BHP profit surges on oil, copper price rises

BHP has boosted underlying first half net profit by 25 per cent to $US4.05 billion ($5.11bn) as oil and copper prices surged.

BHP has boosted underlying first-half net profit by 25 per cent to $US4.05 billion ($5.11bn) as oil and copper prices surged, paving the way for a higher than expected interim dividend.

But the profit fell short of expectations because of higher costs, including at the Olympic Dam copper and uranium mine in South Australia and its Queensland coal operations, leading to a 4.6 per cent fall in the big miner’s shares in London trading last night.

The company is reaping the benefits of high prices and the strongest global growth outlook in years.

But it is under increased pressure and scrutiny after US activist hedge fund Elliott Management last month reignited a campaign to restructure BHP by calling for the jettisoning of the miner’s dual-listed structure in favour of an Australian primary listing.

BHP chief Andrew Mackenzie last night said the case for scrapping the London listing was yet to stack up. He described Elliott’s plan as a “very risky venture”.

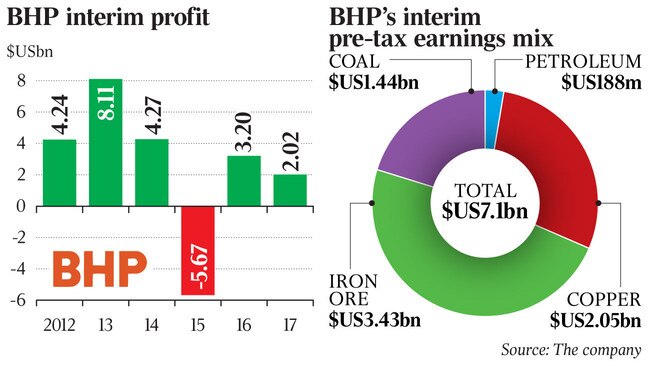

BHP’s statutory profit for the six months to the end of December fell 37 per cent to $US2.02bn, mainly because of a previously announced non-cash accounting impact of US corporate tax cuts, which will actually increase future cash flow.

The underlying first-half net profit of $US4.05bn, which strips out one-off items, missed analysts’ expectations of $US4.25bn.

BHP declared an interim dividend of US55c a share, up from US40c a year earlier and US17c higher than the company’s policy of paying out a minimum of 50 per cent of company profit. The company has also put in place a dividend reinvestment plan to win over retail investors.

Mr Mackenzie described the result as “strong”.

“We’ve delivered another half of strong free cash flow. We’ve further reduced our debt. We’ve increased our return on capital and we’ve returned more cash to our shareholders,” Mr Mackenzie said.

The decision to boost the interim dividend, effectively by $US1bn, was made despite net debt of $US15.5bn at the end of December remaining just above the company’s targeted range of $US10bn-$US15bn.

But Mr Mackenzie said net debt had fallen further, to $US14.7bn, by the end of last month and that if commodities prices stayed where they were, the company would generate $US7bn of cash flow this half.

“Obviously, prices can change, but very much with the increasing delivery of productivity we’re seeing we’re confident we are going to drive into that (net debt) range,” he said.

Revenue rose 16 per cent to $US21.78bn.

This beat market consensus of $US21.45bn as BHP logged a 20 per cent jump in received oil prices to $US54 a barrel and a one-third jump in copper prices to $US3.20 a pound.

But illustrating the cost pressure, earnings before interest, tax depreciation and amortisation of $US11.24bn missed market expectations of $11.59bn.

“The first-half results are fairly underwhelming,” RBC analyst Tyler Broda said.

“Costs were higher than anticipated with expected headwinds coming from exchange rates and inflation, but also a $US496 million negative productivity movement relating to operational issues in coal and at Olympic Dam.”

BHP is chasing $US2bn of productivity improvements by the end of 2018-19.

That target is still in place but appears to have become harder to reach after the $US496m speed bump announced in the report.

The increase was largely due to Queensland coalmine geological issues announced last month and a smelter maintenance campaign at Olympic Dam.

“These were very much one-offs. I’ve always been clear our unrelenting delivery of productivity will come steadily but also in fits and starts,” Mr Mackenzie said.

“Those one-offs are now behind us and we are driving strongly into the second half of the year.”

Brokerage Citi last night said the results were “below expectations” and that underlying earnings per share were 5 per cent short of estimates. In addition, BHP’s net debt figure came in higher that expected.

“We expect a single-digit percentage decline likely in fiscal 2018 consensus earnings based on these results,” Citi said in a note to clients.

In early trading, BHP’s London shares were down 3.8 per cent, compared to a 0.7 per cent early fall in Rio Tinto stock.

The results were released after the Australian Securities Exchange had closed.

BHP said estimated development costs at the planned South Flank iron ore project in Western Australia, which is expected to replace 80 million tonnes of annual iron ore production a year when the Yandi mine runs out, had risen to $US3.6bn The previous cost estimate was between $US2.4bn and $US3.2bn.

“The slight increase in the cost of the capital in South Flank is in large measure down to the stronger Australian dollar, but we are also getting more concrete about the costs as more estimates come in,” Mr Mackenzie said. “It is still a very good project and it is fully funded within the guidance we provided for sustaining capital of about $US4 a tonne.”

It is hoped South Flank, which is still in feasibility study stage, can boost the average grade of BHP’s Pilbara region iron ore from 61 per cent to 62 per cent and boost the proportion of premium “lump” iron ore.

This will take advantage of current higher premiums being paid for lump and higher grade ore as China cuts down on steel mill overcapacity and remaining mills try to do more with less.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout