BHP warns of commodity price volatility as global tensions rise

Same job same pay industrial relations laws are all cost and no productivity gains, BHP says, as it flags a challenging year defined by geopolitical tensions and lingering inflation.

BHP has tipped China will buy less iron ore as steel production plateaus, painting a downbeat forecast for the key commodity as the company battles a looming cost hit from industrial relations reforms imposed by the Albanese government.

The global miner warned on Tuesday that Australia’s international competitiveness will drop as labour costs increase under the “same job same pay” industrial relations changes which are set to wash through the mining sector this year. It also warned that global instability would bring with it an extended period of commodity price volatility, while flagging that after growing by about 50 per cent from 2010 to 2023, China’s steel sector, while still expected to produce more than one billion tonnes per year this year - for the sixth year in a row - had plateaued in term of growth.

China’s voracious demand for steel has underpinned a quadrupling in Australian iron ore exports over the past two decades, with BHP the major beneficiary as the lowest cost producer in the world. While BHP chief executive Mike Henry said his company would benefit from ongoing demand from China, including for future facing metals such as copper, the days of surging demand growth for iron ore appeared to be over.

“BHP has been saying for years now that we believe China is going to develop along a similar path to what other major economies have taken as they’ve developed, and that means a steel intensive initial stage of development, and then as they move past that initial build out of steel in the economy, the ongoing economic growth becomes less steel intensive,’’ Mr Henry said. “You have more scrap coming into the steel cycle, and therefore steel demand plateaus and ultimately moves into decline.

“But alongside that, you see increasing intensity of other metals in ongoing economic growth.

“That still holds true, and we see that playing out. We believe steel has plateaued, albeit at a quite high level of over a billion tonnes per annum.’’

BHP said China’s steel production plateau was expected to continue “across the mid-2020s’’ but demand for its products from elsewhere in developing Asia would offset this to a degree.

The mining giant said it expected a small improvement in global steel production over the next two years led by India and Southeast Asia, while Chinese blast furnaces would ease back this calendar year, “under pressure from subdued steel margins and the potential for policy-driven production controls’’.

“For the balance of 2024 and into 2025, we expect supply from low-cost major iron ore producers to grow while iron ore consumption is experiencing a modest decline,’’ BHP said.

“Our estimate of real-time cost support continues to sit in the $US80-$US$100/t range.

“Should surpluses persist as we forecast, we would expect some high-cost suppliers to be driven out of the market over time.

“How quickly and effectively the Chinese policies targeted at the property sector stabilise it, and the government’s approach to regulating steel production, will both be large swing factors for the remainder of 2024 and into 2025.’’

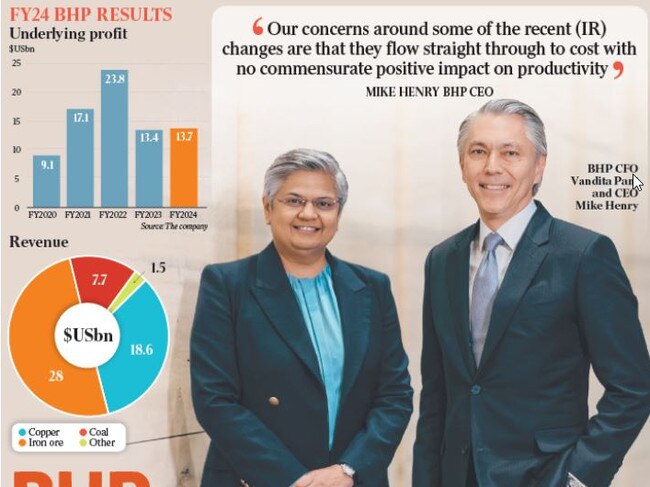

BHP reported an underlying profit of $US13.7bn ($20.22bn) on Wednesday, beating consensus estimates by 4 per cent.

Full year revenue increased 3 per cent to $US55.7bn, while statutory net profit fell 39 per cent to $US7.9bn, largely due to the $US2.7bn write down of Western Australian nickel and a $US3.8bn charge related to the Samarco dam failure.

In its Australian operations across iron ore, metallurgical coal and copper, BHP flagged that labour costs were a “core inflationary concern’’.

And while Australian wage growth was expected to have peaked in the first half of the financial year, “regulatory changes underway in Australia will add to our labour costs and reduce the international competitiveness of the Australian economy’’.

The Albanese Government’s Same Job, Same Pay laws passed federal parliament late last year, and unions are now organising to ensure their impact is felt at mining sites.

The Mining and Energy Union is courting interest from mining employees, calling on them to help it lodge applications with the Fair Work Commission “at work sites where labour hire workers are paid less than direct employees’’.

“The Fair Work Commission will then make an assessment as to whether a same job same pay order is reasonable and may make an order setting a ‘protected rate of pay’, in line with site enterprise agreement rates,’’ the union says.

“Pay rises due to protected rate of pay orders will come into effect in November, 2024.’’

Mr Henry said it was early days for the new laws, but BHP’s concerns were around the fact that there were no provisions for productivity increases under the legislation, which it has previously said could cost it an extra $1.3bn per year. “We’ve always been strong advocates for tying wage increases to productivity increases,’’ he said.

“Our concerns around some of the recent changes are that they flow straight through to cost with no commensurate positive impact on productivity. In fact they can pull things in the other direction.’’

Mr Henry said it was hard to put an exact figure on what the cost impact would be this year and it would “be gradual over time’’.

The Mining and Energy Union has filed 10 applications under the laws to date across BHP’s coal operations while the Australian Manufacturing Workers Union has filed three.

On the macroeconomic front, chairman Ken MacKenzie warned of a challenging year ahead, as geopolitical tides turn from co-operation to instability. Mr MacKenzie said the trend over recent decades which had “seen global economies and supply chains come together and support sustained economic development’’ was being disrupted.

“Today, we are seeing more turbulence, tension and polarisation in the geopolitical landscape,’’ he said. “We expect economic conditions to remain challenging in FY2025 as geopolitical issues continue to create volatility and impact global markets, security and trade.’’

As the world’s lowest cost iron ore miner and a major copper, potash and metallurgical coal producer, the company is upbeat about its own fortunes in the coming year, but warned the path to sustained global economic recovery would be bumpy.

“Major economies are expected to diverge in their growth outlooks, with developed economies facing less of a drag from higher interest rates, China experiencing an uneven recovery among its end-use sectors, and India likely to continue as the fastest growing major economy,’’ BHP said.

“Geopolitical risks remain relatively elevated and are likely to remain so in the near term.’’

Demand for commodities had been “relatively soft’’ over calendar 2023 and into this year, BHP said, with sluggish industrial activity and the last impacts of the energy crisis washing through.

“The impact of higher interest rates is expected to continue to restrain household consumption in the developed world for the balance of calendar 2024, but we expect steel, copper and nickel demand to recover across the OECD,’’ BHP said.

“China is on track to meet official calendar 2024 macroeconomic growth targets, but the property sector is likely to remain a drag.

“India is expected to continue as a bright spot for commodity demand.’’

For the second consecutive year the Western Australian iron ore operations operated at record levels, with incremental supply chain improvements adding 1 per cent to production.

BHP said it was planning to increase production at its WA iron ore operations to more than 305Mt per year over the medium term, and is assessing options to increase this further to 330Mtpa, with those studies to be completed next year.

Production at WA iron ore was 255Mt last financial year, at a unit cost of $US18.19t.

BHP said it had recorded its highest copper production in more than 15 years, up 9 per cent, with record production at Spence and Carrapateena, as well as the highest production at Escondida in four years.

BHP expects to increase copper production another 4 per cent this financial year on higher grades at Escondida and productivity increases across all assets.

The company also announced a mineral resource of 1.3bn tonnes of ore at its Oak Dam deposit in South Australia and said it would make a final investment decision about a smelter and refinery expansion at Olympic Dam in the first half of 2027.

BHP expects the copper market to be in “marginal surplus’’ this year.

“In the medium to longer term, traditional demand (such as home building, electrical equipment and household appliances) is expected to remain solid and demand from emerging sectors such as artificial intelligence and data centres should add to this,’’ the company said.

“The decarbonisation mega-trend is also expected to bolster demand.’’

In the company’s WA nickel operations, where it announced the temporary suspension of operations in July, BHP said it would continue to invest about $US300m a year to support a potential restart.

“BHP intends to review the decision to temporarily suspend WA nickel by February 2027,’’ it said.

BHP said the nickel market moved into significant surplus in 2023, and the overall weakness had continued this year.

“While voluntary curtailments continue to occur across the industry, including by BHP, these are still not near the scale that would be expected to balance the market near term,’’ BHP said.

“We estimate that we are still in a multi–year run of surpluses. Longer term, we see the market rebalancing in the late 2020s as we continue to believe nickel will be a core beneficiary of the electrification megatrend.’’

BHP will pay a fully franked dividend of US74c on October 3, down from US80c last year.

RBC Capital Markets said BHP’s report delivered “another strong set of results, which highlights the consistency of the business, good margins and returns through the cycle’’.

“The continued shift toward growth was further spelled out in copper, which adds to the investment case in our view,’’ RBC said.

UBS said it was a solid result, with lower net debt and a better dividend than it expected.

Net debt was $$US9.1bn, down $US2bn from the same time last year and within the company’s target range of $US5bn-$US15bn.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout