Australian companies face climate crackdown after investor group pressure

Australian companies face a crackdown on disclosing climate risks from major investor groups in the latest warning to business on the risk of climate change.

Corporations face a crackdown on disclosing climate risks after major investor groups held briefings with Treasury and the nation’s financial watchdogs to introduce a mandatory reporting system by 2024, in the latest warning to business on the risk of climate change.

The Investor Group on Climate Change, which represents institutional investors in Australia and New Zealand with $2 trillion in assets, wants to make permanent a scheme – known as the Taskforce for Climate Related Financial Disclosure – aimed at giving shareholders more information about the risks presented by climate change.

The regime would initially be created under a voluntary “if not, why not” approach, before moving to a strict mandatory system by 2024 to protect national economic stability and help investors properly price assets as financial markets grapple with how to address climate risk.

Talks have been held between the IGCC and its investment partners with Commonwealth Treasury, the Australian Prudential Regulatory Authority, Australian Securities & Investments Commission and the ASX Corporate Governance Council.

The plan would initially target Australia’s top 300 listed companies and large unlisted businesses in the hope that the powerful Council of Financial Regulators would provide oversight of the investor scheme.

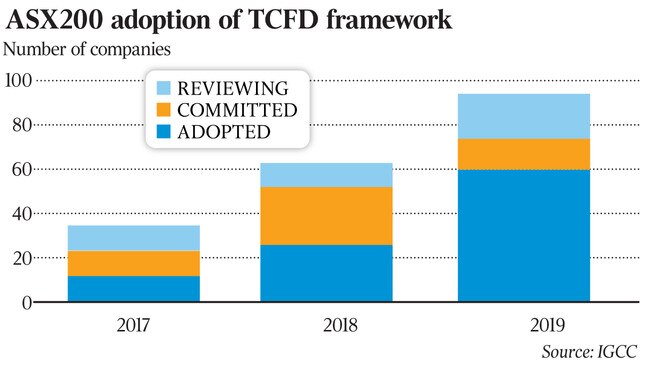

While 60 companies in the ASX 200 have adopted the framework known as TCFD, there is concern from investors over a range of different approaches to disclosing risks that could lead to funding being withheld by financiers pushing for a stronger response to the issue.

Most climate disclosures are not being integrated into financial statements, while there is a low uptake of companies crunching 1.5C Paris target scenarios, suggesting many companies may be failing to adequately stress-test their businesses.

There is currently a voluntary approach in Australia, although listed companies must comply with the continuous disclosure regime.

“Institutional investors have reported that the quality and consistency of these company disclosures is severely lacking, leading to the underpricing of climate risks in the market,” the IGCC said.

“At the same time, companies and financial organisations have been left to navigate the complex and technical elements of such reporting, creating significant business burden.

“Ultimately, despite significant progress, the current disclosure system is not delivering on the core needs of investors, nor the core mandates of the financial regulators to protect the stability of the financial system as a whole. To address these gaps, many jurisdictions are now turning to mandatory regimes.”

It wants all ASX 300 companies disclosing their climate risks by next year, with all other listed firms to follow within a year and with banks, superannuation, asset managers and insurers also to be held to the 2022 target.

Large unlisted companies with minimum revenue of $100m should also be held to the same disclosure expectations.

New Zealand became the first country to introduce a law which requires the financial sector to disclose the impact of climate change on businesses and how they will manage climate-related risks and opportunities.

The world’s largest fund manager BlackRock also incorporated climate change into its capital market assumptions for the first time in March as it ratchets up action to confront global warming, in a move set to weigh on companies without a clear path to net zero emissions.

Australia’s bank regulator warned in April of the unprecedented, far-reaching impact of climate change on all parts of the financial system, putting lenders and insurers on notice they need to be on top of the risks to their businesses.

In 2019, ASIC updated its guidance on climate change-related disclosure, finding in general that its existing principles-based approach was appropriate.

However, ASIC highlighted that climate change was a systemic risk that could affect an entity’s financial prospects for future years and might need to be disclosed in a company’s operating and financial review.

Climate risk disclosures remain “tick the box” exercises for many companies, investors claim.

“Some executives may assume that if it was important it would be mandated, and therefore neglect to prioritise it in the absence of clear direction, even if they are being ‘encouraged’ to do so through voluntary measures. This may in part explain the gaps in adoption including for high-risk sectors,” the IGCC will warn on Tuesday.

Australian companies are increasingly under pressure on climate change as institutional investors such as Climate Action 100+, backed by Australian superannuation funds, use their power to hold companies to account.

A further risk is the prospect of carbon border taxes being imposed by the US and Europe on Australian businesses, according to the investor group.

“Australian firms will be confronted with higher expectations for environmental disclosure from customers and authorities in these and other key markets. Mandatory TCFD-aligned disclosure will help identify companies currently showing climate leadership and position high-emitting companies to begin the transition towards low-carbon business models,” the report says.

Under the plan, consultation on putting the measures in place will take place in 2022-23, with legislatives measures starting the following year and the prospect of full compliance by 2024-25.

The RBA said in June that Australian business will face increasing international pressure to come clean on plans to lower carbon emissions in order to attract investors and grow exports.

Governor Philip Lowe said the question he is mostly asked from international forums is “what is Australian business doing to decarbonise?”