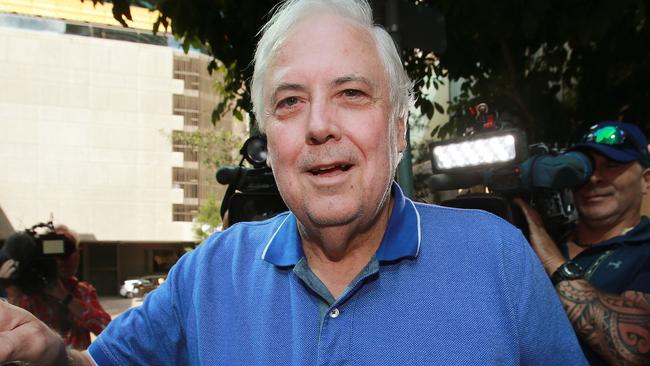

Clive Palmer row pushes Citic to eye Sino Iron closure

Citic will shut its $12bn Sino Iron project by the end of the year unless Clive Palmer agrees to key project permits.

Chinese conglomerate Citic will shut its $12 billion Sino Iron project by the end of the year, putting about 2600 jobs at risk, unless former MP Clive Palmer agrees to key project permits.

Affidavit material filed as part of the ongoing Supreme Court fight between Citic and Mr Palmer over royalties from the project shows that a senior Citic executive has recommended the suspension of the project in the next six months, citing growing inability of the project to store tailings.

Malcolm Northey, the director of project planning and sustainability at Sino Iron, swore in his affidavit that operations would become “severely constrained within 2017” if Mr Palmer’s private company Mineralogy continued to refuse Citic access to additional areas for storage and tailings.

“Without approvals and tenure, the project would cease operations and there would be no prospect of the project ever achieving profitability or economic sustainability,” Mr Northey wrote. “In the event that the (mine continuation plans) are not approved and/or concerns regarding the economics of the project ... cannot be overcome, it would be my recommendation to suspend the project.”

The previously confidential comments, read into court by Citic’s lawyer Charles Scerri late last Friday, are the strongest indication yet by Citic that it could shutter the huge project.

A shutdown would have major ramifications not just for the workforce, but also project suppliers, the state and Mr Palmer himself.

The former MP currently collects about $4 million a year in royalties from operations at Sino Iron, and stands to win tens of millions — if not hundreds of millions — a year in additional royalties should he succeed in the case currently under way. A closure of the mine would kill off Mr Palmer’s biggest source of future cash flow, following his decision to sell off much of his property empire and the financial collapse of his Queensland Nickel refinery near Townsville early last year with the loss of about 800 jobs.

Mr Palmer said earlier this month he believed Citic would “never” close Sino Iron given the amount invested in the project to date and China’s reliance on the project for low-price iron ore.

The lawyer representing Mr Palmer, Thomas Bradley QC, told the court Mineralogy’s decision to withhold the approvals stemmed from the fact it was not being paid the royalties under dispute. He said that without a substantial interest in the project such as a royalty, Mr Palmer and Mineralogy “might not have any rational commercial incentive to expedite, accommodate of support any approvals” that Citic might seek.

Mr Palmer’s decision to withhold approvals that would allow Citic to expand the tailings dam and other storage is despite the fact Mineralogy and Citic are bound under a state agreement to be “ready, willing and able” to support the project in operating continuously.

Citic has previously hinted at the cost pressures brewing at Sino Iron and the compounding uncertainty from the legal battles with Mr Palmer. In April, the company warned its employees it would no longer go ahead with an expansion of its mining fleet and the installation of additional processing fees until the uncertainty was resolved.

The hearing into the royalty dispute is due to close later this week.