COVID could force refineries exit: Viva

Viva Energy has warned that Australia risks losing its remaining refineries, with potential government support warranted.

Viva Energy has warned that Australia risks losing its remaining refineries, with potential government support warranted to head off growing concerns over the nation’s energy security.

The owner of Victoria’s Geelong oil refinery, one of only four remaining in Australia, said record declines in fuel demand because of COVID-19 had put fresh pressure on manufacturers and raised the prospect of closures as owners grappled with losses at their facilities.

Viva is looking to import liquefied natural gas at Geelong as part of efforts to transform the site into a major energy hub, but still faces hefty losses from its refinery operation and has closed a petrol unit due to the slump in demand.

“Although demand will recover in time, some refineries around the world will no doubt close as a result of the more permanent demand impacts and challenging economic outlooks in their respective markets,” Viva chief executive Scott Wyatt writes in The Australian today. “The question for us is whether Australian refineries should again fall victim to this rationalisation.”

Three Australian refineries have shut since 2012 and the remaining plants now produce less than half of the country’s fuel needs, with the bulk of supplies imported from bigger facilities in Singapore, South Korea and Japan. The Morrison government on Monday launched a long-term strategic review of the nation’s refining sector that could see it offer support to ensure it continues operating.

Viva said industry needed to work with the government to ensure it could remain competitive.

“Our dependency on foreign refineries for our energy security would grow, and we might further reduce the level of commercial fuel reserves that are held in Australia. These are important considerations for any nation and it is encouraging to see the government taking an active role to understand the significant challenges facing the sector and consider policies which might improve longer-term viability.”

Mr Wyatt is a member of the government’s COVID Commission manufacturing task-force, chaired by former Dow boss Andrew Liveris, which has pushed for a gas-led manufacturing recovery from COVID-19, including potential government support to lower gas prices.

The Viva chief said it was critical to keep Australia’s manufacturing base alive.

“It’s important that Australia maintains manufacturing capability and provides a level of self-sufficiency for the country. In some sectors lower-priced gas is a key component of that. And in a country that has such a significant natural resource, we should be able to capitalise on that.”

Energy Minister Angus Taylor has held meetings with the industry in the past week and will review the refining sector at the same time as opening a process to boost its fuel storage in the hope it can ensure security of supply.

Between 7 million and 15 million barrels of domestic fuel storage could be added under the storage plans.

Viva said adding storage capacity at Geelong could boost the operation and said the significant investments required talks with the federal government.

“There are some immediate challenges in refining and there are some significant investments that need to occur, including providing low-sulfur petrol to the Australian market,” Mr Wyatt said.

“Some of these investments are important to be made to continue to maintain a viable refining sector but are also quite challenging to make for the sector, particularly in an environment where margins are under pressure. So I think it’s important to be able to sit down with the government and work through those challenges and find a way forward that makes sense not only for the country but also for the sector.”

Underlying earnings from its refinery are expected to plunge to a first half loss of $32.5m-$42.5m after a $18.4m profit in the same period a year ago, due to tough margins and tepid demand. Refining margins were likely to remain weaker through 2020 and possibly into 2021, Viva said.

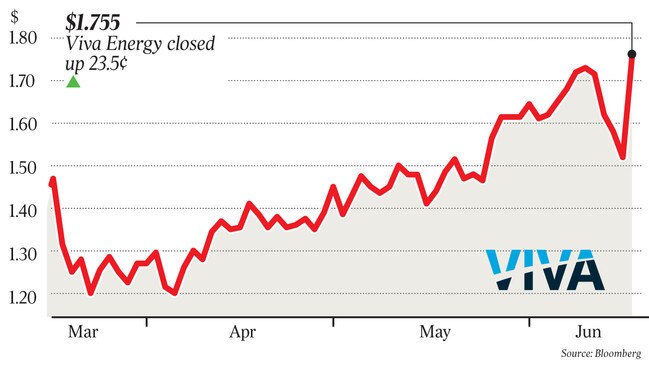

Still, the market focused on a better than expected figure for underlying net profit of $20m-$50m, despite the fallout from COVID-19 crushing demand, compared with $50.9m in the first half of 2019. Viva shares rose 15.5 per cent to $1.75 to be the best performer on the S&P/ASX 200 Index.

Viva’s LNG import proposal would see it battle with high-profile and deep-pocketed rivals including AGL Energy’s Crib Point terminal in Victoria’s Mornington Peninsula and the Andrew Forrest-backed Port Kembla facility in NSW.

With supplies drying up from offshore gas fields in the state’s Gippsland Basin, Viva has pitched the plant as a “virtual pipeline” able to deliver 80-140 petajoules of gas or 30 per cent of southern state demand from northern fields.

Australia is looking to import LNG for the first time, with tight supplies on the east coast forecast over the next few years and much of Queensland’s gas diverted for LNG exports, while contract prices are failing to budge from a $8-10 a gigajoule window.

Viva has sketched plans for a broader energy hub at Geelong including solar and battery storage, the manufacture of hydrogen and gas power generation.

The fuels retailer said it would proceed with major maintenance of its residual catalytic cracking unit in early July at a cost of $85-$100m.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout