Carnarvon’s Bedout exploration fails to find oil or gas

Carnarvon Petroleum’s run of luck in the Bedout Basin has come to an end and its shares are tumbling.

Carnarvon Petroleum’s run of luck in the Bedout Basin has come to an end, with its shares tumbling more than 20 per cent after its latest exploration well failed to find oil and gas.

Shares in Carnarvon were down 12c or 21.2 per cent to 46c each today, wiping more than $160 million off its market capitalisation, after its Roc South-1 well came up dry.

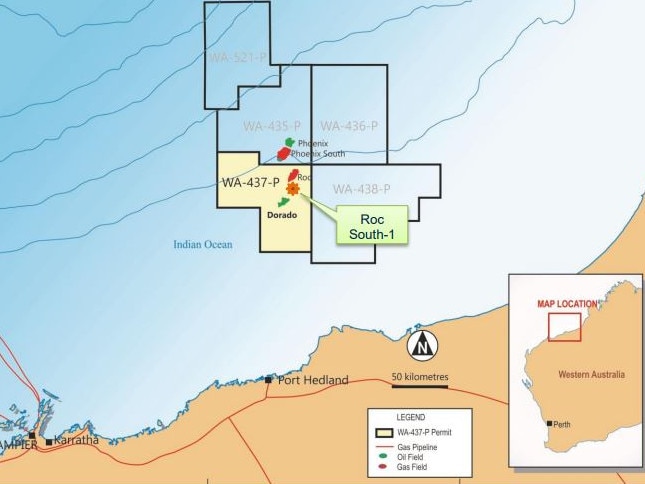

The company and its joint venture partner Santos had been hopeful that Roc South-1 would host more hydrocarbons to feed into their eye-catching Dorado and Roc discoveries nearby.

But after drilling to a depth of more than 4,500m, Carnarvon said there were no producible hydrocarbons from the well.

There had been high hopes for the well, given the earlier exploration success of the partners in the basin. Dorado has been dubbed the most exciting oil and gas discoveries in Australia for years and could see the Bedout emerge as a whole new oil and gas province.

RBC Capital Markets analyst Ben Wilson said his models for both Santos and Carnarvon had not carried any explicit value for Roc South-1.

“While success in Roc South-1 would have represented a nice add to a Dorado development, it is far from the main game,” he said.

Mr Wilson said the share price weakness could represent an opportunity for investors with a longer-term view.

“We continue to view Carnarvon as an appealing pure play on shallow water conventional oil and see weakness related to exploration results as providing an entry point for those more focused on the bigger prize of a Dorado development,” he said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout