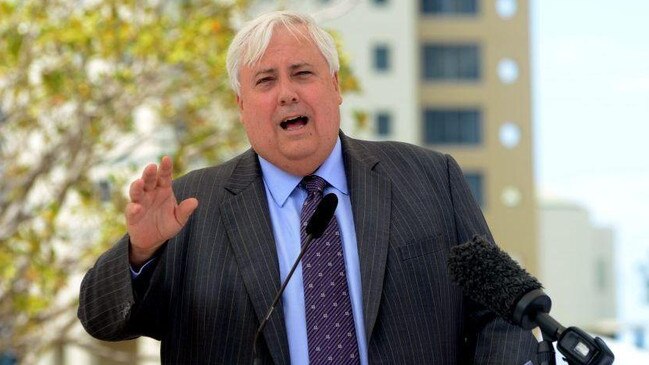

Clive Palmer sells Queensland Nickel refinery in Townsville for about $2bn

The former federal MP says he has sold the refinery, which he bought for $1 before its 2016 collapse, to a Swiss consortium.

Billionaire and former federal MP Clive Palmer says he has struck a deal to sell his mothballed Townsville nickel refinery – which he bought for $1 in 2009 – to a mysterious Swiss syndicate for a rumoured $1bn-plus price tag.

Mr Palmer said the buyer was a newly formed company called Zero Carbon Investek, led by Hong Kong-based Richard Petty, which planned to spend an extra $US800m restarting the mouldering operation, replacing its coal and gas-fired power source with solar.

The Switzerland-based company, which did not appear to have a website, also planned to build a large-scale solar panel plant and battery storage facility on the site, outside of Townsville in north Queensland and 20km from the Great Barrier Reef, Mr Palmer said.

The Australian understands Mr Palmer used the refinery’s tailings dams – the ponds that hold the waste from the refinery – as a key selling point in the deal, with Zero Carbon Investek believing they held $US9.4bn worth of nickel and cobalt that could be extracted and sold.

Mr Palmer said he was “being advised” on the matter by a boutique investment bank called Indian Ocean Capital in Sydney. Corporate searches show IOC’s chair and director is Domenic Martino, a long-time ally of Mr Palmer’s.

A spokesman for Mr Palmer would not say how much the deal was worth, but it has been rumoured to be between $1bn and $2bn.

Public records show Indian Ocean Capital registered Zero Carbon Investek as a business name with corporate regulator ASIC in September.

The sale is subject to Foreign Investment Review Board approval, and Mr Palmer said the syndicate was still hunting for investors and buyers for its nickel and cobalt.

Mr Palmer bought the Queensland Nickel refinery from BHP Billiton in 2009 for $1, a cost that carried heavy environmental and legal obligations. The resources and real estate mogul’s operation was the largest private employer in north Queensland until early-2016, when a plunging nickel price and myriad internal financial issues forced him to sack 237 workers and call in voluntary administrators. The remaining 550 workers were made redundant in March 2016, and the plant has been mothballed – or in “care and maintenance” mode – ever since.

Queensland Nickel collapsed under about $300m in debts, and owing about $70m in redundancy entitlements to workers – the latter bill was footed by federal taxpayers under the Fair Entitlements Guarantee Scheme.

Years of litigation between Mr Palmer’s nebulous group of companies and two sets of liquidators ensued, and the billionaire and political party founder says he has now paid off all creditors. The nickel price has rebounded remarkably since 2016.

Mr Palmer – who a spokesman said was in Europe – said it would take 18 months to restart the refinery, and 800 workers would be employed.

“I look forward to the Queensland government and all relevant authorities lending their full support to the new owners,” Mr Palmer said in a statement. “This is a big win for the people of north Queensland providing jobs and economic benefits.”

Mr Palmer said Yabulu had secured a 30-year port access agreement with the Port of Townsville in September. A port spokeswoman confirmed that it had signed an agreement with Queensland Nickel to restart nickel ore imports. “It will be great to see the Yabulu nickel refinery open and see further investment into Townsville,” the spokeswoman said.

“The port looks forward to continuing to work with Queensland Nickel as they progress their plans and approvals processes.”

Corporate records show Dr Petty is based in Hong Kong and is a director of an ASX-listed 3D printing company. Dr Petty – who left his post as president of CPA Australia, the national peak body for accountants, in 2018 – was quoted in Mr Palmer’s statement as saying the plan was to transition the refinery to net zero emissions by powering it with solar.

“Helping the Queensland government to achieve such (renewables) targets whilst boosting the economy and providing jobs is an important part of Zero Carbon Investek’s mission,” Dr Petty said.

But Resources Minister Scott Stewart – also the local MP – said he was “optimistic” about the sale announcement.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout