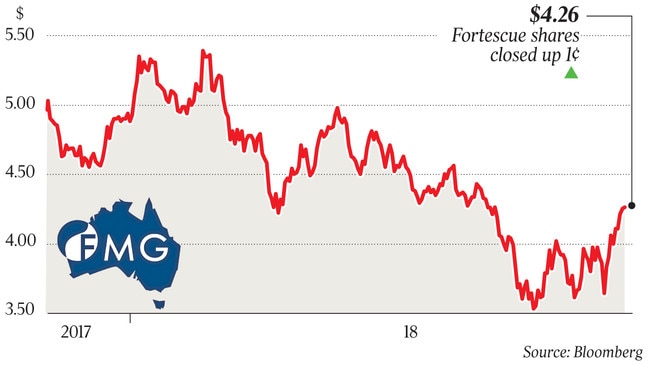

China’s strong steel production drives iron ore demand: Fortescue CEO Gaines

China’s steel output is beating expectations despite US trade row, driving iron ore demand, Fortescue CEO Elizabeth Gaines says.

China’s steel production is continuing to exceed expectations despite its trade war with the US, with continued strong demand for iron ore, Fortescue Metals chief executive Elizabeth Gaines has said.

“Steel production in September has exceeded expectations,” she said in an interview with The Australian yesterday at the China import expo in Shanghai, where Fortescue has signed memorandums of understanding with eight key Chinese steel customers.

“On an annualised basis it is running close to a billion tonnes of steel production.

“And we are not seeing an increase in steel inventories, so all that production is being consumed. The strength in steel production is continuing to drive demand for iron ore.”

China’s strong steel production has seen iron ore prices increase from $US63 a tonne in July to $US75 this month.

Ms Gaines said the strong steel production was a result of continued high levels of infrastructure investment in China.

“We have seen an unprecedented amount of investment in infrastructure,” she said.

“While there are signs of a modest slowing down in the broader economy, it might be more in the services sector.”

Ms Gaines said Fortescue was seeing growth across the Chinese economy. “Steel margins are very high which means, from a profit perspective, the steel mills are in very good shape.”

The Shanghai import expo, launched by President Xi Xinping, is focused on foreign suppliers pitching their wares to Chinese buyers. Fortescue was a sponsor of the Australian pavilion at the expo, where thousands of companies from around the world are represented.

While the memorandum of understanding signings are largely ceremonial expressions of goodwill, the presence of companies like Fortescue and their Chinese customers at the event, as well as the governors of the provinces where the customers operate, is a sign of the strength of the business ties in China.

Fortescue’s MOUs were signed with public and private steel mills across China including the largest, Baowu Steel Group, which received Fortescue’s first cargo of iron ore 10 years ago, and its subsidiary Echeng, as well as Hebei Iron and Steel, China’s second largest steel company.

Ms Gaines said it was too early to tell how China’s trade war with the US would impact on steel production. Fortescue’s customers in China continued to be “quite positive” about demand for their products.

“We know that China consumes most of the steel that it produces domestically, so it is much less reliant on the export of steel,” Ms Gaines said. But if protectionism continued over the long term it would impact global growth.

“During periods of strong trade protectionism, global growth has suffered as a result of that protectionism,” she said.

“But the Chinese government has a number of levers at their disposal if they want to stimulate the economy. That shouldn’t be underestimated.”

Strict government controls on industrial production last winter, aimed at cutting pollution, are expected to be implemented in a more flexible way this year.

Ms Gaines said a number of steel mills had invested heavily in improving environmental performance and they could be expected to face less restrictions than there were last year. “We do know that the government in China is focused on the blue sky policy and that will continue.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout