Big four banks to shift again on climate and resources policies before year’s end

The four major banks will again update their climate policies before the end of the year, some with a focus on oil and gas.

Before the end of the year, each of the four major-bank chief executives will present updated climate policies, as investors demand not only targets but actual measures to contribute to the herculean task of tackling global warming.

As ANZ Bank chief executive Shayne Elliott said at an environmental, social and governance briefing (ESG) on Thursday, climate plans by large institutions are now written in pencil because they require constant updating and redrafting.

Having largely committed to exit thermal coal by 2030, the industry is now turning its attention to oil and gas.

Both ANZ and National Australia Bank will release oil and gas policies before the end of the year, with Westpac to conduct an ESG briefing hosted by CEO Peter King next Tuesday.

Commonwealth Bank, meanwhile, is locked in a dispute with climate activist group Market Forces, which has put forward a shareholder resolution for next month’s annual meeting.

The resolution calls for CBA to cease funding expansion of the fossil fuel industry and the introduction of targets to cut the bank’s exposure, consistent with net zero emissions by 2050.

CBA has pledged to meet the Paris Agreement target but attracted the wrath of Market Forces by setting “glide paths” for key fossil fuel sectors that were aligned with an International Energy Agency sustainable development scenario to achieve the target by 2070.

The bank rejected assertions that it had actually gone backwards, saying it would update the scenario when the IEA released the latest data – coincidentally on the same day as the annual meeting.

Climate is such a rapidly evolving and hotly contested area that even Scott Morrison – still outside the net-zero emissions tent despite the proximity of the UN climate summit in November – accepted last month that financial markets were already making decisions “regardless of governments”.

It was the first time that the Prime Minister had publicly acknowledged the mounting pressure from investors, regulators and faster-moving countries to decarbonise the global economy.

Activists are also updating their methods.

One of the latest tactics is so-called “calendar jamming”, where CEOs or senior company officers are bombarded with calendar invites so they can “meditate” on their obligations to the climate, consider their “culpability”, or “think of the future”.

NAB boss Ross McEwan got the treatment earlier this month, with the tangled mess proudly displayed in a tweet by 350Australia, the local chapter of the global environmental organisation 350.org.

A senior banker said calendar jamming had the potential to create “chaos” in a CEO’s office.

350Australia CEO Lucy Manne was unapologetic, saying the group was engaging with all the big four banks and wouldn’t hesitate to employ the full range of measures at its disposal.

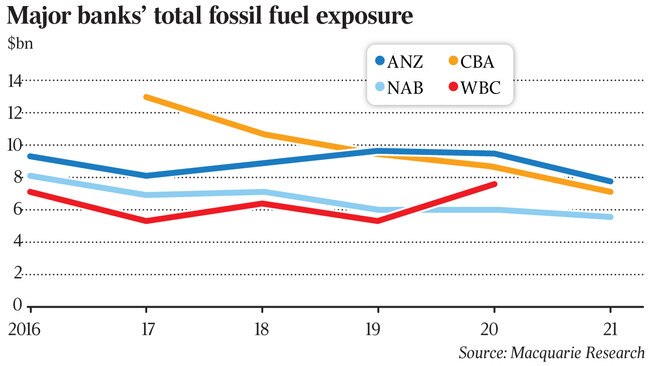

Market Forces campaigns director Jack Bertolus said “inconsistent, unclear and overlapping disclosure” meant it was difficult to compare fossil fuel exposure between the banks, or establish a clear trend for any particular bank.

“Regardless of their disclosures, it‘s obvious the banks are nowhere near aligned with their climate commitments,” he said.

“Despite the IEA concluding net-zero by 2050 means there’s no room for new fossil fuel supply projects, the banks have been pumping billions of dollars into projects that expand the fossil fuel industry and the companies pursuing them.

“Investor expectations and the banks’ own commitments to net-zero by 2050 and the Paris Agreement mean they must rapidly reduce fossil fuel exposure.

“It‘s pretty simple: if Whitehaven, Santos, Woodside, New Hope and others expanding the fossil fuel industry are in your lending portfolio, then your portfolio isn’t aligned with net-zero or the Paris Agreement.”

The banks’ position is, of course, more nuanced.

They jeopardise short-term profitability and run the gauntlet of the conservative wing of the Liberal Party and the National Party rump if they move too quickly on climate.

On the other hand, they risk being shunned by global equity and debt investors if they’re perceived as laggards on decarbonising their lending portfolios.

This was made abundantly clear when CBA institutional boss Andrew Hinchliff told a parliamentary committee earlier this month that failure to respond to the concerns of investors with ESG mandates could destabilise the bank by denying it access to competitive funding.

“So the risk for us is that funding and capital dries, not necessarily instantaneously but over time you’d expect your cost of capital to be affected by that,” Mr Hinchliff said.

“It’s a financial risk to the bank if our risk management framework around our risks is poor.”

Last week, also appearing before parliament, Mr McEwan addressed concerns about loopholes in the bank’s commitment to exit thermal coal, making the broad point that it was very unlikely the bank would “put more in on the way out”.

The new oil and gas policy, he said, would be out in a few months after more than 12 months of work.

“I think we’d rather have the conversation about the policy and the ramifications of it when that policy is out, so we’re dealing with the facts at the time,” the NAB said.

It was a sensible contribution. Who knows what the facts will be in November?

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout