Chevron flags cracking glitch in Gorgon gas project in WA

Chevron has flagged the potential for more problems at its Gorgon gas project facilities in Western Australia.

Chevron has flagged the potential for more problems at its $US54bn ($75bn) Gorgon gas project facilities in Western Australia, with executives saying the company could be forced to reinspect the first of three production trains in light of cracking found at the second.

In July the energy giant discovered hundreds of cracks up to a metre long within propane heat exchangers during routine maintenance on the second train at Gorgon LNG, raising safety fears and potentially hitting production on Australia’s second-largest gas export facility.

The Gorgon processing plant houses three LNG trains with a combined capacity of 15.6m tonnes of LNG. The second train is likely to be out of action until at least September as Chevron tries to repair the cracks, and the entire processing facility could face an extended shutdown and loss of production if the problems found in Train 2 are replicated in the other facilities.

Speaking on an analyst call late on Friday, Chevron’s upstream executive vice president Jay Johnson blamed the defects on the original South Korean manufacturer of the equipment, and said similar cracking was not found on the first train during its first major maintenance shutdown in 2019.

And while Mr Johnson said it was operating as normal, along with the third production line, he said Chevron was considering whether it would have to pull one or both offline to check similar problems were not developing.

“We did not see the issue in Train 1, but we’re assessing whether or not we need to re-evaluate that inspection and go through it again. And we are addressing how best to inspect and, if necessary, repair Train 3 at this time,” he said.

“We do not need to replace the vessels. We believe the repairs are going to be fully effective.”

But Mr Johnson was quick to reassure investors the company did not expect to see similar issues develop at its $US34bn Wheatstone project.

“The defects that we found in the welds, we believe were there from the original manufacturer. They‘re not a design defect at all, but they are a manufacturing defect,’’ he said.

“We do not have the same manufacturer for the vessels in Wheatstone. I don’t expect to see the same issue replicated there.”

Chevron reported a shock $US8.3bn loss in the second quarter as the global coronavirus crisis hit oil and gas prices, including losses of $US4bn from its international production assets, down from a $US4.3bn profit in the same period in 2019.

The company booked after-tax impairments of $US5.3bn, including $US1.8bn “primarily associated with downward revisions to the company‘s commodity price outlook”, and a $US2.6bn hit to its Venezuelan assets.

Revenue from its global operations fell to $US16bn, down from $US36bn in the June quarter of 2019.

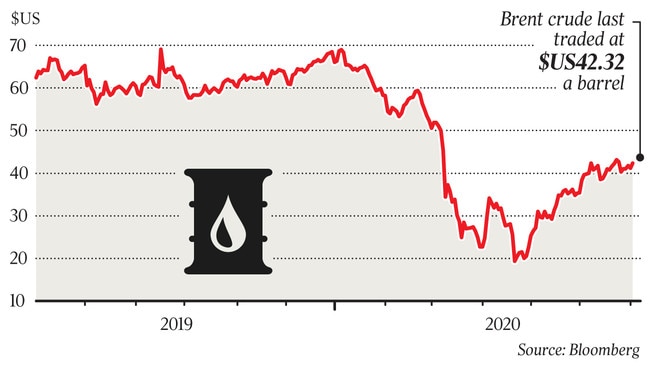

Chief financial officer Pierre Breber flagged a tough second half of the year for local LNG producers, saying he expected a further decline in contract prices for its Australian LNG projects in the third quarter.

“In Australia, we expect LNG contract pricing to be lower due to the three to six-month lag with oil prices,” he said.

Last week Chevron announced it planned to join other oil and gas majors in building renewable energy plants in Australia, saying it would partner with Canada’s Algonquin Power and Utilities Corp to build solar and wind farms to power its local facilities.

ExxonMobil also slumped to a loss in the June quarter, saying on Friday it had slumped to a $US1.1bn loss for the period, but did not contribute to the massive asset writedowns that have hit other oil and gas giants.

The company did not give an update of its efforts to sell its half of the ageing Bass Strait oil and gas wells, but Exxon senior vice president Neil Chapman said the company would push on with attempts to slim down the company’s portfolio despite tumbling prices.

“It‘s not the best environment for selling assets, but I can assure you that we are in the market with multiple assets, and we’re progressing asset sales,” he said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout