BHP takes $US600m hit from unplanned outages

BHP will take a $US600 million hit from unplanned production outages at its mining operations.

BHP may struggle to deliver on first-half earnings expectations after a runaway freight train at its West Australian iron ore operations crimped iron ore shipments and contributed to a $US600 million ($838m) hit.

Plans by the world’s top miner to achieve $US1 billion of productivity gains in the 2019 financial year, in addition to $US12bn of efficiencies already carved out in the prior six years, will now be revised after November’s train derailment in the Pilbara where four locomotives and 268 loaded wagons ran loose for more than 80km without a driver.

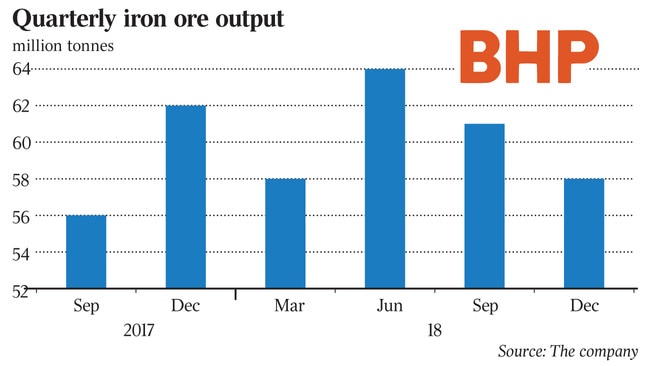

BHP said it lost 4 million tonnes of iron ore volumes resulting in output in the first half of 135m tonnes, trailing an overall full-year target of 273m tonnes to 283m tonnes.

The rail incident along with an acid plant outage at South Australia’s Olympic Dam copper operation and a fire at the Spencer copper mine in Chile hit productivity with new guidance to be detailed at the company’s half-year results in February.

BHP’s first-half earnings are likely to be weaker although the overall full-year result may still hit expectations providing the miner can deliver a strong second-half, Shaw & Partners says.

“What they’re trying to do is steer the first half number. They’re confident of the full-year but the first half is going to be weaker,” Shaw & Partners analyst Peter O’Connor told The Australian. “It’s going to be a very skewed set of halves. I don’t think the full year result will change materially. The underlying result might be modestly lower but the first half will obviously be a lot lower than the second half. Implicit in that is a risk if they don’t deliver, they’re going to have to downgrade.”

BHP boss Andrew Mackenzie has achieved hard fought savings in the business since taking on the top role in 2013 as a response to the excesses of the mining boom earlier in the decade where expensive deals and high operational costs created risks as commodity prices eased.

At this time last year the world’s largest miner was chasing $US2bn of productivity improvements by the end of 2018-19.

However, a $US500m productivity hit at its first half 2018 results saw the miner cut that figure in half by last August with a further downgrade now expected next month at its first half 2019 results.

“It almost feels like a replay of last year where they had problems at Olympic Dam and Queensland coal and they reported a similar big productivity hit,” Mr O’Connor said.

BHP’s consensus earnings may need to be trimmed for the first half of 2019 to reflect higher costs and lower commodity prices, Ord Minnett warned.

The miner flagged unit costs were tracking above full year guidance in the six months to December 31 due to planned maintenance and the production outages.

BHP still expects each division’s costs to remain within guidance for the full year, reflecting a catch-up in the second half, but the broker expects the market will likely be slightly disappointed by the first half cost performance.

The resources operator managed to retain its production guidance across all commodities and raised its full-year forecast for copper production after it called off the sale of its Cerro Colorado copper mine in Chile. However, the expectations for a strong second half adds to the overall earnings risk, according to Morgan Stanley.

“Production guidance was maintained, somewhat surprisingly, but is very second half weighted at the mid point and even our below mid point forecasts require a meaningful step up in production rates especially in coal and iron ore, which adds to the earnings risk,” Morgan Stanley analyst Menno Sanderse said in a note.

The miner’s Australian shares have risen by 8 per cent in the last year, despite the prices of most major global commodities falling in 2018, including oil, which lost 20 per cent of its value over the 12-month period.

The derailment helped to prop up iron-ore prices, which have been trading above analyst expectations as China continues to produce massive amounts of steel.

However, prices for the commodity may now ease bringing the steel-making material back into line with other minerals, according to BHP shareholder Vertium Asset Management.

“The outlook will be dictated by its exposure to commodity prices. The iron ore price has been remarkably resilient in the face of a global slowdown. Most base metals, steel prices and oil are lower from their peaks last year,” Vertium’s chief investment officer Jason Teh said. “The recent strength in the iron ore price is related to the BHP derailment which has tightened up supply. Once volumes come back online, the iron ore price may play catch up to the rest of the commodities.”

BHP shares fell 1.3 per cent or 43c to $32.77 on Tuesday.