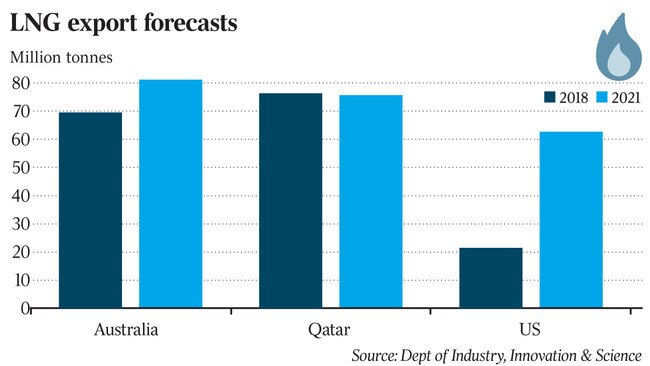

Australia now the world’s biggest annual exporter of liquefied natural gas

Australia’s LNG exports overtake Qatar’s, as debate escalates over our global greenhouse gas emissions.

Australia has overtaken Qatar to become the world’s biggest annual exporter of liquefied natural gas, achieving the milestone as bushfires rage across the country and debate over the nation’s contribution to greenhouse gas emissions reignites.

Adelaide energy consultant EnergyQuest said on Monday that Australia’s LNG exports topped 77.5 million tonnes in 2019, tipping Qatar’s expected 75 million tonne output for the year — although EnergyQuest chief executive Graeme Bethune noted Qatar was yet to release its official export figures.

Australia is likely to confirm its place as the top LNG producer in 2020 as major projects such as the Shell-operated Prelude floating LNG project off the coast of WA and Northern Territory’s Ichthys LNG project continue to ramp up to full output.

Dr Bethune said Australia’s total output capacity was 88 million tonnes, well ahead of Qatar’s 77 million tonne potential.

EnergyQuest figures underline the industry’s value to the Australian economy, suggesting the record output is worth $49bn in export revenue, but come amid a fresh debate about Australia’s contribution to global greenhouse gas emissions as bushfires rage across the country.

The huge growth in LNG exports underscores Australia’s challenges as it attempts to transition to a low-carbon world. Most of the political focus has been on Australia’s thermal coal exports, tipped by the Department of Industry to top 212 million tonnes in 2019-20, with an export value of about $21bn.

Federal Greens leader Richard Di Natale again called for the winding down of Australia’s coal exports on Monday.

He called Prime Minister Scott Morrison — who in December said any move against the coal sector would be “reckless and job-destroying” — a lobbyist for the industry, and called for the government to pledge to refuse approval for any new coal mines.

While those calls have not directly extended to LNG exports, recent federal approval for Norwegian energy giant Equinor’s plans to drill for oil and gas in the Great Australian Bight has also led to criticism that the government is prioritising fossil fuel extraction over environmental risks.

The International Energy Agency forecasts natural gas to be the fastest-growing fossil-fuel energy source through to about 2040, arguing it could play an increasingly important role as switching from coal to gas reduces greenhouse gas emissions by about 50 per cent in electricity generation, and up to 33 per cent in heating.

Australia is not the only country looking to grow LNG exports, with the US also growing rapidly and exporting 34.3 million tonnes in 2019, according to Dr Bethune.

Russia is already the world’s biggest exporter of natural gas through pipelines. In September two of its biggest fossil fuel companies, Rosneft and Novatek, separately announced plans for two new LNG plants worth a collective 26 million tonnes a year, which would double Russia’s current exports.

Australia booked an 11 per cent rise in exports in 2019, according to EnergyQuest.

The rising output is unlikely to ease the concerns of domestic gas users, however — particularly major manufacturers that have long complained about high prices.

Dr Bethune said EnergyQuest estimated the average price achieved by exporters was $11.41 per gigajoule, with east coast prices down 8.9 per cent to an average $8.15/GJ in 2019. This compared to an average $4/GJ in Western Australia, which has had a 15 per cent domestic gas reservation scheme for the past decade.

Some hope may be on the horizon for east coast users, however, with Dr Bethune saying prices had fallen to $5/GJ on the east coast this month.

With a number of major projects sitting in the wings, Australia’s LNG exports may continue to grow for at least the next decade.

While the partners in the giant Browse project off WA are still wrangling over the details of its development, Woodside Petroleum took another step to realising its plans to add another 5 million tonnes of capacity to its WA operations on Monday, winning support from WA’s environment watchdog for a near-shore pipeline to connect its Pluto processing facility to the Scarborough gas fields.

The Environmental Protection Authority has recommended the approval, but the final decision remains with WA environment minister Stephen Dawson.

The oil and gas major still needs federal approval for the bulk of the 434km pipeline that runs through commonwealth waters to the gas field.

Woodside resubmitted its major approval document covering Scarborough to the National Offshore Petroleum Safety and Environmental Management Authority (NOPSEMA) in December, and also requires a number of other secondary environmental and regulatory approvals before work can begin. Woodside and BHP, which owns 25 per cent of the project, agreed a tolling price for the gas at Pluto in November, clearing the way for a final investment decision by the middle of 2020. The pair plan to start operation by 2024.

More Coverage

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout