BHP AGM: Global trade tensions hurting Covid recovery, says Henry

The mining giant’s CEO was speaking at BHP’s virtual AGM amid speculation that China has again targeted Australian coal exports.

BHP chairman Ken MacKenzie has revealed the mining giant’s Queensland coal exports have been hit by China’s import restrictions, saying a number of its Chinese customers had asked to defer shipments.

Speaking on the sidelines of BHP’s annual Australian shareholder meeting on Wednesday, Mr MacKenzie said BHP was still trying to get to the bottom of reports this week that Chinese authorities had told steel mills and power companies to cease buying Australian coal.

It is still unclear whether the measures relate to the enforcement of coal import quotas or whether they are the result of political tensions, but Mr MacKenzie confirmed that BHP’s coal business had been affected.

“We understand there may be some new developments relating to how China plans and moderates imports versus their own domestic coal production,” he said late on Wednesday.

“Our commercial team has recently received deferment requests from some of our Chinese customers. But we have long-standing relationships with our customers in China and we’re working with them to understand the situation more clearly.

“It would be concerning if the rumours are true concerning an import restriction of Australian coal into China. Over the last year our customer and supply relationships have strengthened as we have supported them over COVID.”

China’s reported crackdown on Australian coal comes amid ongoing trade tensions between Canberra and Beijing, and follows Chinese authorities slapping tariffs on Australian barley earlier this year.

Shares in Australian coal exporters this week had come under pressure, with Coronado Global Resources off another 6 per cent on Wednesday. New Hope and Stanmore Coal shares recovered after Tuesday’s selldown. BHP shares closed down 0.8 per cent at $36.03. Mr MacKenzie was speaking after the market closed.

Analysts believe the latest round of restrictions were likely to hit Australian coking coal — which is used in steelmaking — as well as energy coal exporters.

Mr MacKenzie’s comments came as rail hauler Aurizon on Wednesday said it believed Chinese import restrictions hit its coal volumes in the last quarter.

In a quarterly update, Aurizon said that September quarter coal volumes had softened 5 per cent, or 2.8 million tonnes, compared with the corresponding period last year, on the back of a drift in demand for coal as the coronavirus hit its customers’ major buyers overseas and as China slowed imports of Australian coal.

“This is in line with expectations of a softer first half of the financial year with recessionary conditions from COVID-19 impacting coal demand in addition to China curtailing aggregate coal import volume to maintain a similar annual result to the prior calendar year,” Aurizon said at a quarterly update.

Earlier, BHP chief executive Mike Henry told the miner’s annual meeting it would take “some time” for the global economy to stabilise from the global coronavirus crisis, telling shareholders the pandemic’s impact would be exacerbated by ongoing international trade tensions.

Mr Henry’s comments came amid speculation that China is again targeting Australian coal exports as a result of tensions between Beijing and Canberra.

Speaking at his first annual shareholder meeting as BHP’s chief executive, Mr Henry said the outlook for commodity markets remained uncertain, but BHP’s diversified portfolio remained in good shape.

“In the near term, we expect that the global economy will take some time to stabilise and recover from COVID-19,” he said.

“Given the variable nature of the pace and structure of the recovery around the world and exacerbated by global trade tensions, the outlook for commodity markets remains uncertain. However, the strength and consistency of the economic recovery under way in China does provide a measure of confidence and optimism.”

His comments came as rising confidence is spreading through the economy more broadly, with figures released on Wednesday showing consumer confidence surged in response to the federal budget, according to Westpac.

The Westpac-Melbourne Institute Index of Consumer Sentiment surged by 11.9 per cent to a three-month high of 105 points in October, from 98 points in September.

“This is an extraordinary result,” Westpac chief economist Bill Evans said on Wednesday.

“The index has now lifted by 32 per cent over the last two months to the highest level since July 2018. The index is now 10 per cent above the average level in the six months prior to the pandemic.”

Mr Evans attributed this to the response to the huge fiscal stimulus outlined in the federal budget, ongoing success across the nation in containing the COVID-19 outbreak, and expectations that the Reserve Bank board will further cut interest rates after its next meeting on November 3.

Financial markets have also reacted positively to these developments, with the dollar hitting a three-week high of US72.43c and the S&P/ASX 200 index reaching a seven-month high of 6214.7 following the October RBA meeting and the budget last Tuesday.

Elsewhere, Josh Frydenberg on Wednesday pointed to six straight weeks of rising consumer sentiment, which is almost back to pre-COVID levels.

Ultimately, though, confidence depended on the successful suppression of the virus, the Treasurer told a Citi conference in Sydney.

“As long as that occurs then that confidence will come back,” Mr Frydenberg said.

He remained “hopeful” around the pace of the global recovery, but emphasised that Australia as a trading nation was exposed to volatility.

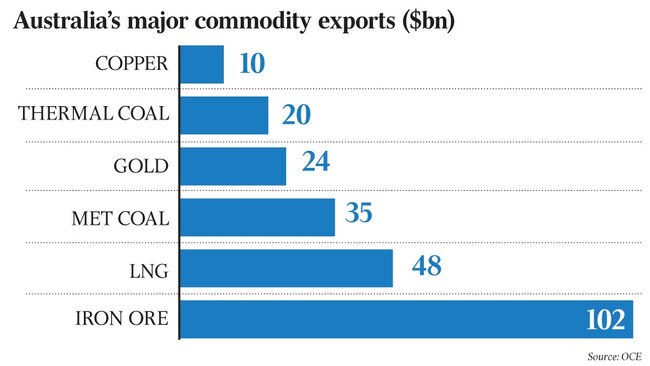

Mr Henry said BHP’s outlook remained strong, despite the challenges faced by the global economy, flagging ongoing moves to gradually reshape BHP’s portfolio in the long term to refocus the company on copper, nickel and other so-called “future-facing commodities” such as potash.

Mr Henry recently reshaped his leadership team to include the appointment of chief development officer Johan van Jaarsveld, flagging a greater emphasis on exploration and the acquisition of early-stage development assets. “We will create and secure more options through innovation, exploration, early-stage entry and well-timed acquisitions of attractive resources and assets,” he said on Wednesday.

Additional reporting: David Rogers

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout