BHP joins Newcrest on copper junior’s register

BHP may have sparked a bidding war with Newcrest Mining for control of Brisbane-based copper miner SolGold.

BHP may have sparked a potential bidding war with Newcrest Mining for control of Brisbane-based copper miner SolGold after buying a 6.1 per cent stake nearly two years after it first attempted to gain exposure to the Ecuador-focused explorer.

The world’s largest miner paid about £27.3 million ($48.8m) for 103.1m shares in a deal with Guyana Goldfields that gives it access to the prospective Cascabel copper-gold discovery in northwest Ecuador, 85 per controlled by the London and Toronto-listed SolGold with Canada’s Cornerstone Capital owning the balance.

BHP was rebuffed in October 2016 in its efforts to take a 10 per cent equity stake with the junior instead favouring gold producer Newcrest in the arm wrestle to win a spot on its register.

While Newcrest now owns 14.5 per cent of SolGold, analysts say BHP may look to build its position further by cutting a deal with Cornerstone given it holds both a direct stake in SolGold and an equity stake in the Cascabel joint venture.

If BHP “found a way to pair up this Guyana-bought stock with Cornerstone’s equity and joint venture interest in SolGold they would be on an equal or better footing than Newcrest”, Cormack Securities analyst Tyron Breytenbach saidyesterday. “That backdrop does lend itself to a potentially competitive scenario.”

Should a battle between BHP and Newcrest for control of SolGold emerge, the company that snares Cornerstone may ultimately prevail, according to a second analyst.

“The project is big enough for two companies to share both the risk and reward so why get in a bidding war?” Paradigm Capital analyst David Davidson said. “Pay a fair price and move on. Who gets Cornerstone’s shares will tell the outcome.”

BHP said the SolGold investment would hand it exposure to a high quality copper exploration project in Ecuador, which the miner considers a highly prospective location.

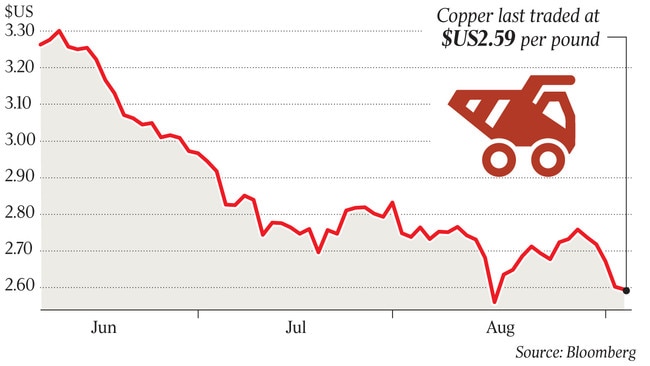

“Consistent with our positive long-term outlook, copper is a key exploration focus for BHP as we seek to replenish our resource base and grow this important business,” BHP chief executive Andrew Mackenzie said.

The Melbourne-based miner, which operates the world’s largest copper mine in Chile’s Escondida, wants to boost its exposure to the red metal as output from existing mines tails off over the next decade against a backdrop of stronger demand from metal-dependent electric vehicles and the electrification of energy demand.

SolGold shares soared by more than 22 per cent in early trading on the London Stock Exchange reflecting the market’s view the Australian junior may yet become the target of more action from two of the world’s premier mining companies.

BHP’s move “ensures SolGold shareholders will have a good shot at getting fair value if the company has continued drilling success”, Mr Breytenbach said. “The copper project pipeline is pretty thin, so a bidding war is still a possibility.”

Australian mining investor DGR Global, the second-largest shareholder in SolGold, also received a bounce from BHP’s move with the small cap’s shares soaring by 17 per cent and attracting a “speeding ticket” query from the Australian Securities Exchange.

DGR responded by saying BHP’s non-control transaction “may have had an impact” on its share price.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout