Cheaper power tipped as subsidies wind up

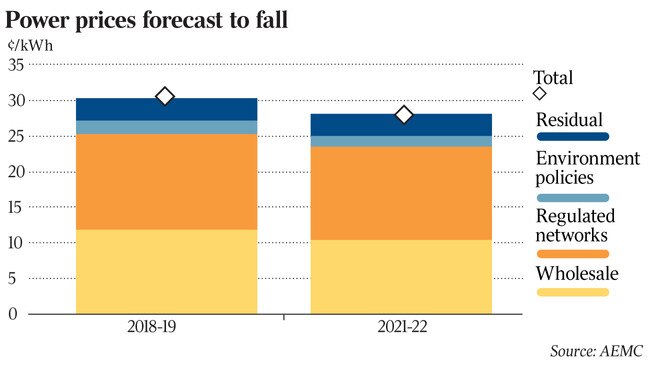

Household power prices are set to fall by 7 per cent by 2022 as green subsidies are wound up and renewables enter the grid.

Household power prices are set to fall by 7 per cent by 2022, easing several years of bill shocks, as green subsidies are wound up and a flood of new renewable supply enters the electricity grid.

The federal government’s policy adviser said consumers should see a $97 fall in their tariffs over the three years to June 2022.

Falling wholesale costs would be the largest contributor to declining bills, accounting for $62 of the projected total, as an extra 10 per cent or 5000 megawatts of solar, wind and battery storage supply enters the market.

“More supply puts downward pressure on prices,” Australian Energy Market Commission chairman John Pierce said.

The supply boost would be closely split between wind and solar with a small amount of gas-fired generation also entering the grid.

The wind-down of the 2020 large-scale renewable energy target will see environmental costs fall by nearly a quarter over the period to 2022, contributing to a $21 drop, while $11 will be shaved off network charges from falling distribution costs.

“Generation costs are falling because of additional generation; regulated network prices have been lowered in response to falling distribution costs; and green scheme costs are being driven down by cheaper large-scale generation certificates for increasing levels of renewable generation,” Mr Pierce said.

The biggest cut is expected in southeast Queensland with a 20 per cent or $278 reduction over three years. South Australia will fall 2 per cent or $27, Victoria 5 per cent or $53, NSW 8 per cent or $107, ACT 7 per cent or $134 and Tasmania 5 per cent or $93.

West Australian electricity costs are projected to rise by 6 per cent to $102 on higher gas costs and retail margins, but the AEMC noted the state government uses a different methodology which could affect final bill amounts.

The projected figures would ease the pressure after several years of bill hikes for many Australian households sparked by the closure of the Hazelwood and Northern coal plants in Victoria and South Australia, which created supply shortages and price jumps across the national electricity market.

Still, looming exits of big baseload supplies and new government policies could see price volatility continue.

AGL Energy’s 2000MW Liddell coal plant in NSW is due to close in the summer of 2022-23 and in Victoria there is uncertainty over the longevity of EnergyAustralia’s Yallourn coal station, with the state government weighing the introduction of new emissions targets.

“It’s important to note that over a decade of analysis we have seen trends change sharply in response to factors such as sudden generator closures and implementation of new policies. As such, all price projections should be seen as just that: projections.” Mr Pierce noted.

In the near term the ability of ageing coal plants to cope with searing temperatures in Victoria is expected to test the resilience of the grid this summer.

Electricity futures for the first quarter of 2020 remain over 60 per cent above rates this quarter, suggesting a volatile few months ahead.