Brokers are urging caution on the iron ore price, which still sits well above consensus estimates

Key events in China in coming weeks could be a tipping point for the iron ore price which is sitting well above analyst estimates, while Australian production is expected to keep growing.

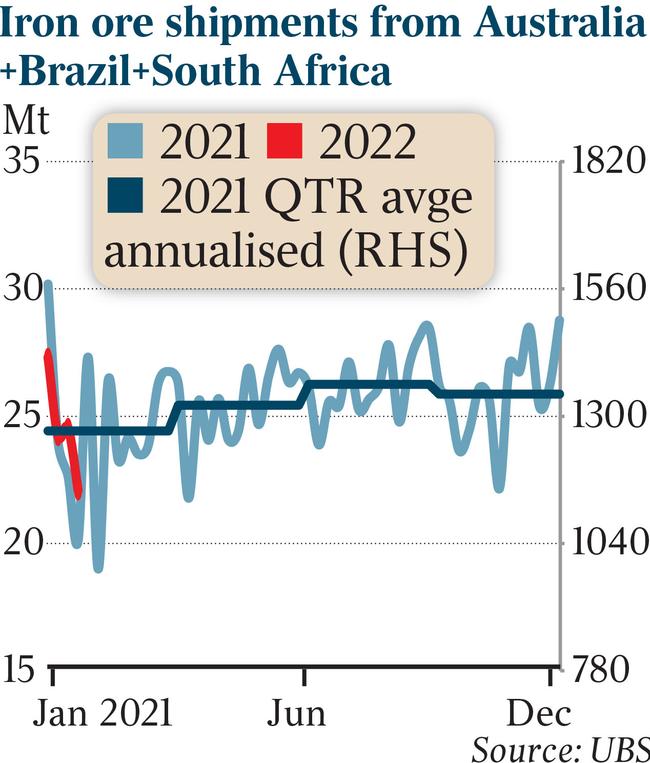

Australian iron ore production is expected to have another strong year of growth, but brokers are urging caution on the price outlook due to high inventories and a trio of significant events looming in China.

The spot iron ore price is currently sitting just below $US130 per tonne, however consensus estimates are for that to moderate to about $US100 per tonne this year.

UBS, which has flagged its iron base case as $US85 per tonne this year, says demand dynamics do not favour ongoing strength, but has stopped short of predicting a price collapse in the first quarter.

“We are cautious on iron ore prices as we expect demand to weaken year on year and supply to lift in 2022,’' the broker has said in a note to clients.

But while three important events will transpire in China over the next eight weeks - Chinese New Year, the Winter Olympics and Beijing’s annual parliamentary meetings, the “Two Sessions” in early March - the broker says that is unlikely to have an impact in the short term.

“In our opinion, these events are unlikely to have a material impact on the iron ore price so long as steel spreads remain healthy.,’’ UBS says in a note to clients.

“Construction activity will moderate over Chinese New Year as migrant workers can return home over the holiday period (unlike in 2021); we expect this to drive a seasonal build in steel inventory, not a collapse in steel production.

“We expect Blue Sky campaigns to restrict steel production around Beijing in the first quarter; however, if spreads are healthy, steel production should lift elsewhere in China so the impact on iron ore will likely be limited.’’

UBS has flagged that what comes out of the Two Sessions meetings could sway the market as the Chinese Government sets out its priorities for the year.

“While iron ore spot prices have lifted to more than $US135 per tonne, they remain vulnerable to weaker (Chinese) property construction with near record high port stocks,’’ the broker says.

“Our iron ore price base case is $US85 per tonne in 2022, $US80 per tonne in 2023 and $US75 per tonne in 2024 ... as China’s mandated steel production cuts puts the iron ore market into a growing surplus.”

Meanwhile Fitch Solutions has maintained its growth forecast for Australian iron ore production at 3 per cent this year, falling to 1.5 per cent in 2023 as delayed new projects and expansions come online. This would push production to 1.004 billion tonnes this calendar year.

READ MORE:Andrew Forrest’s Wyloo Metals emerges with key stake in Western Areas

Further out there are also “upside risks” to production in 2024 as Hancock Prospecting and Mineral Resources consider new projects and a potential bump from an increase in exploration in 2021 flows through.

“Nevertheless, we expect Covid-related labour shortages and disruptions to continue to pose downside risks for iron ore production in 2022 as they did in 2021,’’ Fitch says.

“Heavy rainfall, Covid-related labour shortages, and supply chain interruptions have also delayed projects and lowered production in 2021.’’

Fitch expects an increase in steel production in China after the Winter Olympics and Chinese New Year, and says continued monetary policy support will also bolster China’s iron ore demand.

“On one hand, Australian iron ore miners expect seaborne demand to positively support prices and production levels in 2022, after the fall in demand last year from Chinese steel output curbs,’’ Fitch says.

On the other hand, Australian production will increase as projects such as Rio Tinto’s Gudai-Darri mine start up, with that project having a nameplate capacity of 32 million tonnes per year.

“Overall, the midpoint of Rio Tinto’s shipment guidance suggests 1.7 per cent year on year growth in 2022, an increase of about 5.5 million tonnes,’’ Fitch says.

“While BHP and Fortescue’s 2022 guidance shows no growth, that guidance may be adjusted in the second quarter or when their new financial year begins in July.’’

Fitch is forecasting the iron price will moderate to $US90 per tonne this year, dropping to $US75 and $US70 in subsequent years.

“Lower iron ore prices and rising steel inventories in the years ahead will still eventually lead to output contraction in the coming decade as junior miners higher on the cost curve are forced to consolidate or else liquidate holdings as the demand profile for iron ore shifts,’’ Fitch says.

“This may increase the relative discount for lower quality ores over time as green steel production expands and forces miners to invest more in refining operations thereby reducing their profit margins.

“Persistently high costs hiring new labour may also affect the profitability of miners less

able to automate processes or else deploy autonomous systems that improve productivity in the next two years and accelerate these trends.’’

Fitch is also predicting further consolidation among junior miners, due to lower prices and competition for labour.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout