Caltex flags split as rival bid looms

Caltex Australia has flagged a potential break-up of its wholesale and retail fuel arms, confirming it has fielded multiple approaches.

Caltex Australia has flagged a potential break-up of its wholesale and retail fuel arms, confirming it has fielded multiple approaches for all or some of its assets, including one from Britain’s EG Group.

EG is said to be mulling a bid for Caltex, which is already seeking an improvement on Alimentation Couche-Tard's latest $8.6bn offer.

Caltex confirmed on Wednesday that EG and other groups had indicated that they were “potentially interested in making a proposal to acquire Caltex or some of its assets”.

But the company said it had not received any proposal since it disclosed the $34.50-a-share offer from the Canadian retail and fuel store giant.

While Caltex has rejected the Couche-Tard offer, it has opened its books to the Canadian company for limited due diligence in the hope of an improved bid.

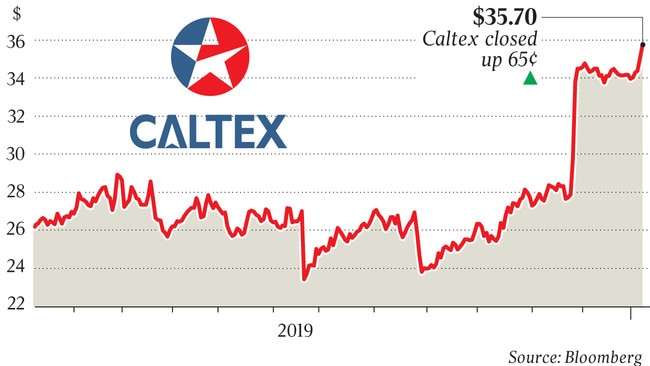

The potential entry of EG into the fray pushed Caltex shares up again on Wednesday, with the company closing up 65c, or 1.8 per cent, to $35.70.

EG has grown rapidly in Europe, the US and Australia, building a network of about 5000 fuel stations and convenience stores in a series of debt-fuelled acquisitions capped by last year’s $1.7bn deal for Woolworth’s network of 540 petrol stations.

It has debts of about £7.3bn ($13.9bn), according to Bloomberg, levels that may constrain a serious offer for Caltex.

The Australian Competition & Consumer Commission is also keeping a close eye on the sector, which could also limit EG’s expansion through acquisition. It examined, but did not intervene, in Viva Energy’s offer to mop up the wholesale arm of Liberty Oil. Two years ago the ACCC blocked a bid by BP to take control of Woolworth’s fuel store chain, a decision that cleared the way for EG to enter Australia.

RBC analyst Ben Wilson noted on Wednesday that Caltex Australia controls about 34 per cent of Australia’s wholesale fuel market, 25 per cent of the country’s fuel refining capacity and up to 17 per cent of retail fuel sales, suggesting a new player such as Couche-Tard would face less difficulty in winning regulators over than an existing market participant like EG.

“We think the chances of success of any bids hinge largely on deal value as opposed to regulatory risk with any additional entrants/competition into the mix a positive indicator,” Mr Wilson said in a client note on Wednesday.

“We do not see any prima facie competition concerns with Couche-Tard being a potential new entrant into the market.”

Neither Couche-Tard or EG control any refining assets as part of their own portfolios.

The potential bidding war for Caltex is the latest in a flurry of deal-making in the fuel station and convenience store space, coming after EG’s acquisition of Woolworth’s network, Viva’s move on Liberty, Caltex’s sale of 25 of its own sites as development properties, and Charter Hall’s $840m sale and leaseback deal over 49 per cent of 225 BP fuel stores. As it offers Couche-Tard a limited look at its books, Caltex is also considering spinning out the property underlying its own network into a listed trust.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout