB’s report praised the NSW government’s plan for taking the broader NEM into consideration, but warned a patchwork approach to inventising new energy developments risked distorting the market, and pushing up energy prices in the long term.

“The NEM is transforming rapidly and, as a result, the challenges in integrating the system as it evolves are complex. Rewarding resources outside the market increases the risk of distortions and adds to the complexity. This is further exacerbated when interventions are delivered inconsistently and in uncoordinated ways,” the ESB said.

Bringing state systems back together and ensuring that conflicting policy goals did not destabilise the national market needed to be a key priority for all governments, if the market was to deliver lower prices with more stable supply, the ESB said.

“The ESB recognises that government investment schemes have an important role to play in delivering on broader policy objectives that go beyond the scope of the electricity market design,” the report said, flagging the release of a separate paper on the issue to be delivered shortly.