Crib Point terminal on AGL backburner

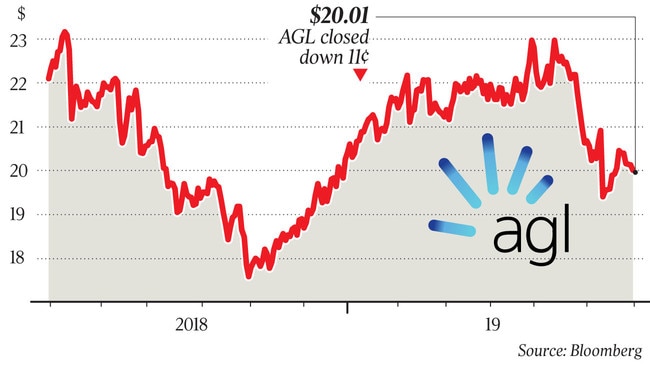

Power giant AGL Energy has suffered a delay on its controversial LNG import terminal in Victoria.

Power giant AGL Energy has suffered a delay on its controversial LNG import terminal in Victoria, with first gas from the Crib Point plant put back until the second half of 2022 from an earlier 2020-21 target.

The new timeline for delivering the project — which has faced environmental opposition from local groups in the Mornington Peninsula — may also have wider ramifications for AGL’s own gas portfolio if the utility is forced to cover a shortfall by signing expensive short-term contracts, UBS warned earlier this month.

AGL faces an annual gas portfolio shortfall of 40 petajoules from 2021 on, and may have to look beyond the delayed gas import hub and strike deals at higher prevailing prices potentially topping $10.50 a gigajoule.

“To ensure continuity of gas supply to meet AGL’s 150-petajoule portfolio demand, we had assumed the emerging supply shortfall in 2021 would be supplied by AGL’s own planned LNG import facility at Crib Point in Victoria,” UBS analyst Tom Allen said, noting the project was still waiting on a final investment decision.

“However, our review of the risks associated with obtaining environmental approvals and the time frame required to secure those approvals has led us to change our base case supply assumption to now assume gas supply is sourced from recontracting existing gas resources at prevailing (higher) market prices.”

The delay, confirmed yesterday, has seen AGL switch from using its Hoegh Giant floating ship to the Hoegh Esperanza vessel with a later delivery date.

“AGL believes the Esparanza better fits timing and operational requirements arising from the Environment Effects Statement process currently being undertaken by the Victorian government,” the company said.

“AGL expects the outcome of the EES to occur no earlier than late 2020, subject to and following which AGL expects to reach a final investment decision on the Crib Point project.”

Australia is in the odd position of planning for gas imports to help stem a supply shortage on the east coast despite only just snatching the title of the world’s biggest LNG exporter from rival Qatar.

Plans for LNG import plants have been hatched as domestic gas prices have surged on a wide range of factors, including Queensland’s gas export plants, the growing cost of developing new gas fields and onshore production restrictions in NSW, Victoria, South Australia and the Northern Territory.

The Andrew Forrest-backed Australian Industrial Energy LNG plant planned to start up next year in NSW’s Port Kembla is now expected to be the first Australian import facility to open amid a range of rival developments in other states. In addition to AGL’s Victorian plant, big gas producer ExxonMobil has also flagged a potential import terminal in the state while Japanese conglomerate Mitsubishi is backing a plan to import LNG at Pelican Point in South Australia.

AIE concedes prices will be between $10 and $11 a gigajoule — three times historical levels — but says the volumes will be available next year, compared with more uncertain timings for domestic gas production.