Coal and LNG prices hit fresh records as China scrambles for winter fuel

Thermal coal and LNG prices have both hit fresh peaks as the global energy crisis bites ahead of the northern winter.

Thermal coal and LNG prices have both hit fresh peaks as the global energy crisis bites ahead of the northern winter, but Australian coal and natural gas producers may struggle to lift supply to take advantage of surging prices.

Spot LNG prices in Asia have soared to a fresh all-time record this week amid a global scramble to secure supplies, potentially putting Australian exporters including Woodside Petroleum in line for massive profit windfalls.

The Japan-Korean Marker, North Asia’s benchmark for spot LNG shipments, hit $US35.07 ($48.30) per million British thermal units for gas cargoes to be delivered in November, nearly 20 times the LNG spot price recorded in June 2020.

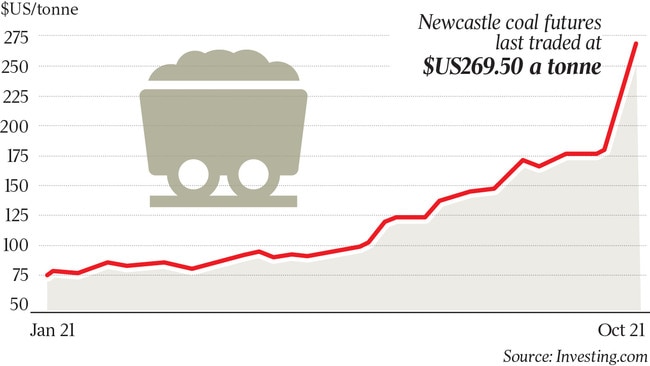

Benchmark prices for high quality Australian coal have also surged to fresh highs above $US230 a tonne, according to UBS analysts.

Futures based on the Newcastle spot price are trading at levels close to $US270 a tonne, according to an ANZ commodities research note on Wednesday.

The frenzy among buyers to grab gas volumes could lead to hugely lucrative shipments by Australia’s top LNG exporters, Credit Suisse said, with a single cargo topping $US100m and potentially doubling that if prices keep rising.

“Woodside may have three to five spot cargoes this winter that could fetch over $US500m just by themselves,” Credit Suisse analyst Saul Kavonic said.

“It used to be a very rare event to see a ‘gold’ LNG cargo sold, referring to a cargo worth more than $US100m. Now they are selling strings of gold cargoes and may need to term a ‘platinum’ cargo in case a $US200m cargo is sold.”

The massive jump in LNG spot prices may also hike concerns for Australia’s gas hungry manufacturers, with the nation’s east coast domestic gas price now linked to international LNG prices due to Queensland’s export industry.

The Australian Competition & Consumer Commission’s LNG netback series – a local LNG price that takes out the cost of processing and shipping gas to Asian customers – is currently just under $36 a gigajoule for November, quadruple the price most local industry normally pays.

Ultimately, skyrocketing prices could be bad for the industry, Credit Suisse added.

“We are in demand destruction territory where prices will just keep going up until the pain is too much to bear and a customer, or country, turns the lights off. In the long-term, this crisis is bad for LNG demand as shocks can leave buyers wary of becoming too reliant on LNG.”

The desperation for fuel supplies ahead of the northern hemisphere winter has also seen coal prices spike in Europe and Asia, as China scrambles for both commodities.

Reports this week indicate that China’s desperation for fuel has led to the unloading of a small number of Australian coal cargoes stranded outside its ports, but industry sources say there is little sign Chinese authorities will relax the ban on Australian coal.

And despite the thermal coal price recovery since the beginning of the year – prices are now up more about 185 per cent since January, according to UBS analysts – Australian export volumes have remained relatively steady.

Rising prices have seen the return to full production of some coal mines. As prices plunged in 2020, Glencore sent thousands of workers across its Hunter Valley and Queensland mines on leave in September as it cut shifts and idled equipment and sought a “targeted” reduction of about 7 million tonnes of annualised output.

Those mines are now running back at full capacity on this year’s price gains but a UBS research note this week noted that coal exports through NSW ports, the primary export terminals for thermal coal, were up only 2 per cent compared to the same period in 2020.

Part of that is attributable to the outage of a Newcastle Coal Infrastructure (NCIG) shiploader, which went down in November 2020. The loader returned to service in July, and UBS shipping figures for NCIG terminals suggest export rates have since lifted about 40 per cent.

Newcastle’s returned infrastructure capacity would allow Australian coal producers to lift exports, and The Australian understands some producers have been able to move a small number of additional lower-grade coal cargoes into the market as buyers scrambled for supply.

Industry sources point to the difficulty in winning regulatory approvals for new mines as a major factor in supply constraints, as well as the increasing reluctance of major lenders and shareholders to back their construction due to concerns about the impact of fossil fuel use on global climate change.

But shifts in the market – largely caused by China’s bans on importing Australian coal – may limit their ability to respond to surging demand on anything more than an opportunistic basis.

A number of major coal exporters have shifted to a focus on higher quality coal to meet customer requirements in Japan and Korea, opting to leave lower grades of coal in the ground to ensure the long-term value of their deposits.

BHP has been running an aggressive “high grading” strategy at its Mt Arthur mine for the last two years, and in August slashed the value of the operation as it prepared Mt Arthur for sale.

Whitehaven Coal has also shifted the mine plan at its Narrabri mine in NSW, taking a $548.7m impairment to the value of the mine as it cut about 70 million tonnes of coal from its mining reserves at Narrabri.

That is partly the result of geological problems with the deposit, but Whitehaven boss Paul Flynn told reporters in August the mine plan changes were also designed to take advantage of the “sweet spot” of higher value coal at Narrabri and cut areas of with lower energy values and high ash content from the mining plan.

A third major producer, Yancoal, has also adopted an aggressive strategy of “washing harder” to upgrade its coal products for sale in non-Chinese markets, also the company has also flagged a likely minor lift in total output for this financial year, to 39 million tonnes from 38.3 million tonnes in its previous fiscal period.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout