Energy giants in last-ditch bid to soften ‘big stick’ law

Companies have called for the government to give ‘extraordinary’ divestment powers to the courts, not the treasurer.

Electricity companies have called for the government to give “extraordinary” divestment powers to the courts rather than the federal treasurer, in a last-ditch effort to soften “big stick” legislation that they claim will still do nothing to lower electricity prices.

Companies threatened by the legislation — which gives the treasurer power to strip them of their assets — said the government had ignored their recommendations to make the legislation fairer and warned it would cause significant distortions in the market.

The companies, including the big three generators and retailers AGL, Origin and EnergyAustralia, as well as the federal government-owned Snowy Hydro and Queensland’s CS Energy, said the laws were unnecessary, duplicated existing legislation, and would discourage investment in new generation needed to bring prices down.

The complaints are in a series of submissions to the Senate Economics Legislation committee about Treasury Laws Amendment (Prohibiting Energy Market Misconduct) Bill 2019 which failed to make it through the Senate before the last election and is being reintroduced to parliament as the government maintains pressure on companies to push down electricity prices.

The committee is due to report next month on possible changes to the legislation after the government took its big stick policy to the election.

But Origin Energy said the legislation “remains largely duplicative, runs the risk of discouraging investment, and is likely to impede efficient market operations”.

“We are disappointed that to date, despite a great deal of engagement, there has been no material change to the 2018 version of the bill which was subject to an earlier inquiry by the Committee.”

Origin said that allowing the treasurer to impose punitive measures on companies suspected of misconduct would undermine the separation of judicial and executive powers. Unlike the Competition and Consumer Act that gave courts the power to make findings against companies, the big stick bill handed this power to the treasurer, with input from the Australian Competition & Consumer Commission.

A court would only be able to decide whether a business has failed to comply with the order, and not whether the order itself was justified.

“This would remove a vital check and balance that is an important feature of the current regulatory arrangements,” Origin said.

Grattan Institute director Tony Wood said the legislation focused on issues that were not driving prices higher and would not deliver cost savings. Instead of pushing “novel” solutions that were unlikely to work it should concentrate on implementing the “more practical” recommendations from the Australian Competition & Consumer Commission report in 2018.

“Lowering prices ultimately requires private investment; a ‘company bashing’ approach may well prove counter-productive,” Mr Wood said.

In a separate report Mr Wood accused the government of crowding out and scaring off private investment in new generation via the proposed Snowy 2.0 pumped hydro scheme, its underwriting new generation investment program and retail price caps, and urged them to pull back.

Energy Australia, with generation assets and 2.6 million customers around the country, said the treasurer should have to apply to the courts for an order against companies.

“If unchanged it would enable the treasurer to set the price and terms at which a private business contracts its product, in our case electricity. We question the ability of a business to invest with confidence when the treasurer can step in at any time and dictate the terms of sale,” it said.

“These powers are extraordinary and if incorrectly used could cause significant distortions in the market.”

Energy Australia said there could also be a conflict of interest caused by the federal government’s ownership of Snowy Hydro and its retail business Lumo and Red Energy, if the treasurer made orders against a rival company.

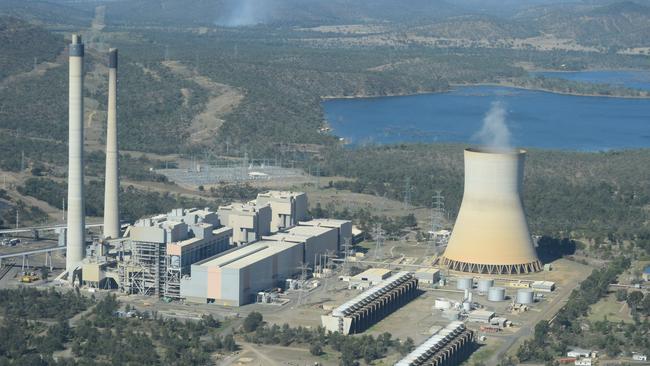

CS Energy, the state-owned operator of the Kogan Creek and Callide coal-fired power stations, said the government had made only minor amendments and did not adopt suggestions from the industry that would avoid unintended consequences. While the industry was consulted, documents attached to the bill explained that the government would not adopt industry recommendations because this “would undermine the policy objectives of the bill”, CS Energy said in its submission.

The proposed law was unnecessary and would create “vague and uncertain obligations thereby heightening risk for energy market participants”.

Snowy Hydro said existing laws already addressed the offences the bill was trying to target and that these had already been reinforced. “Snowy Hydro believes that high prices in energy markets reflect other factors, such as increased market concentration, regulatory uncertainty and a lack of strategic transmission investment,” it said.

Snowy also said planned prohibitions on types of bidding to supply the wholesale market failed to allow for different generation types, such as the limitations on water supply that affect hydro generation.

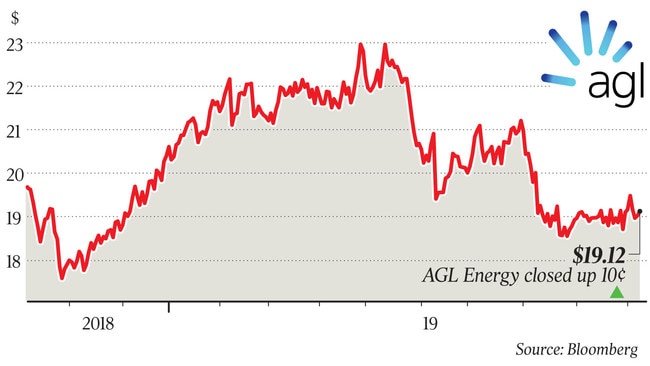

AGL said the legislation allowed the treasurer to make contracting orders that directly interfered with private businesses and dictated the type, price and duration of the contracts.

“This represents a significant intrusion into private contractual rights and agreements in the electricity market, in circumstances where there has been no judicial process or finding of a breach of the provisions,” it said.

“The unprecedented nature of these powers coupled with the lack of procedural fairness will create risks and uncertainty for electricity businesses as they contract and manage their hedge books, and undermine a business’ ability to implement legitimate risk management strategies that are cost effective and efficient.”