Dacian downturn bodes ill for West Australian gold producers

The reputation of Western Australia’s mid-tier gold sector has taken another hit after shares in Dacian Gold cratered yesterday.

The reputation of Western Australia’s mid-tier gold sector has taken another hit after shares in one-time market darling Dacian Gold cratered yesterday following its second production downgrade in as many months.

The gold price is still sitting around historic highs, in Aussie dollar terms, but that has not helped the WA miners who rushed their operations into production to take advantage of the gold price, seemingly without a full understanding of the deposits they are mining.

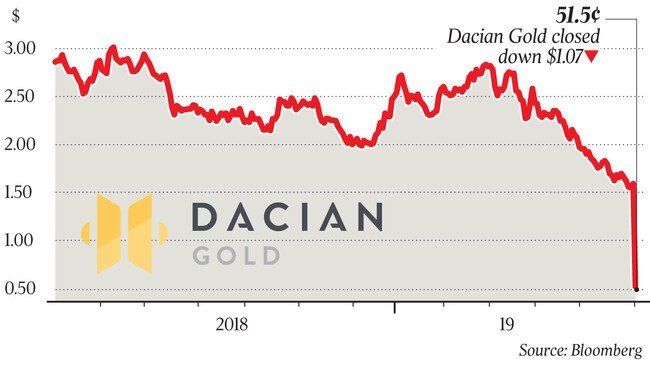

Shares in Dacian crashed $1.07, or 67.5 per cent, to close at 51.5c following the announcement of yet another production downgrade from its Mount Morgans gold hub in WA.

Dacian slashed its June quarter production guidance by up to 19,000 ounces of gold, saying it now expected to produce 36,000-38,000 ounces in the period, down from the 50,000-55,000 ounces forecast at the end of March.

And in another damaging admission, Dacian flagged five-year production from Mount Morgans as averaging 160,000-180,000 ounces a year, well below the 200,000 ounces a year over a 10-year mine life it had previously predicted.

The market pummelling followed the collapse of Gascoyne Resources on Monday, only weeks after shareholders pumped in $24.5 million to keep the company afloat.

Gascoyne’s Dalgaranga problems stemmed from the fact the company’s ore was grading lower than its studies said it should be, and Dacian has had similar issues, exacerbating the problems it was having with its main underground contractor.

Dacian said yesterday its long-term mining reserve-to-mill reconciliation rate at Mount Morgans was only 85 per cent.

Shares in Pilbara producer Millennium Minerals have also tanked on operational issues and problems with the gold grade at its mine, falling from 24.7c in February to close at 6.3c yesterday.

Managing director Rohan Williams said yesterday Dacian had launched a strategic review to “consider potential corporate and finding initiatives available to the company”.

Mr Williams said the review could end in a change of control transaction, following unsolicited approaches from other companies over the past five to six months.

Dacian is carrying $120m in debt and had $70m in cash at the end of March — down from $93m at the end of July last year, shortly after the company closed a $40m raising at $2.70 a share.

Despite a $19.8m debt repayment due this quarter and ongoing cash burn, Mr Williams said Dacian had no plans to tap the market. “There are no plans for us to be raising capital, and this review process will proceed accordingly,” he said.

The problem for the company — beyond the fact Dacian is now worth a third of what it was on Monday — is that cashed-up potential buyers such as St Barbara and Northern Star Resources have looked elsewhere for acquisitions. St Barbara, which disclosed its own production downgrade this week, already faces criticism that its $768m bid for Atlantic Gold is over the odds, Northern Star is bedding down the acquisition of the Pogo mine in Alaska, and few other contenders with cash and the operational experience to bed down a relatively new mine exist.

Market sources say Dacian’s issues may also have a damaging effect on other would-be WA producers, coming on the back of other recent failures, and it may have a chilling effect on the willingness of institutional investors to back emerging projects.

Yesterday’s announcement from Dacian came as Norwegian sovereign wealth fund Norges Bank emerged as a substantial shareholder on its register, after the Scandinavian bank spent months buying up 11.4 million Dacian shares at prices ranging from $2.76 to $1.56.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout