Mike Henry sharpens BHP’s iron will

Incoming BHP boss Mike Henry has flagged a fast finish to the year for the company’s flagship iron ore division.

Incoming BHP boss Mike Henry has flagged a fast finish to the year for the company’s flagship iron ore division, as the mining giant revealed its NSW coal operations had been hit by bushfire and drought.

Marking his first formal investor update since being named BHP chief executive in November, Mr Henry described BHP’s December quarter performance, its last under the leadership of outgoing boss Andrew Mackenzie, as “solid”.

But as Mr Henry considers the shape of his new leadership team, likely to be announced early next month, BHP signalled a big lift in iron ore production in the second half of the financial year, tipping output to rise as much as 9 per cent as the mining giant looks to take advantage of lingering high iron ore prices.

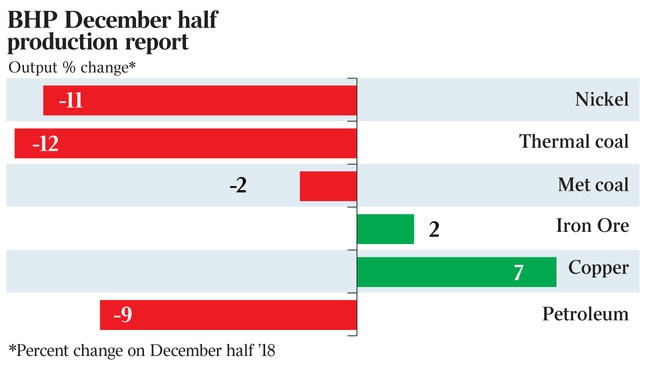

BHP’s Pilbara iron ore mines produced 137 million tonnes of iron ore in the six months to the end of December, lifting production on the same time the previous year — a period hit by the company’s notorious runaway train disaster — by 2 per cent, disappointing analysts.

BHP is tipping second-half output of as much as 149 million tonnes,

This is a run rate well above the theoretical annualised maximum capacity of its mines and infrastructure of 290 million tonnes.

The first-half result for iron ore still promises a bumper return in its half-year financial results in February, with BHP averaging sales receipts of $US78.30 at the port, 41 per cent above the same period in 2018.

And, with iron ore prices still high, BHP said it was on track for a stronger second half of the year after completing a major maintenance program at its port facilities to improve the performance of its rail unloading equipment.

The company maintained its full-year output guidance of 273-286 million tonnes, suggesting it expects second-half production could approach 149 million tonnes.

While its iron ore division is closing on its best, BHP’s thermal coal production fell in the first half of the year as the company chased higher grades at its Mount Arthur mine in NSW, where production was also hit by bushfires and drought.

BHP left its annual production guidance at Mount Arthur unchanged at 15-17 million tonnes, after it had produced seven million tonnes in the first half, but said it could fail to meet that goal if smoke from the bushfires still burning across NSW continued to cause safety and air quality concerns, interrupting work.

Dust storms caused by the state’s savage drought had also affected air quality at Mount Arthur, the company said.

“We are monitoring the situation and if air quality continues to deteriorate then operations could be constrained further in the second half of the year,” the company said.

Strikes and social unrest also took a toll on its Escondida copper mine, knocking 5000 tonnes off its production, although BHP said that shortfall was offset by record throughput at the mine’s concentrator, with total production from Escondida up 4 per cent to 602,000 tonnes from the December 2018 half year.

But while its Pilbara iron ore mines will deliver BHP an outsized return for the half year, that will be undermined by falling prices in most of its other major commodities.

Average metallurgical coal prices of $US140.94 a tonne were 22 per cent below the same period in 2019, with thermal coal down 30 per cent at $US58.55 a tonne despite its high-grading strategy at Mount Arthur.

Under Mr Mackenzie’s leadership, BHP sold a string of assets ranging from US shale gas deposits to South African coal mines and jettisoned a long-held pledge to increase its annual dividend.

The result is a slimmed-down company, but one more reliant on swings in prices of just a handful of commodities such as iron ore and crude oil for profit growth.

“We delivered solid operational performances across the portfolio in the first half of the 2020 financial year, offsetting the expected impacts of planned maintenance and natural field decline,” Mr Henry said. “Our six major development projects are progressing well, and we continue to advance our exploration programs in petroleum and copper.”

BHP was paid 13 per cent less for its oil, at $US60.64 a barrel, 9 per cent less for natural gas, while its LNG cargoes fetched 25 per cent less.

Copper received an extra US6c a pound, to $US2.60 a pound, and the nickel price underscored BHP’s renewed confidence in its Nickel West division, jumping 26 per cent to an average $US15,715 a tonne.

BHP shares closed down 4c at $41.20 on Tuesday.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout