Coal-fired power plant extensions ruled out

Australia’s ageing coal fleet may be forced out of the electricity grid earlier than forecast, with plant extensions ruled out.

Australia’s ageing coal fleet may be forced out of the electricity grid earlier than forecast, with plant extensions ruled out as the market operator banks on a surge in renewables, transmission and fast-start power replacing the fossil fuel in the grid.

Coal would contribute less than a third of supply by 2040 — from 70 per cent currently — as solar, wind, gas and hydro dominate the nation’s energy mix, the Australian Energy Market Operator said.

While it wants Australia’s coal plants to remain in the grid until their planned retirement dates, AEMO ruled out the need to extend the life of coal stations.

It also conceded some may be edged out faster than anticipated, undercut by cheap renewables and states’ clean energy and emissions targets.

“Essentially we’re having to rebuild the market because of the amount of ageing coal infrastructure that needs to be replaced,” AEMO chief executive Audrey Zibelman told The Australian.

The operator’s draft 2020 integrated system plan maps out how Australia’s power grid will change over the next two decades.

The study finds some 63 per cent, or 15 gigawatts, of the country’s coal fired generation will retire by 2040, requiring more than 30 gigawatts of new large-scale renewable energy to be added — which represents more than half the current capacity of the national electricity market.

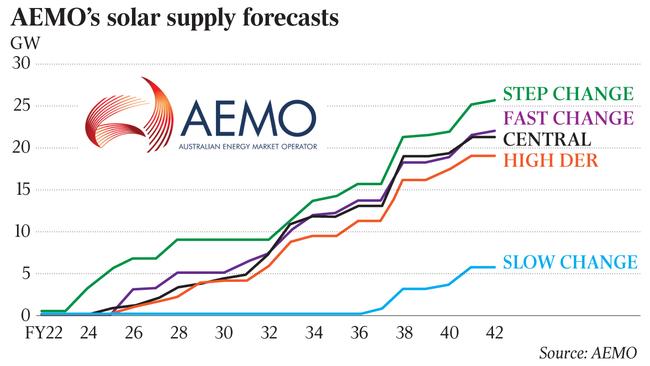

Households will also play a significant part in the transition to renewables, with rooftop solar on consumers’ homes potentially tripling capacity and providing up to 22 per cent of total energy by 2040. That compares with just over 20 per cent for small and large-scale renewables currently.

Crucially, nearly as much capacity will have to be added for backing up intermittent renewables, with up to 21 gigawatts of hydro, batteries and demand response also transforming the market.

Priority transmission investments are also recommended to unlock capacity from projects including Snowy 2.0, with spending needed on interconnector upgrades between Queensland and NSW and down to Victoria.

The place of coal within the energy mix over the next two decades could be further challenged under several scenarios. AEMO warned a plant like EnergyAustralia’s Yallourn station could be forced out of the system as early as 2026, compared with its 2032 retirement based on Victorian government renewable and emissions targets, which threaten the viability of baseload generation.

Concerns have flared within the industry that both the state and the broader electricity grid face a repeat of the market chaos that followed the hasty closure of the giant Hazelwood coal plant in Victoria two years ago, which contributed to a 40 per cent surge in power prices.

While there has been a political flare-up in recent years over extending the life of ageing coal plants like NSW’s Liddell facility, AEMO said there was no expectation any of the current fleet would look to extend their working life.

“We have to replace these plants at some point,” AEMO’s design and engineering head Alex Wonhas said. “With this pathway to do that in an economic way we may as well get on with it and not create extra risk on the market by nursing them along.”

That may spark tensions with the federal and NSW governments, which are currently leading a Liddell taskforce to consider a range of options for the plant including a potential extension.

The AGL Energy plant supplies more than 10 per cent of the state’s power needs.

AGL has agreed to add an extra year to the planned retirement of Liddell until 2023 to avoid supply shortfalls in the national power grid over peak summer months, amid speculation the creation of the taskforce may have reopened the potential for suitors to dust off plans to acquire the plant.

AEMO said it was critical to introduce a new price mechanism reflecting the important reliability role provided by power stations, which are currently struggling to receive any value for their generation when they get undercut by renewables that can produce at close to zero cost. Separate markets for firming generation and a similar system to Germany’s reserve power market could help with the clean energy transition.

Finding the huge investment needed, particularly on critical firming generation, was a challenge but one Ms Zibelman was confident the market would respond to.

“The plan provides a pathway for least-cost investment but it’s cognisant of the fact the market needs to invite that investment in by having the right signals,” she said.

In the near-term the ability of ageing coal plants to cope amid searing temperatures in the southern state of Victoria is expected to test the resilience of the grid this summer.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout