Energy crisis: Origin knuckles down amid electricity market tension

Origin Energy concedes Australia’s electricity system is in ‘uncharted territory’ after the operator seized control of the market in a bid to stabilise the grid.

Origin Energy has conceded the nation’s electricity system is in “uncharted territory” after the operator seized control of the market in a bid to stabilise the grid and cut the risk of blackouts.

The comments from Origin’s chief executive Frank Calabria came as the Australian Energy Regulator sent a second warning to the industry over holding back supplies to the market.

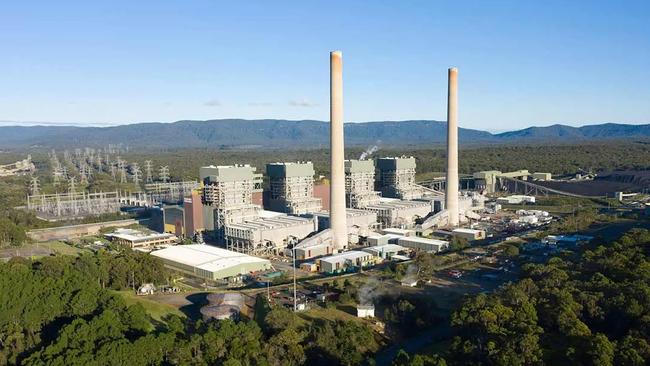

The power giant runs Australia’s largest coal plant – Eraring in NSW – and said it was working with authorities to ensure the lights stayed on as analysts cautioned the market intervention may depress company earnings.

“There’s no doubt we’re in uncharted territory right now,” Origin chief executive Frank Calabria told The Australian. “We’ve never had administered price caps for electricity and gas across all markets. So we are in a situation where there are a large amount of plants that remain offline. And we’re working incredibly hard to maintain that reliable power supply.”

The action by the Australian Energy Market Operator was in part sparked by the large amount of supply sitting on the sidelines due to concerns about running at a loss, prompting AER chair Clare Savage to suggest some generators might be withholding power to manipulate pricing.

While that letter was considered highly inflammatory by generators who have privately criticised the move, sources said Ms Savage repeated the same warning on Thursday morning in a phone hook-up with industry to discuss the suspension, adding to growing tensions between generators and regulators.

The Origin chief said the company was focused on meeting demand and the AER was right to keep a watch over compliance with market rules. “We understand they’ll review the activity in the market as a regulator,” he said.

“We are in unprecedented times, but it’s appropriate that they undertake a review and from our perspective we would expect them to do their role.

“We were making the plants available and certainly working with AEMO closely,” Mr Calabria added. “Certainly we’ve got other plants running, and they’re available and they’ve been in some cases directed by AEMO.”

Origin faces a risk to earnings from the market suspension, according to Macquarie, but Mr Calabria said it was far too early to quantify any impact. “There’ll be plenty of time for us to work with AEMO on some of those practicalities of the suspension and how that plays out. Right now it’s all about getting the power and getting the fuel to the Eraring power station in particular and having it run every day and making it available.”

The return to service of AGL Energy’s units may help to soften an earnings hit, with Macquarie estimating the power giant had faced a $25m-$40m weekly pre-tax loss from the large chunk of its capacity being offline.

“In NSW, the loss of four of seven units is beyond any hedging strategy,” Macquarie analysts wrote on Thursday. “We estimate AGL would be short between 0.11-0.15 terawatt hours of energy per week. The price administered market/suspension has limited losses associated with the outages. We estimate the loss is in the order of $25m-$40m pre-tax per week.”

Origin also faces a negative drag on earnings from the suspension. “To date we have seen no update to FY22 guidance of $310m-$460m, albeit we see risk to the downside,” Macquarie said.

Origin may experience mixed earnings from the market suspension, with its coal and gas generation potentially positive but renewables, batteries and retail markets less positive. “Even with coal prices at $200-$300 per tonne, Origin in the near term is better off as it is selling energy during the middle of the day at $300/MWh,” the analysts added.

The gas market is more structured under the suspension, with Origin looking at recouping a cost of $9-$11 per gigajoule and potentially additional compensation if spot supplies are needed to meet market directions.

Wind and solar have already been sold to customers, which may limit any upside unless it has access to uncontracted volumes, while retail faces a “residual loss” due to plants being directed by AEMO.

Increases in retail prices are now likely for 2024, according to Morgan Stanley. “We view policy risk as elevated, in view of rapidly rising end user prices – all else equal, we estimate that retail prices would need to rise further … to cover persistent wholesale price increases and suspension compensation, if required,” Morgan Stanley’s Rob Koh said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout