Clough administrators in talks with Webuild as early figures show contractor owes $78.8m

Clough administrators Deloitte have confirmed they are in exclusive negotiations with Italy’s Webuild to take control of a number of the collapsed contractor’s projects.

Clough administrators Deloitte have confirmed they are in exclusive negotiations with Italy’s Webuild to take control of a number of the collapsed contractor’s projects, with the focus on Clough’s existing joint ventures with Webuild.

Deloitte confirmed late on Wednesday it was dealing exclusively with the Italian construction giant over whether Webuild would take over a number of Clough’s projects – including its current joint ventures on Snowy Hydro 2.0 and on the $3.7bn contract for a key section of the federal government’s Inland Rail project.

Deloitte and Webuild have until December 21 to finalise a deal, which could also include Clough’s work on the Mitsui and Beach Energy Waitsia project, Energy Australia’s Tallawara gas plant, Clough’s role in Transgrid’s giant Energy Connect transmission project and the Navy’s Lombrum base in PNG.

The confirmation comes on the cusp of the first meeting of Clough creditors on Thursday, and as federal court documents show Clough collapsed owing its staff $12.2m in accrued entitlements and with debts to trade creditors of at least $66.6m, according to figures from administrator Deloitte.

But the $284.1m bulk of its secured credit is with lenders that have extended performance bonds over Clough projects, according to documents filed with the Federal Court this week.

The figures are contained in a judgment issued by Federal Court judge Katrina Banks-Smith, after Deloitte administrators successfully applied to the court for orders seeking to limit their personal liability for any trade debts incurred as they try to find a buyer for the company. Deloitte told the court Clough needed to spend $2.7m a week just to cover its corporate overheads and its administrators had cut deals with “most” clients on Clough’s six biggest jobs for accelerated progress payments that would cover payments to staff and subcontractors.

But ongoing work meant that the company was still building up trade debts, for which Deloitte could ultimately be liable.

Deloitte is due to hold its first meeting to brief Clough creditors on the state of the company’s affairs on Thursday, but told the Federal Court this week their preliminary investigations suggested the company collapsed owing at least $66.6m to trade creditors.

Clough has four major secured creditors – HSBC Bank Australia, Liberty Speciality Markets, Assetinsure and AAI – who, combined, have provided performance bonds covering Clough projects to a combined value of $284.1m.

More than 290 creditors have registered some sort of security over debts on the federal government’s Personal Property and Securities Register, with Clough staff owed $12.2m in accrued annual leave and long service leave entitlements. But those employees face an anxious wait to find out whether their accrued entitlements will be protected through the company’s administration process, with court documents revealing the majority of its staff are employed by holding companies without assets of their own.

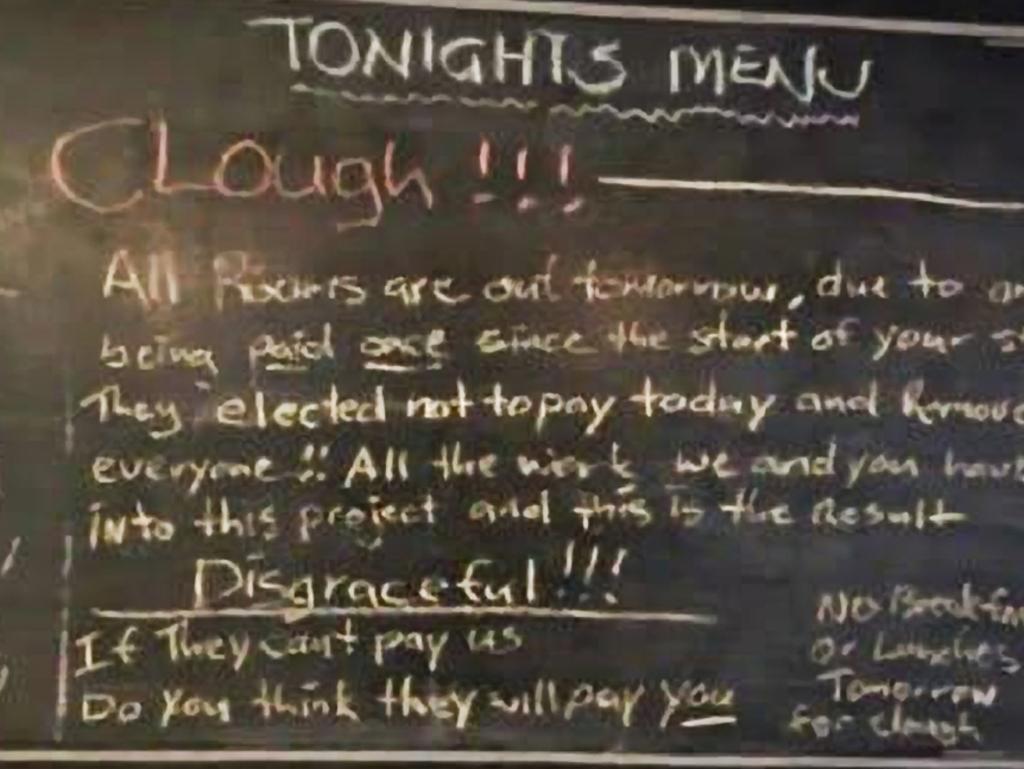

Clough is believed to have begun rejecting staff requests to have their entitlements cashed out in October, as it sank deep into trouble. Sources inside Clough say Deloitte administrators are yet to give a clear answer on how those entitlements will be protected through the administration process. Under Australian laws, staff sit above trade creditors in the event of a company liquidation, but generally below other secured creditors such as banks.

A portion of their entitlements would be also protected by the government’s Fair Entitlements Guarantee Scheme, but that only kicks in if Clough’s administrators fail to keep the business alive and liquidation results.

FEG payments are capped at a maximum annual wage of about $130,000 – less than many of Clough’s skilled workers and engineers would be earning. Redundancy payments are also capped.

Employee entitlements not paid out by the scheme would need to be claimed as if they were creditors, but court documents filed this week suggest that could be a complex process.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout