Demand for coal suffers a record fall over past two years

Worldwide coal demand has suffered its biggest-ever fall as the global revolution under way in energy eats into the market.

Worldwide coal demand has suffered its biggest-ever fall over the past two years as the global revolution under way in energy eats into the market for Australia’s second-biggest export.

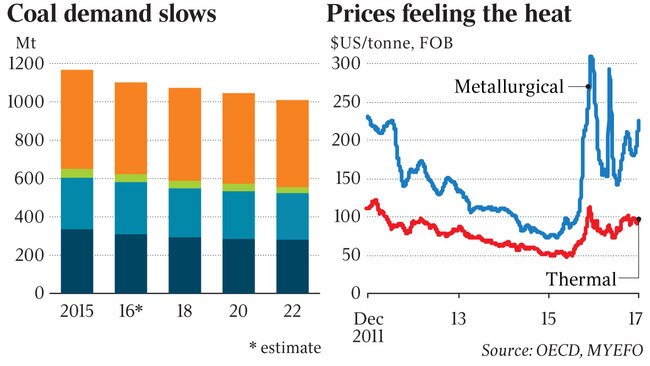

A detailed annual analysis released last night by the International Energy Agency found that coal demand fell by 1.9 per cent to 5.3 billion tonnes last year, taking the total drop in demand since 2014 to 4.2 per cent.

That fall in demand is the largest in absolute terms ever recorded over a two-year period, and the equal-largest in percentage terms since 1990-92.

The drop reflects a combination of factors, including the impact of low gas prices in the US and China’s efforts to tackle its air pollution problems through increased regulation.

International coal prices are a key driver of Australia’s terms of trade, and yesterday’s midyear economic and fiscal outlook from Treasury included forecasts for a fall in metallurgical coal prices and a flat trajectory for thermal coal. Coal is Australia’s second-largest export by value, behind only iron ore.

Treasury expects metallurgical coal prices to drop to $US120 a tonne by September next year, while thermal coal is forecast to remain around $US55 a tonne over the same period, according to MYEFO documents released yesterday.

In a further setback for development, more than $2 billion of potential contracts between Adani and construction heavyweight Downer Group over Adani’s controversial Carmichael coal project in Queensland’s Galilee Basin were abandoned amid the fallout from the Queensland government’s funding veto.

IEA executive director Fatih Birol said it was clear that global energy markets were changing significantly.

“We are currently witnessing a rapid energy transformation — a real revolution — that is being driven by falling costs and rapid progress in a diverse mix of technologies at different stages of development, including hydraulic fracturing, solar PV and electric vehicles,” Dr Birol said.

He noted that the advances being made in gas and renewables had outpaced progress with carbon capture, utilisation and storage technology, which is central to plans to cut the emissions associated with the burning of coal and protect coal’s market share.

“(CCUS) is one of the critical solutions needed to decarbonise energy systems. But CCUS is lagging behind many other low-carbon energy technologies, and this is not good news as climate-change mitigation will become much more difficult and expensive without it,” Dr Birol said.

“It is also bad news for coal. Without CCUS, coal will be further edged out by other lower and zero-carbon alternatives.”

The abundance of gas in the US in recent years following breakthroughs with hydraulic fracturing has helped drive an 8 per cent drop in US coal use last year, with 2016 the first year on record in which coal was not the largest source of the country’s electricity. Coal use in China, which is by an order of magnitude the world’s largest consumer of the commodity, fell 5 per cent.

Coal consumption in Britain, meanwhile, plunged by more than 50 per cent in 2016 following the introduction of a carbon price floor that the IEA described as a “death knell for coal use in power generation”.

The IEA is forecasting global coal demand to remain stagnant out to 2022 on the back of sluggish demand growth relative to other fuels.

The global trend away from coal highlighted by the IEA contrasts with the federal government’s strong advocacy for the commodity. The government earlier this year flagged its preparedness to back the construction of new coal power stations as a means of improving electricity supplies on the east coast, with Malcolm Turnbull declaring the government was open to using “clean coal” technology to replace existing generators.

The government has also been a champion of Adani’s controversial Carmichael coal project in Queensland’s Galilee Basin, although the project’s uphill battle to secure funding has become even harder following the Queensland government’s decision to veto any government loan provided through the Northern Australia Infrastructure Facility.

The two companies announced yesterday they had agreed to cancel letters of intent, under which Downer would have carried out construction and mining services at Carmichael.

Despite the tough outlook analysts at Credit Suisse yesterday substantially upgraded their price forecasts for coking coal, which is used in the production of steel.

Credit Suisse now expects coking coal to average $US175 a tonne in 2018, up from its previous forecast of $US125 a tonne.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout